Calavo (NASDAQ:CVGW) Misses Q1 Revenue Estimates

Fresh produce company Calavo Growers (NASDAQGS:CVGW) fell short of analysts' expectations in Q1 FY2024, with revenue down 43.6% year on year to $127.6 million. It made a non-GAAP loss of $0.01 per share, improving from its loss of $0.08 per share in the same quarter last year.

Is now the time to buy Calavo? Find out by accessing our full research report, it's free.

Calavo (CVGW) Q1 FY2024 Highlights:

Revenue: $127.6 million vs analyst estimates of $252.7 million (49.5% miss)

EPS (non-GAAP): -$0.01 vs analyst estimates of $0.17

Gross Margin (GAAP): 9.8%, up from 6.4% in the same quarter last year

Market Capitalization: $521.5 million

Management Commentary “Our first quarter results were affected by temporary market dynamics within our avocado business, particularly for smaller sized fruit, and we are pleased to report that conditions have improved in February and March,” said Lee Cole, President and Chief Executive Officer of Calavo Growers, Inc.

A trailblazer in the avocado industry, Calavo Growers (NASDAQGS:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

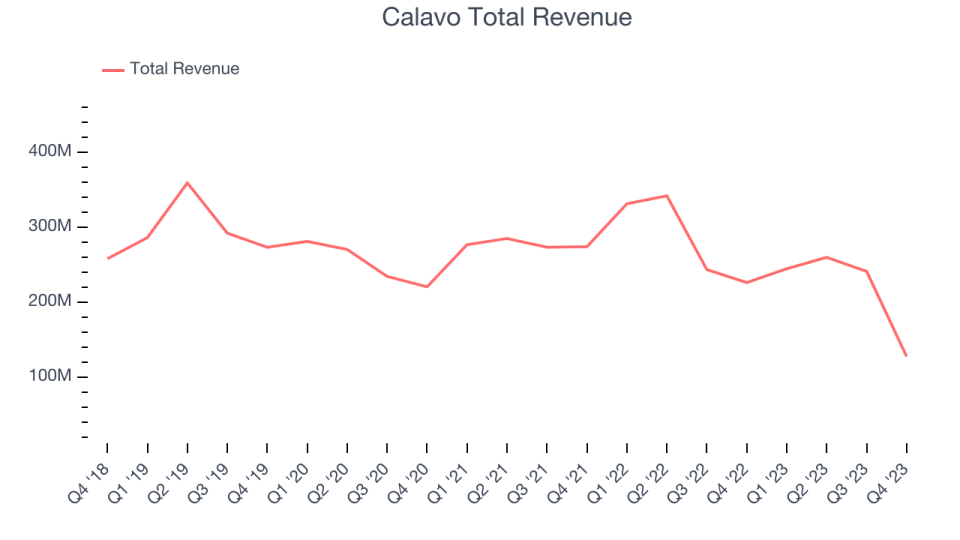

As you can see below, the company's revenue has declined over the last three years, dropping 4.6% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Calavo missed Wall Street's estimates and reported a rather uninspiring 43.6% year-on-year revenue decline, generating $127.6 million in revenue. Looking ahead, Wall Street expects sales to grow 12% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

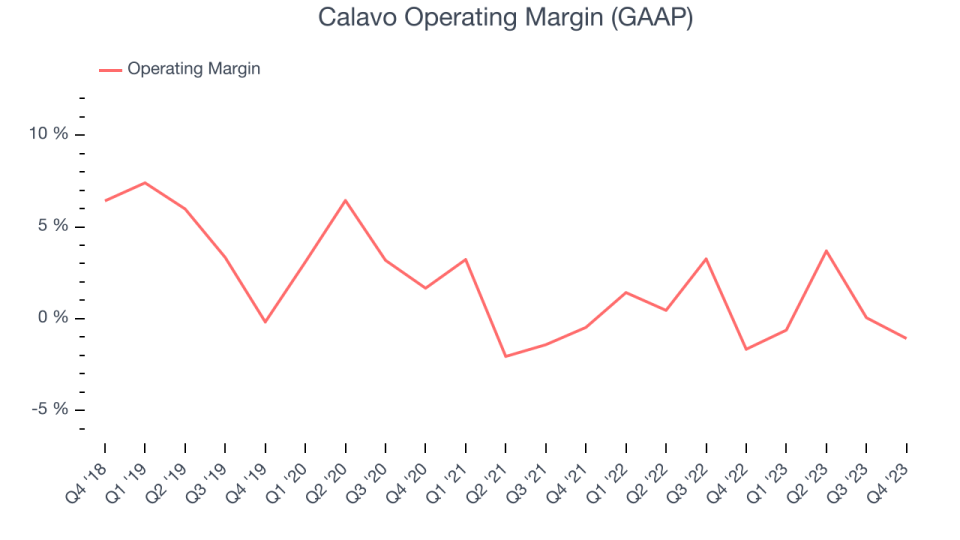

This quarter, Calavo generated an operating profit margin of negative 1.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Calavo was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer staples business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Key Takeaways from Calavo's Q1 Results

We were impressed by how significantly Calavo beat analysts' gross margin expectations this quarter. But that's where the good news ends. Its revenue missed Wall Street's estimates by a huge margin, and its operating profit and EPS were not spared either. Next quarter, the company expects to complete the sale of its "fresh cut" business. Overall, this was a bad quarter for Calavo. The company is down 1.3% on the results and currently trades at $28.2 per share.

Calavo may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.