Cactus Inc (WHD) Reports Solid Q4 and Full Year 2023 Financial Results

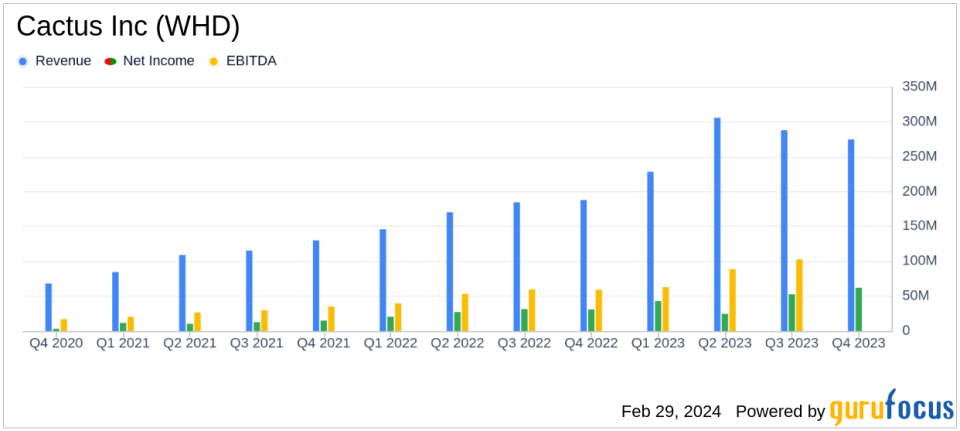

Revenue: Q4 revenue reached $274.9 million, with full-year revenue totaling $1.096 billion.

Net Income: Q4 net income stood at $62.1 million, contributing to a full-year net income of $214.8 million.

Adjusted EBITDA: Q4 Adjusted EBITDA was $100.1 million, while the full-year Adjusted EBITDA reached $398.1 million.

Dividends: A quarterly cash dividend of $0.12 per Class A share was declared in January 2024.

Liquidity: Cactus ended the year with $133.8 million in cash and cash equivalents and no bank debt.

Capital Expenditures: Net capital expenditures for Q4 were $9.6 million, with expectations of $45 million to $55 million for the full year 2024.

On February 28, 2024, Cactus Inc (NYSE:WHD) released its 8-K filing, announcing its financial and operating results for the fourth quarter and full year of 2023. The company, a leader in the design, manufacture, and sale of wellheads and pressure control equipment, has reported a robust set of financials, underpinned by its commitment to execution and strategic initiatives.

Company Overview

Cactus Inc is known for its Cactus SafeDrill wellhead systems, frac stacks, zipper manifolds, and production trees, as well as mission-critical field services. These offerings are essential for the drilling, completion, and production phases of unconventional oil and gas wells, primarily onshore. The company's recent acquisition of FlexSteel has diversified its revenue streams and enhanced margins, positioning it for growth both within and beyond the upstream oil and gas sector.

Financial Highlights and Performance

The fourth quarter saw Cactus Inc generate $274.9 million in revenue and $78.6 million in operating income. The company's net income for the quarter was $62.1 million, resulting in a diluted earnings per Class A share of $0.74. The adjusted net income was slightly higher at $65.1 million, with adjusted earnings per share of $0.81. The net income margin for the quarter was 22.6%, with an adjusted net income margin of 23.7%. The Adjusted EBITDA of $100.1 million represented a strong Adjusted EBITDA margin of 36.4%.

For the full year, Cactus Inc's revenue soared to $1.096 billion, a significant increase from the previous year's $688.4 million. The operating income for the year was $264.4 million, with a net income of $214.8 million. These figures underscore the company's financial achievements in a challenging environment, highlighting its ability to maintain profitability and cash flow generation.

Scott Bender, CEO and Chairman of the Board, remarked on the company's performance, stating:

"I am proud of our company's continued focus on execution as well as its integration of FlexSteel. In the fourth quarter, Adjusted EBITDA margins in both segments exceeded expectations, and we generated substantial free cash flow."

Financial Statements Summary

From the income statement, the year-over-year increase in revenue and net income is evident, reflecting the company's operational efficiency and market strength. The balance sheet remains robust, with a healthy cash and cash equivalents balance of $133.8 million and no bank debt, showcasing the company's solid liquidity position. The cash flow statement reveals strong cash flow from operations amounting to $91.7 million for the quarter, further solidifying the company's financial stability.

Key metrics such as the net income margin and Adjusted EBITDA margin are crucial indicators of the company's profitability and operational effectiveness. The absence of bank debt and the strong cash position are particularly important for Cactus Inc, as they provide financial flexibility and the ability to navigate the cyclical nature of the oil and gas industry.

Segment Performance and Future Outlook

Cactus Inc's Pressure Control segment experienced a slight decrease in revenue but increased operating income and margins due to cost management efforts. The Spoolable Technologies segment, which includes the recently acquired FlexSteel, saw a decrease in revenue and operating income, attributed to changes in the earn-out liability remeasurement. However, Adjusted Segment EBITDA margins improved slightly due to favorable input costs.

Looking ahead, Bender anticipates flat U.S. land activity levels in the first quarter of 2024 but remains optimistic about the company's initiatives to enhance margins and diversify international revenue streams.

In conclusion, Cactus Inc's strong financial results for the fourth quarter and full year of 2023 reflect the company's resilience and strategic positioning in the oil and gas sector. With a focus on customer service, margins, and returns, Cactus Inc is well-equipped to navigate the industry's challenges and capitalize on growth opportunities.

Explore the complete 8-K earnings release (here) from Cactus Inc for further details.

This article first appeared on GuruFocus.