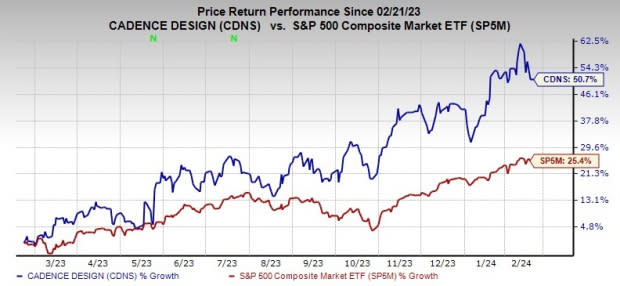

Cadence (CDNS) Gains 51% in the Past Year: Will the Rally Last?

Cadence Design Systems’ CDNS stock is continuing its upward trajectory with a gain of 50.7% in the year past year compared with the S&P 500 Composite’s growth of 25.4%.

Cadence offers products and tools that help customers design electronic products. The company’s core electronic design automation software and services enable engineers to develop different types of ICs.

CDNS’ performance is being driven by the healthy demand for its diversified product portfolio across all segments.

Image Source: Zacks Investment Research

The company sports a Zacks Rank #1 (Strong Buy) at present.

Strong Quarterly Results

The company recently reported better-than-expected fourth-quarter 2023 results. Non-GAAP earnings of $1.38 per share increased 43.8% year over year. Revenues of $1.069 billion rose 18.8% on a year-over-year basis. The top line benefited from higher customer demand amid robust design activity and strong operational execution. CDNS ended the quarter with a backlog of $6 billion and current remaining performance obligations of $3.2 billion.

For 2023, the company delivered 15% growth in revenues to $4.09 billion, while earnings were up 20% to $5.15 per share.

Accelerated design activity owing to transformative generational trends, such as generative AI, hyperscale computing, 5G and autonomous driving, is likely to boost the top line going ahead. Momentum in 3D-IC and chiplet designs bodes well. Expansion of its well-established partnerships with strategic partners like NVIDIA, Arm and Intel is a tailwind.

The company’s Functional Verification business is gaining traction due to the rising complexity of system verification and software bring-up. Revenues from this segment were up 11% year over year in the fourth quarter.

Demand for CDNS’ hardware systems remains robust. Palladium and Protium (especially Z2 and X2) platforms witnessed continued traction with many deal wins. It added 26 new and more than 110 repeat customers during 2023.

Recently, the company also announced a new set of applications designed to enhance the capabilities of its flagship Palladium Z2 Enterprise Emulation System. The applications are domain-specific apps that are tailored to help customers navigate the increasing complexity of system design.

The Digital IC business was up 22% year over year in the fourth quarter. CDNS’ digital full flow was adopted by 34 additional customers during the year.

Robust Outlook

Revenues for 2024 are now projected in the range of $4.55-$4.61 billion. Non-GAAP earnings per share (EPS) for 2024 are expected between $5.87 and $5.97.

Non-GAAP operating margin for 2024 is projected in the range of 42-43%. Management envisions operating cash flow between $1.35 billion and $1.45 billion. CDNS expects to utilize 50% of the free cash flow to repurchase shares in 2024.

It repurchased shares worth $125 million in the fourth quarter and $700 million for 2023.

A Look at Estimates

Cadence’s EPS for 2024 and 2025 is expected to climb 14% and 17.6% on a year-over-year basis to $5.87 and $6.91, respectively. The Zacks Consensus Estimate for 2024 and 2025 earnings has improved 1.9% and 6%, respectively, in the past 60 days. The long-term earnings growth rate is 17.1%.

Revenues for 2024 and 2025 are projected to rise 12.3% and 12.1% to $4.59 billion and $5.15 billion, respectively.

Few Headwinds

Though the outlook for the full year was robust, management’s guidance for the first quarter of 2024 was lower than the reported actuals in the prior-year quarter.

For first-quarter 2024, revenues are estimated between $990 million and $1.01 billion. The company reported sales of $1.022 billion in the year-ago quarter.

Non-GAAP EPS for first-quarter 2024 is anticipated between $1.10 and $1.14. CDNS reported EPS of $1.29 in the year-ago quarter.

Higher costs, stiff competition and weak global macroeconomic conditions continue to remain concerns for CDNS.

Other Stocks to Consider

Some other top-ranked stocks worth consideration in the broader technology space are Manhattan Associates MANH, Watts Water Technologies WTS and Microsoft MSFT. While Manhattan Associates sports a Zacks Rank #1, Watts Water and Microsoft carry a Zacks Rank of 2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MANH’s 2024 EPS has increased 3.6% in the past 60 days to $3.76. Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 27.6%. Shares of MANH have surged 70.4% in the past year.

The Zacks Consensus Estimate for Watts Water’s 2024 EPS has improved 11 cents to $8.44 in the past 60 days. The long-term earnings growth rate is pegged at 7.8%. Shares of WTS have jumped 12.5% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2024 EPS is pegged at $11.60, indicating growth of 18.3% from the year-ago levels. Microsoft’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 8.8%. The long-term earnings growth rate is pegged at 16.2%. MSFT has gained 59.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report