Cadence (CDNS) Introduces New AI-Powered OrCAD X Platform

Cadence Design Systems CDNS recently rolled out next-generation Artificial Intelligence (AI)-powered OrCAD X platform which is also enabled with Cadence OnCloud Platform.

With cloud scalability and AI-powered placement automation technology, the platform is capable of reducing design turnaround time by 5X, per Cadence.

OrCAD X platform will gain access to automated placement through Allegro X AI system. This will lead to transformative placement time reduction from days to minutes, noted Cadence. Users will not have to compromise on concerns like signal and power integrity, thermal design effects during placement, routing of critical signals and the generation of power planes while achieving time reductions.

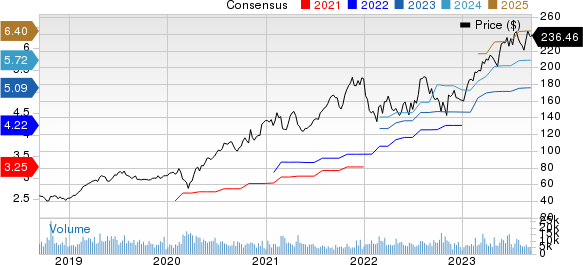

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

The platform also boasts augmented electrical constraints and performance improvements. It is deeply integrated with Cadence system design and analysis portfolio leading to reduced time to market.

Being cloud-enabled, OrCAD X improves productivity with real-time access to data management. Using a cloud login to manage and store data facilitates a smooth hybrid work environment across desktops and cloud, thereby slashing infrastructure costs for users, added CDNS.

Management further stated the new platform is optimized for small and medium businesses by offering “easy-to-learn and easy-to-use PCB layout canvas”. The platform also has several new cloud-based licensing options along with various user-experience enhancements from installation through design. This manufacturing documentation will offer users fabrication details in real time throughout the design process. The new platform supports Cadence’s Intelligent System Design strategy.

Based in San Jose, CA, Cadence is focused on providing end-to-end solutions, which rapidly reduces the time required to introduce a semiconductor product in the market. It is experiencing strong demand for its software – particularly verification and digital design products – from customers providing datacenter servers, networking products and smartphones that continues to invest in new design concepts and projects.

Frequent product launches are expected to help the company sustain top-line growth. In 2022, it introduced nine new products, including LPDDR5X memory interface IP, Certus Closure Solution, Cadence Joint Enterprise Data and AI Platform, Verisium AI-Driven Verification Platform and more. Among existing products, its Palladium and Protium platform is gaining traction among clients in the AI, hyperscale computing and automotive segments.

Management noted that customers are significantly increasing their R&D budget in AI-driven automation, which, in turn, is benefiting the company. Most of the generational trends like 5G, hyperscale computing and autonomous driving are being reinforced by the use of generative AI. This is accelerating chip design activity and thereby creating plenty of business prospects for the company, per CDNS.

However, higher costs related to R&D are likely to dent margins in the near term. Stiff competition and volatile macroeconomic conditions continue to be concerns.

CDNS currently carries a Zacks Rank #3 (Hold).

In the past year, shares of CDNS have gained 41.4% compared with Zacks sub-industry’s growth of 37.9%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Badger Meter BMI, Synopsys SNPS and Adobe ADBE. While Synopsys sports a Zacks Rank #1 (Strong Buy), Badger Meter and Adobe carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 5.1% in the past 60 days to $2.86. BMI’s earnings beat estimates in the last four quarters, the average surprise being 6.7%. Shares of BMI have surged 70.2% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS is pegged at $11.09, up 2.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.4%.

SNPS’ earnings surpassed estimates in the last four quarters, the average beat being 4.2%. Shares of SNPS have rallied 40.5% in the past year.

The Zacks Consensus Estimate for Adobe’s fiscal 2023 EPS has remained unchanged in the past 60 days at $15.70. ADBE’s earnings outshined estimates in the last four quarters, the average surprise being 3.1%. Shares of ADBE have jumped 45.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report