Calavo Growers Inc's Dividend Analysis: A Look at Upcoming Payments and Sustainability

A Comprehensive Review of Calavo Growers Inc's Dividend Performance

Calavo Growers Inc (NASDAQ:CVGW) recently announced a dividend of $0.1 per share, payable on 2023-10-11, with the ex-dividend date set for 2023-09-26. As investors anticipate this upcoming payment, it's crucial to also examine the company's dividend history, yield, and growth rates. Using data from GuruFocus, we delve into Calavo Growers Inc's dividend performance and evaluate its sustainability.

Understanding Calavo Growers Inc's Business

Warning! GuruFocus has detected 5 Warning Signs with CVGW. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

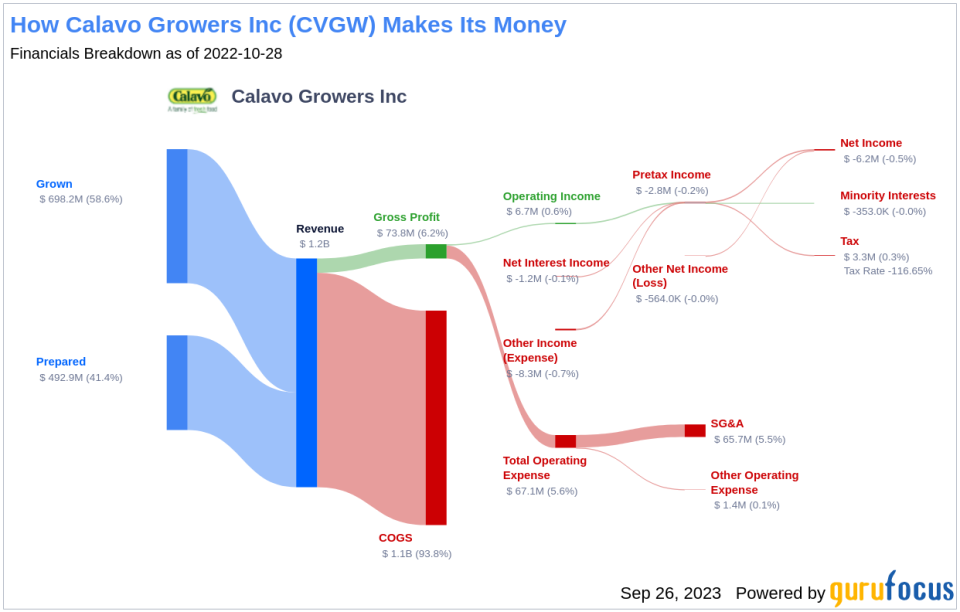

Calavo Growers Inc operates in the avocado industry and is an expanding provider of value-added fresh food. The company sells avocados to supermarket chains, wholesalers, food service and other distributors, under both brand labels and private labels. The company procures avocados from California, Mexico, and other growing regions globally. Calavo is segmented into three segments: Fresh products; Calavo Foods; and RFG. The company primarily derives its revenue from its Fresh products segment.

Calavo Growers Inc's Dividend History at a Glance

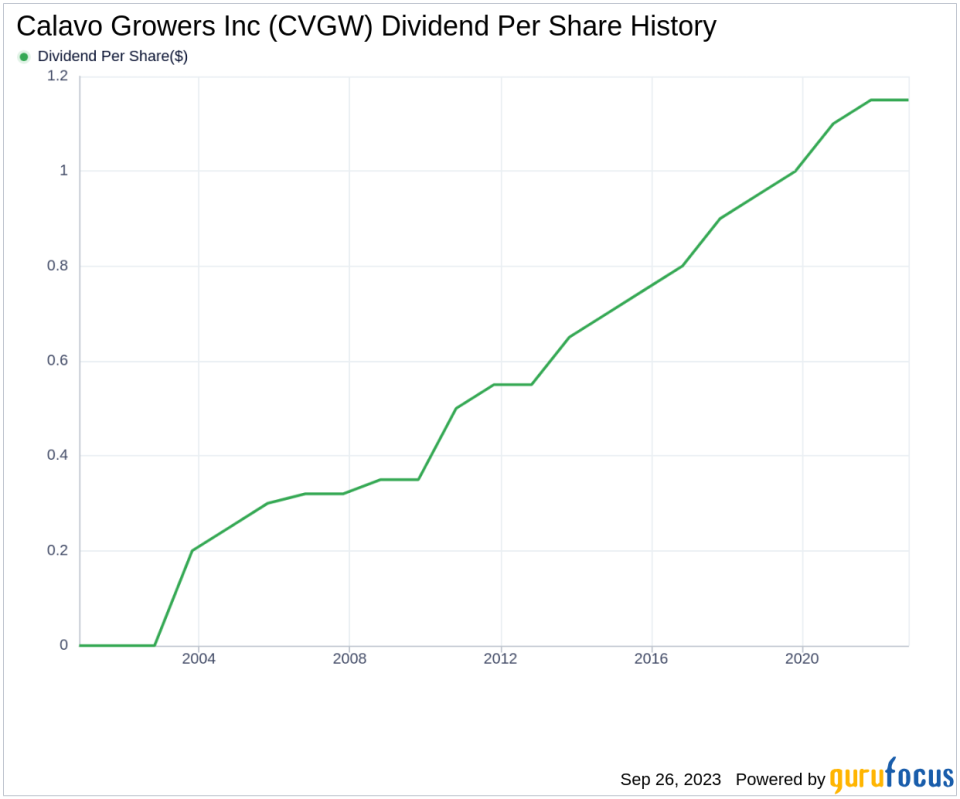

Calavo Growers Inc has maintained a consistent dividend payment record since 2002, with dividends currently distributed on a quarterly basis. The company has increased its dividend each year since 2003, earning it the status of a dividend achiever, a distinction given to companies that have increased their dividend each year for at least the past 20 years.

Dissecting Calavo Growers Inc's Dividend Yield and Growth

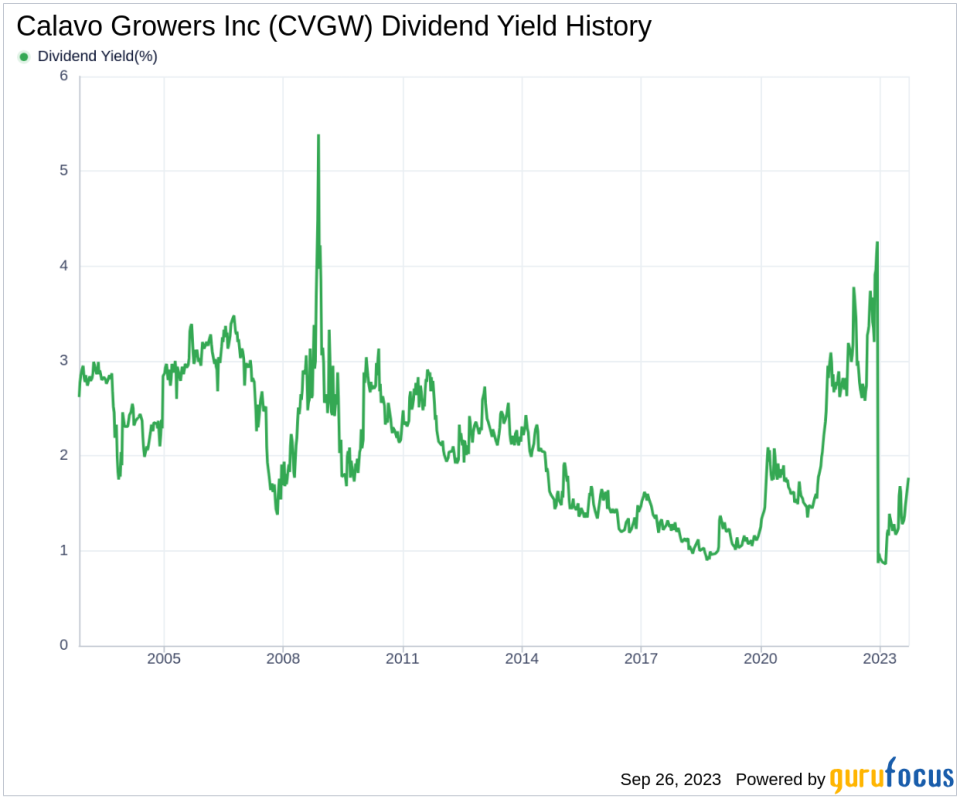

As of today, Calavo Growers Inc has a 12-month trailing dividend yield of 1.85% and a 12-month forward dividend yield of 2.22%, indicating an expected increase in dividend payments over the next 12 months.

Over the past three years, Calavo Growers Inc's annual dividend growth rate was 4.80%. This rate increased to 5.60% per year over a five-year horizon. Over the past decade, Calavo Growers Inc's annual dividends per share growth rate stands at 7.60%.

Based on Calavo Growers Inc's dividend yield and five-year growth rate, the 5-year yield on cost of Calavo Growers Inc stock as of today is approximately 2.43%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The dividend payout ratio of Calavo Growers Inc, which indicates the portion of earnings the company distributes as dividends, is crucial in assessing dividend sustainability. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-07-31, Calavo Growers Inc's dividend payout ratio is 0.00.

Calavo Growers Inc's profitability rank of 5 out of 10 suggests fair profitability. The company has reported net profit in 6 out of the past 10 years.

Future Prospects: Growth Metrics

For dividend sustainability, robust growth metrics are essential. Calavo Growers Inc's growth rank of 5 out of 10 suggests a fair growth outlook. Calavo Growers Inc's revenue has increased by approximately -0.30% per year on average, a rate that underperforms approximately 71.97% of global competitors.

Concluding Remarks

Calavo Growers Inc's consistent dividend payments, growth rates, and a low payout ratio underscore its commitment to rewarding shareholders. Although its growth metrics suggest a fair growth outlook, investors should continue monitoring its profitability and dividend growth. With a solid dividend history and promising yield, Calavo Growers Inc presents an intriguing prospect for income-focused investors.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.