A Calculated Look at Texas Instruments

I have held Texas Instruments Inc. (NASDAQ:TXN) in my portfolio for a while. I originally bought the company as a hedge against the more severe geopolitical risks associated with an investment in semiconductor behemoth Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM). However, I wanted to understand more about the business as I consider increasing my exposure to the semiconductor space in the coming months. Therefore, I performed a deep dive to discover more intricacies that make the company stand out.

What is Texas Instruments?

The global semiconductor company designs, manufactures and sells integrated circuits, embedded processors and other components.

Semiconductors are a vital ingredient in modern electronics. They are materials with electrical conductivity between a conductor, such as aluminum, and an insulator, such as glass. These components are integral in controlling the flow of electrical current and make it possible to store data, perform computations and manipulate signals.

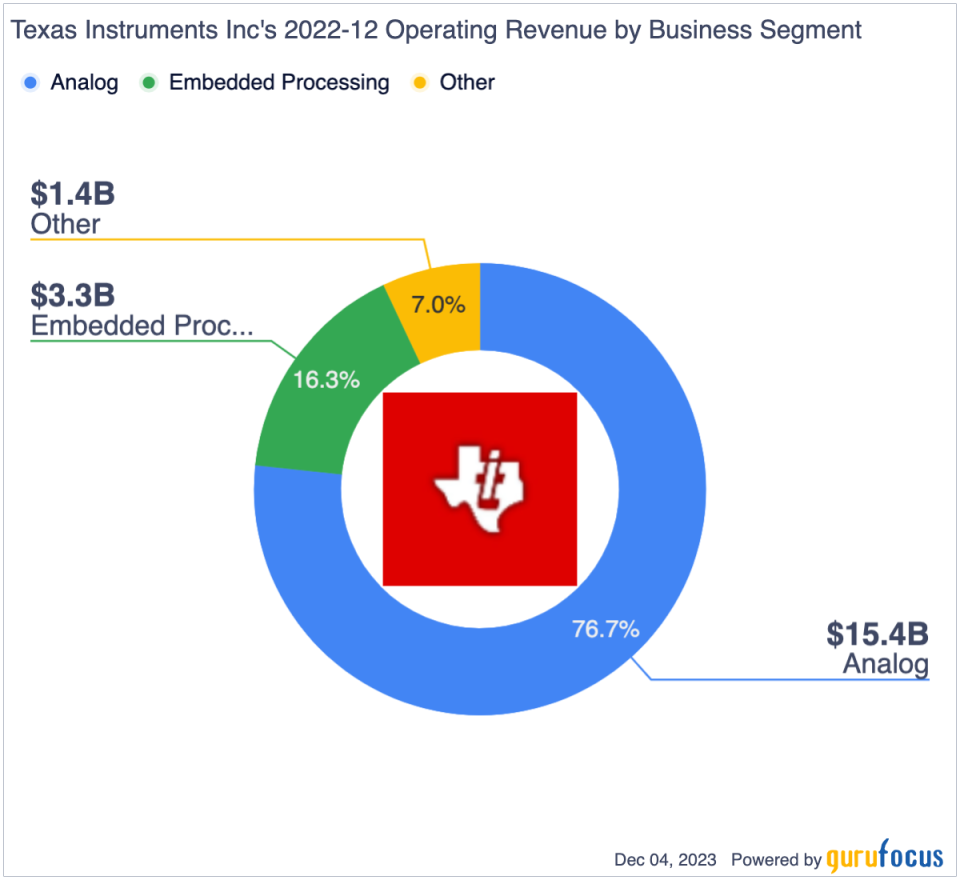

According to GuruFocus, Texas Instruments' primary revenue stream is its Analog segment, bringing in 76.70% of the total income. Embedded Processing takes home 16.30% and other revenue sources 7%.

The Analog segment refers to products dealing with analog signals. These signals differ from digital signals, as analog signals are continuous and vary smoothly, while digital technology uses binary signals (0s and 1s) for precision and noise reduction.

Embedded Processing relates to specialized semiconductor chips. These are integrated into electronics and perform specific computational tasks. For example, microcontrollers are small computers on single chips found in washing machines, microwaves and automobiles, among other devices.

The other revenue streams include a range of products and services. However, here are the top three I have found:

Digital Signal Processing: processors for efficiently manipulating digital signals in audio, telecommunications and digital images.

Educational Technology: graphing calculators have been a successful revenue stream for Texas Instruments.

Power Management: semiconductor products for regulating and distributing power for electronic devices.

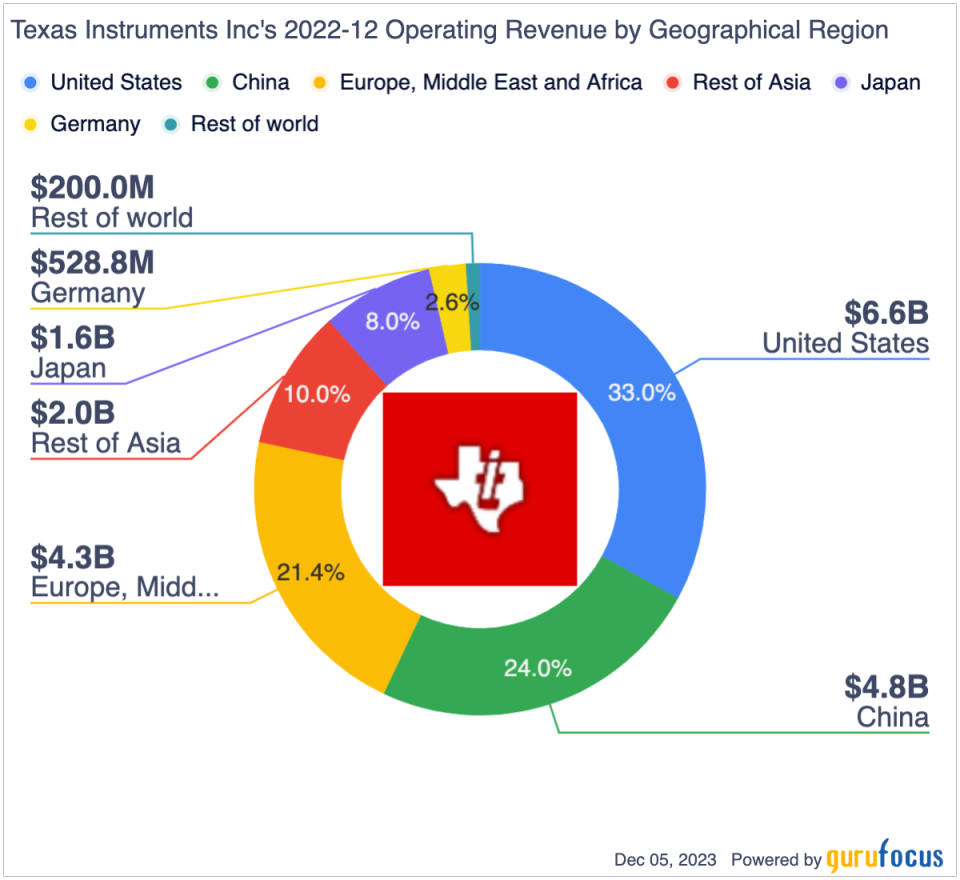

Looking at the company's geographic revenue diversification is equally fascinating. GuruFocus shows us that 33% of the revenue comes from the U.S. and 24% from China.

I find it particularly interesting to compare this to Taiwan Semiconductor's revenue diversification. Of these, 66% come from the U.S. and only 10.8% from China. Partly, I think this is due to the tailored operations of Taiwan Semiconductor as opposed to Texas Instruments' analog and embedded processing segments. The company is particularly useful for advanced semiconductor manufacturing driven by some of the biggest technology companies in the world, most based in the U.S., including Apple Inc. (NASDAQ:AAPL) and Tesla Inc. (NASDAQ:TSLA). In comparison, Texas Instruments does not specifically cater to these companies, but focuses on a larger market of various industries and sectors.

The company's main competitors

On that note, Taiwan Semiconductor is not a direct competitor to Texas Instruments as it is a semiconductor foundry manufacturing chips designed by major technology players. Texas Instruments, on the other hand, designs and manufactures its semiconductor products. This contrast can be most powerfully divided as such: Taiwan Semiconductor is a foundry service, while Texas Instruments is an integrated device manufacturer.

Instead, the three most prominent competitors to Texas Instruments based on my analysis (and there are many) are:

Analog Devices Inc. (NASDAQ:ADI) is a strong player in the analog semiconductor sector with a product portfolio driven by acquisitions. It has a market cap around $90 billion and a 10-year price return of around 320%.

Qualcomm Inc. (NASDAQ:QCOM) is a wireless communications company focused on developing 5G. It has a market cap of $145 billion and a 200% 10-year price return.

NXP Semiconductors NV (NASDAQ:NXPI) is honed in on automotive and industrial semiconductors. It focuses on electronics in vehicles, for example. It has a market cap of $50 billion and a 10-year price return of around 390%.

For comparison, Texas Instruments has a market cap of $140 billion and a 10-year price return of around 280%.

The company has significant competitive advantages over other semiconductor companies. Most notably, Texas Instrumens has a vast portfolio of products that treat the needs of various industries. This is a crucial differentiator from some of its main competitors. In addition, the company can produce 300 millimeter wafers, which significantly lowers costs. Highly efficient production such as this allows for scalability and keeps supply flowing to demand.

However, the company's research and development spending of between 8% and 10% of total revenue over the past few years is lower than its major competitors. For comparison, Analog Devices currently has 13.5% R&D spending, Qualcomm 24.6% and NXP 17.5%. This could leave Texas Instruments behind over the long term if other companies advance at higher rates due to deeper research on core advanced technologies driving revenue growth. In the semiconductor industry, advanced knowledge and technological capabilities are paramount in the race for better, faster, more attractive products.

Analyzing the financials

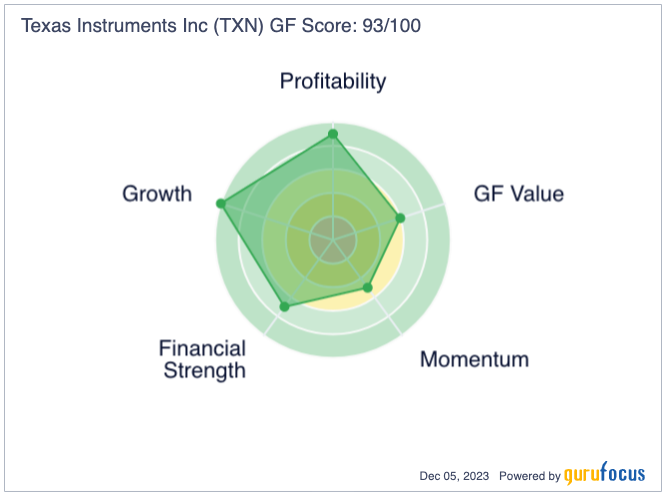

The GF Score of 93 out of 100 for Texas Instruments presents a favorable picture for investors. The strongest aspects of the chart are growth and profitability; interestingly, the company's value is rated as less strong. Let's have a look at why.

The company's gross margins are almost 65%, which boils down to 44% for operating margin and only a 5% decrease to a 39% net margin. Those are very high figures. For reference, the company's operating margin is in the top 2% of companies in the semiconductor industry.

Texas Instruments' 300mm wafer technology is a significant factor causing higher margins. This is because larger wafers mean more chips produced on a single wafer, decreasing the cost of chip production. The company also focuses explicitly on high-margin products from analog and embedded processing segments, and vertically integrating manufacturing to distribution reduces third-party spending. In my opinion, the company has a shrewd, efficient business model.

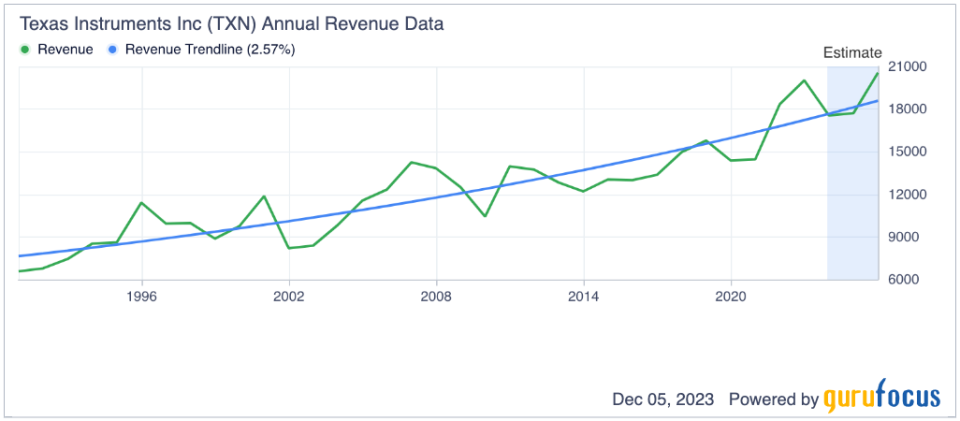

While the company's three-year revenue growth rate is 12.7%, which is only better than 51% of companies in the semiconductor industry, the growth rates are still relatively stable and strong, moving up consistently over time.

I think the company's revenue growth rates could be stronger. I am a shareholder because the company presents compelling operational advantages and significant semiconductor exposure. To me, it is the margins that really shine, and those have grown significantly from 32.4% in December 2014 to 51.9% in December 2022.

While the GF Value rank suggests a score of 6 out of 10, some compelling points to the valuation make the company a stable, well-valued investment.

For instance, while the company's forward price-earnings ratio is relatively high at almost 24 and it has a price-to-tangible book value of nearly 12 (in the bottom 7% of semiconductor companies), it performs well on a discounted cash flow analysis.

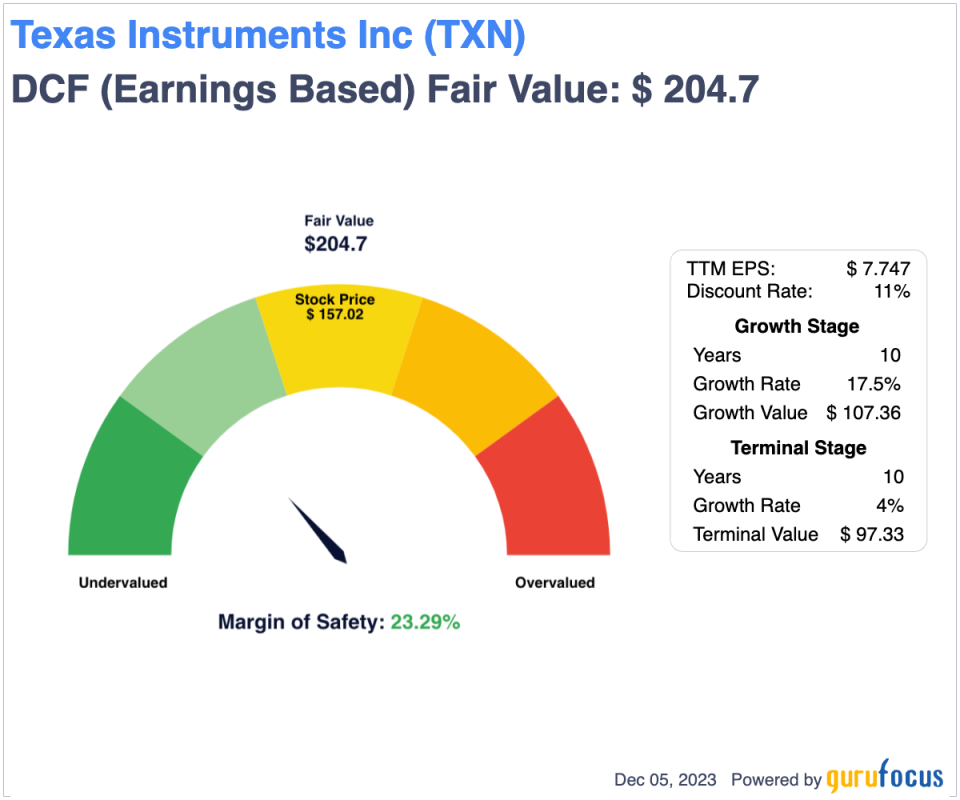

Given that the organization has a 10-year average annual earnings per share without non-recurring items growth rate of 17.5%, computing this into GuruFocus' DCF calculator gives us a wonderful 23% margin of safety. This makes up for the inferior book value and meager price-earnings ratio.

The bottom line

Texas Instruments is essential to my portfolio because it provides semiconductor exposure without the geopolitical risk associated with Taiwan Semiconductor. The company is also solid and stable, presenting compelling margins.

Going forward, I will look deeper into less-renowned semiconductor companies, outlining the details of some of the highest-growth, foundational infrastructure companies associated with semiconductor manufacturing. There may be better semiconductor investments out there than Texas Instruments and Taiwan Semiconductor.

This article first appeared on GuruFocus.