Caleres (CAL) Unveils a Comprehensive Three-Year Strategic Plan

Caleres, Inc. CAL hosted its Investor Day on Oct 5, 2023, in the bustling city of New York. This event reflects the company's impressive 145-year heritage and marked a significant occasion for the company.

This prominent player of footwear brands has unveiled a comprehensive three-year strategic and financial plan while reaffirming its third-quarter and fiscal 2023 expectations for consolidated net sales, earnings per share (EPS) and adjusted EPS.

One of the standout achievements of the company was the remarkable transformation of the organization's earnings power over the past four years. Structural changes have set a baseline for earnings at $4.00 per share behind this transformation. Fiscal 2023 is anticipated to be the third consecutive year of achieving this milestone.

Image Source: Zacks Investment Research

Inside The Headlines

The introduction of Caleres' three-year strategic and financial plan was aimed at propelling the company to greater heights of growth and profitability. Its brand assets, competitive advantages and core competencies position it uniquely to realize these ambitious goals and deliver enduring value to its shareholders.

Caleres aims to fuel growth by concentrating on its brand portfolio segment, which is anticipated to make a significant contribution to the company's earnings. The company has set ambitious targets for 2023, including achieving a double-digit operating margin and generating 50% of its revenues from this segment by 2026.

The company intends to deepen its connection with the Millennial family demographic through its Famous Footwear brand. Leveraging its dominant position in the Kids segment, enhancing the omni-channel experience and utilizing consumer analytics, the company aims to sustain profitability and generate substantial cash flow.

By consolidating its capabilities and resources under the One Caleres platform, the company seeks to enhance profitable growth. This integrated approach will enable CAL to boost customer acquisition, further vertically integrate its operations, and leverage consumer insights and investment expenditure across the organization.

Lastly, the three-year plan is underpinned by a commitment to deliver a robust financial performance, ultimately generating value for shareholders in the long term. Caleres has set targets, including a three-year CAGR of 3-5% for net sales, a three-year CAGR of 11-13% for adjusted EPS, aiming to reach $6.00 at the mid-point of the range, and an annual Total Shareholder Return in the low-to-mid-teens.

Wrapping Up

Despite the challenges from the demanding consumer environment in September 2023, Caleres is steadfast in its financial projections for the third quarter and fiscal 2023. For the third quarter, the company anticipates a year-over-year low-single-digit decline in consolidated net sales, with $1.25-$1.30 for EPS and $1.30-$1.35 for adjusted EPS.

For fiscal 2023, Caleres expects a measured 3-5% year-over-year reduction in consolidated net sales, considering the additional 53rd week. The company anticipates an EPS of $4.02-$4.22 and an adjusted EPS of $4.10-$4.30.

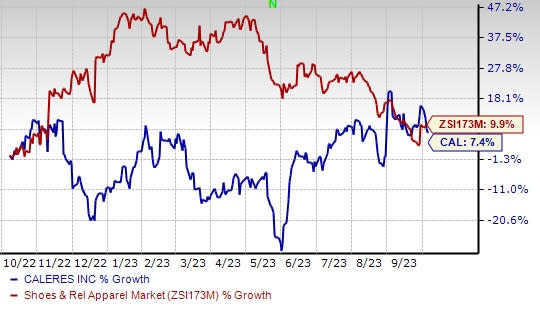

Lately, this Zacks Rank #4 (Sell) stock has rallied 7.4% in the past year compared with the industry’s growth of 9.9%.

Three Solid Picks

A few better-ranked stocks in the same space are Urban Outfitters, Inc. URBN, American Eagle Outfitters Inc. AEO and Skechers U.S.A., Inc. SKX.

Urban Outfitters, which specializes in the retail and wholesale of general consumer products, sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year earnings and sales indicates growth of 83.4% and 6.6% from the year-ago period’s reported figures. URBN has a trailing four-quarter average earnings surprise of 19.2%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 33% and 2.2% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 43.2%.

Skechers designs, develops, markets and distributes footwear for men, women and children. It presently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Skechers’ current financial-year earnings and sales indicates growth of 42.4% and 8.7% from the year-ago period’s reported figures. SKX has a trailing four-quarter average earnings surprise of 39.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Caleres, Inc. (CAL) : Free Stock Analysis Report