Cadence (CDNS) Expands Portfolio Through Intrinsix Acquisition

Cadence Design Systems CDNS announced that it has entered into a definite agreement with CEVA to acquire its subsidiary — Intrinsix Corporation. Intrinsix is a leading provider of design engineering solutions for the U.S. aerospace and defense industry.

This acquisition aims to further expand Cadence’s footprint in the advanced nodes, radio frequency, mixed-signal, and security algorithms. CEVA is selling Intrinsix to focus on its core expertise, which is wireless communications, sensing, and edge artificial intelligence (AI) technologies, aligning with its long-term growth strategy.

The acquisition will likely help Cadence enhance its system and IC design services and help customers to achieve design excellence, especially in high-growth verticals like aerospace and defense. The impact of this acquisition on Cadence's revenues and earnings for the current year is expected to be insignificant, pending the fulfillment of certain closing conditions.

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Cadence offers products and tools that help customers to design electronic products. The company is focusing on providing end-to-end solutions, which rapidly reduces the time required to introduce a semiconductor product in the market.

Going ahead, the company is likely to benefit from customers increasing their R&D spending in AI-driven automation. Secular trends like 5G, increasing usage of hyperscale computing and autonomous driving are driving design activity across semiconductor and systems companies.

The company continues to invest heavily in verification and digital design products, helping it to launch products that address the ever-growing needs of electronics and semiconductor companies. The company’s verification business is gaining traction due to the rising complexity of system verification and software bring-up.

In July, the company announced that it had entered into an agreement with Rambus to acquire the Rambus SerDes and memory interface PHY IP business. The acquisition will help Cadence to expand its reach across geographies and vertical markets.

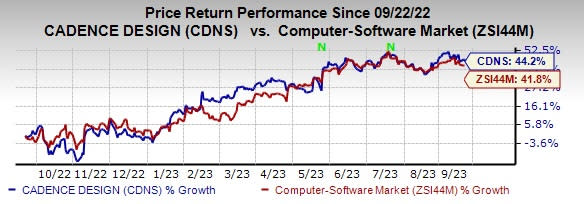

CDNS currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 44.2% compared with the sub-industry’s growth of 41.8% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Aspen Technology AZPN and Badger Meter BMI. Asure Software presently sports a Zacks Rank #1 (Strong Buy), whereas Badger Meter and Aspen Technology currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 376.4%. Shares of ASUR have surged 66.7% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has increased 5.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 12.6% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 6.3% in the past 60 days to $2.86.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 69.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report