Calavo Growers Inc (CVGW) Faces Headwinds in Q1 2024 Despite Strong Avocado Pricing

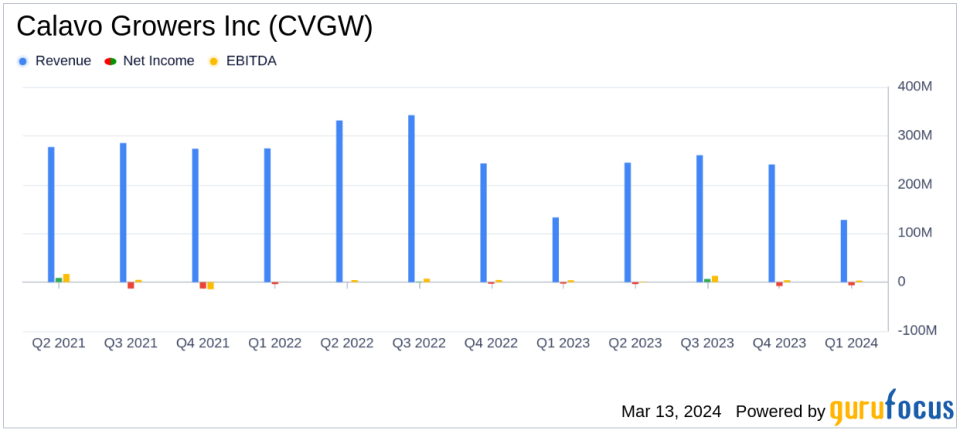

Net Sales: Reported a slight decrease to $127.6 million in Q1 2024 from $132.8 million in Q1 2023.

Gross Profit: Gross profit marginally declined to $12.5 million, or 9.8% of net sales.

SG&A Expenses: Increased to $13.5 million due to $2.4 million in professional fees related to an ongoing investigation.

Net Loss: Posted a net loss of $2.6 million, or $0.15 per diluted share, compared to a net loss of $0.7 million in the prior year.

Adjusted EBITDA: Slightly improved to $4.8 million from $4.6 million in Q1 2023.

Liquidity: Ended the quarter with $47.0 million of net debt and approximately $33.6 million of available liquidity.

Segment Performance: Grown segment sales decreased by 4.0%, while Prepared segment sales decreased by 2.9%.

On March 11, 2024, Calavo Growers Inc (NASDAQ:CVGW), a global leader in the avocado industry and provider of value-added fresh food, released its 8-K filing, detailing financial results for the fiscal first quarter ended January 31, 2024. The company, which operates in two segmentsGrown and Preparedsaw a decline in net sales by 3.9% year-over-year, primarily due to a decrease in the Grown segment sales and a slight dip in the Prepared segment sales.

Financial Performance and Challenges

Calavo's first-quarter performance was impacted by market dynamics, particularly for smaller-sized avocados. Despite this, the company reported a 20% increase in the average selling price of avocados compared to the previous year. The gross profit for the quarter was $12.5 million, or 9.8% of net sales, a slight decrease from $13.1 million and 9.9%, respectively, for the same period last year. Selling, general, and administrative (SG&A) expenses increased to $13.5 million, or 10.6% of net sales, compared to $11.6 million and 8.8% of net sales for the same period last year. The increase was primarily related to $2.4 million of professional fees associated with an ongoing investigation.

The company reported a net loss of $2.6 million, or $0.15 per diluted share, compared to a net loss of $0.7 million, or $0.04 per diluted share, for the same period last year. Adjusted net loss was $0.2 million, or $0.01 per diluted share, compared to adjusted net income of $0.8 million, or $0.05 per diluted share last year. Adjusted EBITDA saw a slight improvement to $4.8 million compared to $4.6 million for the same period last year.

Strategic Initiatives and Outlook

President and CEO Lee Cole commented on the results and the company's strategic direction:

Our first quarter results were affected by temporary market dynamics within our avocado business, particularly for smaller sized fruit, and we are pleased to report that conditions have improved in February and March. We expect a solid rebound in earnings in the second quarter and fiscal 2024 owing to improved avocado margins, improved tomato performance and the ramp up of the California avocado season. We expect another successful California avocado season for Calavo in fiscal 2024.

We continue to anticipate completing the sale of our fresh cut business within the fiscal second quarter. We expect to realize SG&A cost reductions from both the sale of the fresh cut business as well as other cost reductions as we make our corporate structure more efficient. We are targeting SG&A savings of $20 million or more on an annualized basis and already have begun implementing some efficiencies in our corporate structure. We also anticipate a reduction of depreciation and amortization expense of approximately $10 million on an annualized basis due to the divestiture.

Calavo's balance sheet reflects $47.0 million of net debt, including $45.7 million of borrowings under its credit facility and $6.9 million of other long-term obligations and finance leases, less cash and cash equivalents of $5.7 million. The company had approximately $33.6 million of available liquidity as of January 31, 2024.

The company's Grown segment gross profit was $8.1 million, $1.3 million below the prior year quarter, with avocado gross profit per case higher than in the year-ago quarter, while volume declined 18%. The Prepared segment gross profit improved to $4.3 million from the prior year quarter, with gross margin rising to 30% from 24% last year on lower fruit input costs.

Conclusion

Calavo Growers Inc (NASDAQ:CVGW) is navigating through a challenging market environment with strategic initiatives aimed at cost savings and operational efficiency. The company's focus on improving avocado margins and the anticipated sale of its fresh cut business are expected to contribute to a stronger financial performance in the upcoming quarters. Investors and stakeholders will be watching closely as Calavo continues to adapt to market conditions and execute its strategic plans.

Explore the complete 8-K earnings release (here) from Calavo Growers Inc for further details.

This article first appeared on GuruFocus.