Cal-Maine Foods (CALM): A Hidden Gem in the Consumer Packaged Goods Industry

Cal-Maine Foods Inc (NASDAQ:CALM) recently experienced a daily loss of -8.07% and a 3-month loss of -3.31%. Despite these downturns and its Earnings Per Share (EPS) of 15.53, the stock is significantly undervalued. This article explores the intrinsic value of Cal-Maine Foods (NASDAQ:CALM), providing an in-depth analysis of the company's financial health, profitability, and growth prospects.

Company Overview

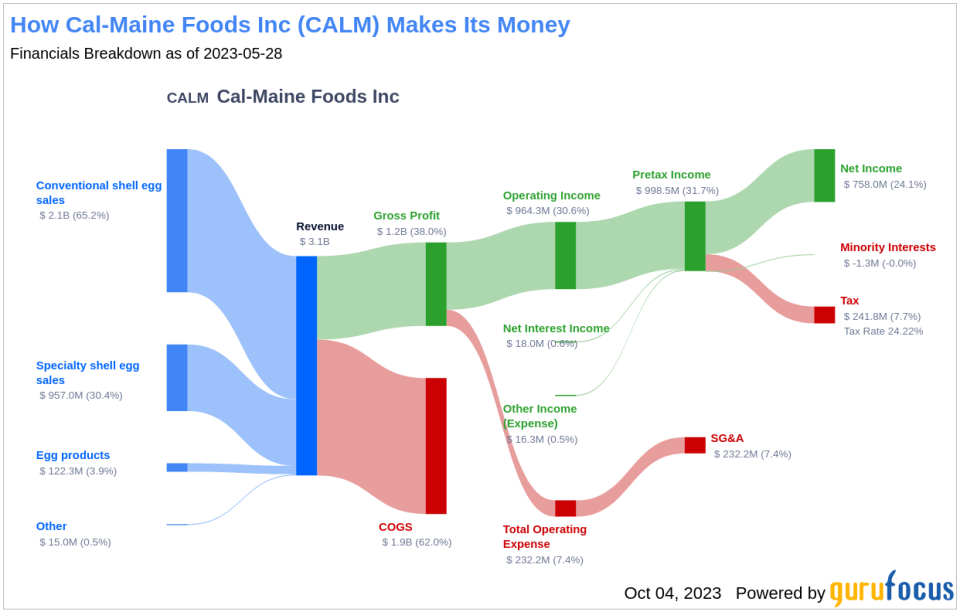

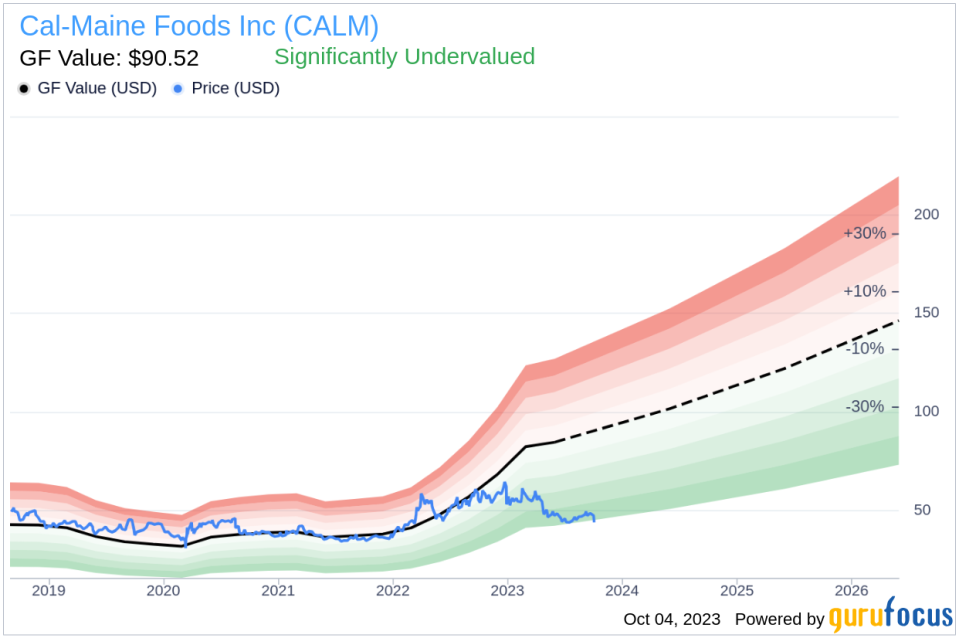

Cal-Maine Foods Inc is a leading producer and distributor of shell eggs in the United States. The company's portfolio includes nutritionally enhanced, cage-free, organic, and brown eggs, marketed to a diverse clientele comprising grocery-store chains, club stores, and food-service distributors. Its brands include Egg-Land's, Land O' Lakes, Farmhouse, and 4-Grain. The company's current stock price stands at $43.67, significantly lower than the GF Value of $90.52, indicating a potential undervaluation.

Understanding the GF Value

The GF Value is a proprietary valuation model that estimates a stock's fair value, considering historical trading multiples, GuruFocus adjustment factors based on past performance and growth, and future business performance estimates. The GF Value Line represents the ideal fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Cal-Maine Foods (NASDAQ:CALM) is currently considered significantly undervalued, with a market cap of $2.10 billion. This undervaluation suggests that the long-term return of its stock is likely to be much higher than its business growth.

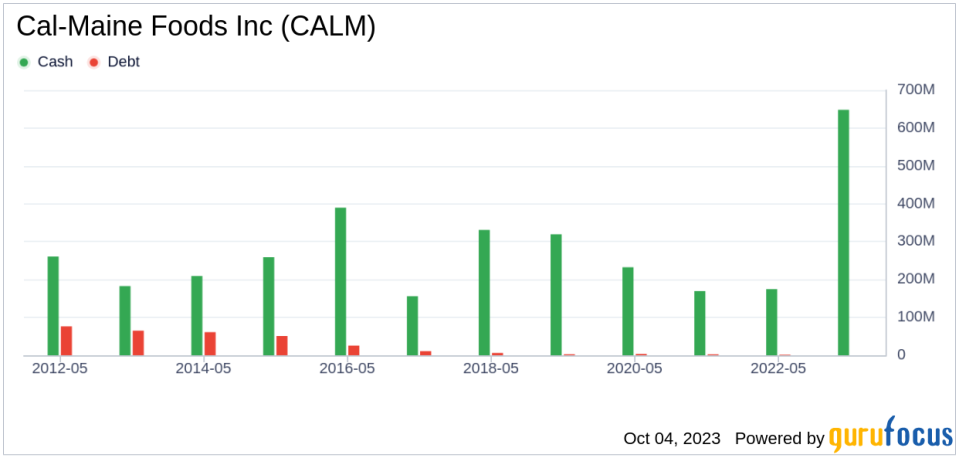

Financial Strength

Cal-Maine Foods' financial strength is a critical aspect of its valuation. Companies with poor financial strength pose a high risk of permanent capital loss. Cal-Maine Foods has a cash-to-debt ratio of 10000, ranking better than 99.94% of companies in the Consumer Packaged Goods industry. Its overall financial strength is 10 out of 10, indicating robust financial health.

Profitability and Growth

Cal-Maine Foods' profitability and growth are other essential factors in its valuation. The company has been profitable for 9 of the past 10 years, with a revenue of $3.10 billion over the past twelve months. Its operating margin is 30.65%, ranking better than 97.97% of companies in the Consumer Packaged Goods industry. The 3-year average annual revenue growth of Cal-Maine Foods is 32.3%, ranking better than 91.69% of companies in the industry. The 3-year average EBITDA growth rate is 138.4%, ranking better than 98.28% of companies in the industry.

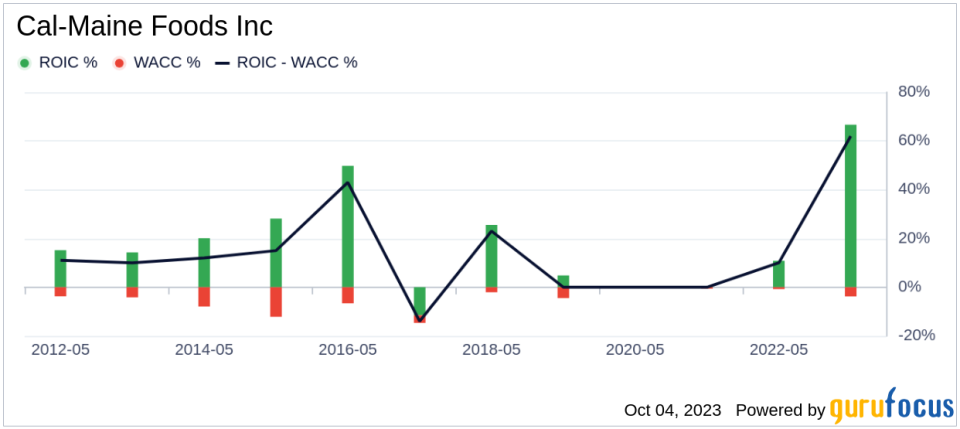

Return on Invested Capital vs Weighted Average Cost of Capital

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Cal-Maine Foods's ROIC is 68.33 while its WACC is 5.17, indicating value creation for its shareholders.

Conclusion

Overall, Cal-Maine Foods (NASDAQ:CALM) stock is significantly undervalued. The company's strong financial condition, impressive profitability, and promising growth prospects make it a compelling investment opportunity. To learn more about Cal-Maine Foods stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.