Caesarstone (CSTE) to Close Richmond Hill Manufacturing Facility

Caesarstone Ltd. CSTE announced the closure of its Richmond Hill manufacturing facility, effective from mid-January 2024, consistent with its restructuring plan initiated in mid-2023. This is likely to contribute $20 million in annual savings by optimizing its manufacturing footprint.

CSTE expects to incur restructuring expenses and a one-time non-cash impairment charge of $45-$55 million in fourth-quarter 2023. Total cash costs related to operations through 2024 are projected to be $3-$5 million.

Additionally, the company noted that the Australian federal, state and territory governments banned the use, supply and manufacture of engineered stone slabs containing crystalline silica (including its quartz-based products) in the country starting Jul 1, 2024. The decision is expected to negatively impact sales in the near term. The Australian market accounted for approximately 18% of total revenues in the first nine months of 2023.

On the contrary, CSTE disagrees with the decision and has appealed its position to the Australian government. It believes that its installed products were never an issue and that the products are safe to fabricate under safe working practices. The company believes that the focus should be aimed at improving occupational health and safety.

The stock plunged 9.74% in the day trading session on Dec 13 post the news release.

Yos Shiran, chief executive officer of Caesarstone, stated, “The Caesarstone brand is well known in Australia and its products have earned tremendous success over the years. We are already taking steps to supply our Australian market with alternative products while maintaining our strong market presence.”

In the third quarter, total revenues fell 21.2% on a reported basis and 20.3% on a constant currency basis due to lower volumes. Volumes were primarily impacted by global economic headwinds, particularly in renovation and remodeling channels, across the regions and the competitive landscape, resulting in lower demand. Australia unit revenues declined 12.4% year over year and 8.4% on a constant currency basis.

The adjusted gross margin of 19.8% was also down from the 23.1% reported in the prior-year quarter on lower revenues and increased manufacturing unit costs due to lower fixed cost absorption related to lower capacity utilization. Adjusted EBITDA was $1.9 million in the same period compared with the $13.4 million reported in the previous year.

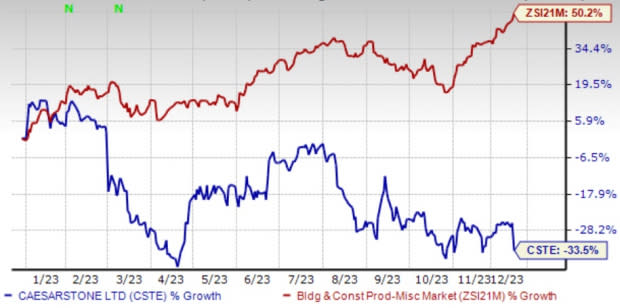

Image Source: Zacks Investment Research

Year to date, shares of the company have declined 33.5% against the Zacks Building Products - Miscellaneous industry’s 50.2% growth.

Zacks Rank & Key Picks

CSTE currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks that warrant a look in the same industry are Frontdoor, Inc. FTDR, Knife River Corporation KNF and James Hardie Industries plc JHX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Frontdoor: Based in Memphis, TN, the company provides home service plans in the United States. The company is benefiting from impressive customer retention rates. Thanks to the robust awareness of the Frontdoor brand, it has been shifting its attention toward capitalizing on customer demand. This strategic move allows FTDR to redirect its marketing investments toward expanding its Direct-to-Consumer channel under the American Home Shield brand. Looking ahead, the company is committed to establishing a solid foundation by investing in its brand, technology infrastructure and enhancing productivity throughout the organization.

Frontdoor has seen an upward estimate revision of 23% and 23.8% for 2023 and 2024 earnings over the past 60 days to $2.03 and $2.34 per share, respectively. The estimated figure indicates 59.8% and 15.1% year-over-year growth for 2023 and 2024, respectively. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 163.7%.

Knife River: Headquartered in Bismarck, ND, this firm offers construction materials and contracting services throughout the United States, specializing in aggregates-based solutions. Knife River has effectively implemented its EDGE plan to enhance Adjusted EBITDA margins and achieve strategic objectives. A crucial component of this strategy involves optimizing pricing to fully capture the value of core products, including aggregates, ready-mix concrete, asphalt and contracting services. The company has adopted a more judicious approach in selecting higher-margin projects within its contracting services division. Despite challenges, Knife River maintains a positive outlook on the long-term market strength, anticipating favorable impacts from local, state and federal funding.

Knife River has seen an upward estimate revision of 30.2% for 2023 earnings over the past 60 days to $3.15 per share. The company’s earnings surpassed the Zacks Consensus Estimate in the last reported quarter by 41%.

James Hardie Industries: The company pioneered the development of fiber cement technology in the 1980s. JHX has many product applications, including external siding, trim and fascia, ceiling lining and flooring, partitioning, decorative columns, fencing and drainage pipes.

JHX has seen an upward estimate revision of 0.6% and 1.2% for fiscal 2024 and 2025 earnings over the past seven days to $1.58 per share and $1.66 per share, respectively. The estimated figure indicates 16.2% and 5.1% year-over-year growth for fiscal 2024 and 2025, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

James Hardie Industries PLC. (JHX) : Free Stock Analysis Report

Caesarstone Ltd. (CSTE) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

Knife River Corporation (KNF) : Free Stock Analysis Report