CACI International Inc (CACI) Reports Strong Q2 Fiscal 2024 Results and Raises Full-Year Guidance

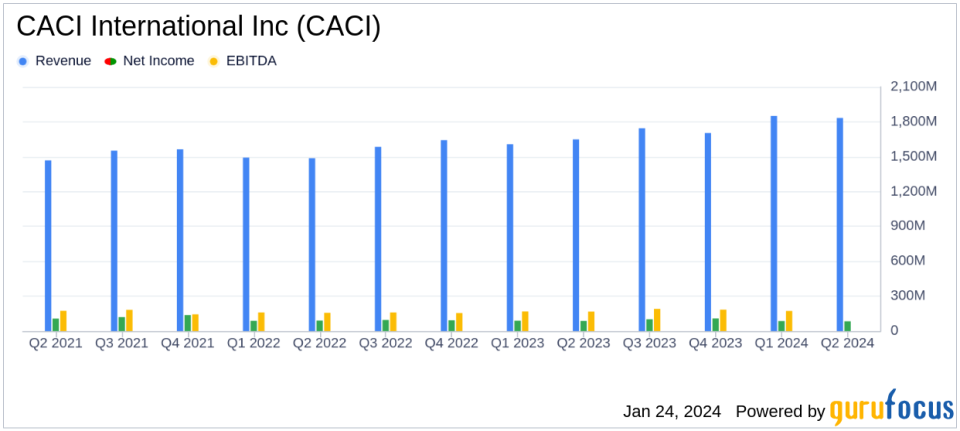

Revenue: $1.8 billion, an increase of 11.2% year-over-year (YoY).

Net Income: $83.9 million, a slight decrease of 3.7% YoY.

Adjusted Net Income: $97.6 million, reflecting a 3.6% decrease YoY.

Diluted EPS: $3.74, up 1.6% YoY; Adjusted Diluted EPS at $4.36, up 1.9% YoY.

Contract Awards: $2.2 billion with a book-to-bill ratio of 1.2x.

Free Cash Flow: $67.8 million, a significant increase of 647.4% YoY.

Fiscal Year 2024 Guidance: Raised for revenue, adjusted net income, adjusted diluted EPS, and free cash flow.

On January 24, 2024, CACI International Inc (NYSE:CACI) released its 8-K filing, detailing the financial results for its fiscal second quarter ended December 31, 2023. The company, a leading provider of expertise and technology to government customers, reported revenues of $1.8 billion, marking an 11.2% increase YoY, driven primarily by organic growth. Despite a slight decrease in net income of 3.7% YoY to $83.9 million, the company saw a substantial increase in free cash flow and raised its full-year guidance for fiscal 2024.

CACI International Inc is renowned for its information solutions and services, primarily serving U.S. government agencies and departments. The company's offerings are critical for national security missions and government modernization, making its financial performance particularly significant for investors interested in the defense and technology sectors.

Financial Performance and Challenges

The company's performance this quarter reflects its ability to convert a growing backlog into revenue, with President and CEO John Mengucci commenting on the company's success in winning new business and investing ahead of customer needs. However, the slight decrease in net income and adjusted net income indicates challenges that may include increased competition, pricing pressures, and the cost of innovation.

Financial Achievements and Industry Significance

The surge in free cash flow to $67.8 million, up from $9.1 million in the previous year, is a testament to CACI's operational efficiency and effective capital management. This is particularly important in the software and services industry, where cash flow is crucial for funding ongoing research and development, as well as for pursuing strategic acquisitions.

Key Financial Metrics

Important metrics from the income statement include an increase in income from operations by 1.9% YoY to $133.3 million. The balance sheet shows a healthy liquidity position with cash and cash equivalents of $128.9 million. The cash flow statement highlights the impressive growth in operating cash flow, excluding MARPA, by 278.8% YoY to $83.2 million.

Days sales outstanding (DSO) improved to 47 days, indicating better efficiency in collecting receivables. The company's backlog increased by 2% to $26.9 billion, with funded backlog up 16% to $3.7 billion, suggesting a strong pipeline for future revenue.

"Im pleased with how our business is performing, both the near-term conversion of our growing backlog as well as our positioning for future growth," said John Mengucci, CACI President and Chief Executive Officer. "This acceleration enables us to raise our Fiscal Year 2024 guidance."

Analysis of Company's Performance

CACI's ability to secure significant contract awards, such as the $526 million GENMOD task order, demonstrates its competitive edge and strategic positioning in the market. The company's focus on differentiated capabilities and investment in future needs is likely to sustain its growth trajectory. The raised guidance for fiscal year 2024 indicates management's confidence in the company's continued performance.

Overall, CACI's second-quarter results and optimistic outlook for the fiscal year are likely to appeal to value investors, particularly those with an interest in the defense and government services sector. The company's solid financial position, combined with strategic contract wins, positions it well for sustained growth and shareholder value creation.

For more detailed information, investors and interested parties are encouraged to listen to the webcast and view the accompanying exhibits on CACIs investor relations website.

Explore the complete 8-K earnings release (here) from CACI International Inc for further details.

This article first appeared on GuruFocus.