Caleres Inc (CAL) Delivers Steady Earnings Amidst Market Headwinds

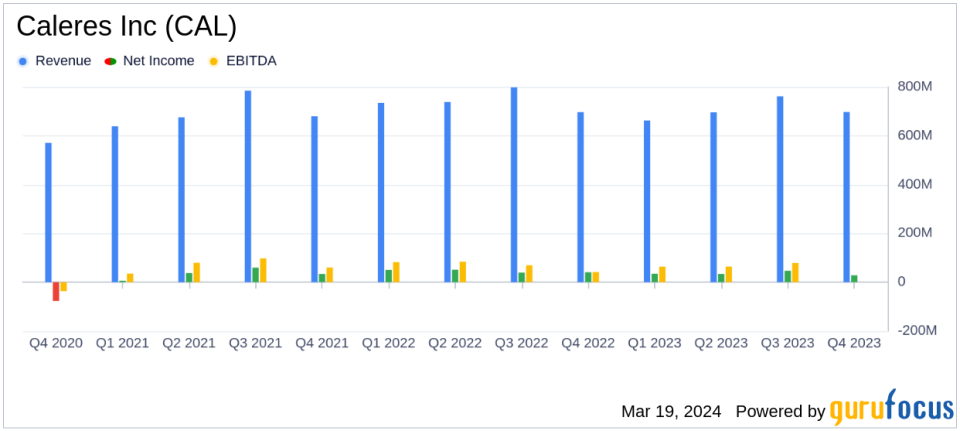

Net Sales: Reported a slight decrease to $2.82 billion for fiscal year 2023.

Gross Profit: Improved to $1.26 billion, reflecting a stronger gross margin.

Operating Earnings: Achieved $194.5 million, despite market challenges.

Net Earnings: Attributable to Caleres Inc shareholders were $171.4 million.

Debt Reduction: Reduced short-term borrowings by $125.5 million, reaching the lowest indebtedness since Q1 2010.

Shareholder Returns: Repurchased 763,000 shares and paid $10.0 million in dividends.

Fiscal 2024 Outlook: Expects net sales to be flat to up 2 percent, with EPS in the range of $4.30 to $4.60.

On March 19, 2024, Caleres Inc (NYSE:CAL), a diversified portfolio of global footwear brands, announced its financial results for the fourth quarter and full fiscal year 2023. The company released its 8-K filing, highlighting a year of strategic achievements and financial discipline, despite a challenging market environment.

Caleres Inc operates through two primary segments: Famous Footwear, a retail chain specializing in branded footwear, and Brand Portfolio, which includes wholesale operations that design, source, and distribute footwear to various retailers. The latter segment delivered a standout performance with record-setting financial metrics, including a 4.5-percent increase in net sales year-over-year and a significant improvement in gross margin.

Financial Performance and Challenges

The company's financial results reflect a resilient performance in a competitive market. Caleres reported consolidated net sales of $2.82 billion for the fiscal year 2023, a slight decrease from the previous year's $2.97 billion. However, the company saw an improvement in gross profit, which rose to $1.26 billion, thanks to a stronger gross margin. Operating earnings stood at $194.5 million, and net earnings attributable to Caleres Inc shareholders were $171.4 million.

Despite these achievements, Caleres faced several challenges, including a competitive retail environment and inflationary pressures. The company's Famous Footwear segment navigated these challenges effectively, capitalizing on holiday demand and achieving positive sales trends, particularly in its Kids business. However, the company anticipates headwinds such as a forecasted decline in the footwear market and higher freight costs in the upcoming fiscal year.

Financial Achievements and Industry Significance

Caleres' financial achievements are particularly noteworthy given the cyclical nature of the retail industry. The company's ability to reduce short-term borrowings by $125.5 million to its lowest level since the first quarter of 2010 demonstrates strong financial management. Additionally, the repurchase of 763,000 shares and the payment of $10.0 million in dividends underscore the company's commitment to returning value to shareholders.

The company's fiscal 2024 outlook is cautiously optimistic, with expectations for consolidated net sales to be flat to up 2 percent and earnings per diluted share to be in the range of $4.30 to $4.60. This outlook balances the positive momentum in the Brand Portfolio segment and ongoing cost reduction initiatives against the anticipated market challenges.

Analysis of Caleres Inc's Performance

Caleres Inc's performance in fiscal 2023 illustrates the company's strategic focus and operational efficiency. The Brand Portfolio's record performance and Famous Footwear's market share expansion in the Kids category are particularly impressive. The company's proactive capital allocation, including debt reduction and shareholder returns, positions it well for future growth.

As Caleres moves into fiscal 2024, the company's guidance reflects a realistic approach to the expected market conditions. The focus on growth strategies and long-term financial targets suggests a commitment to sustainable value creation for shareholders.

Value investors and potential GuruFocus.com members should consider Caleres Inc's consistent track record of adjusted earnings per share, its strategic positioning in the footwear industry, and its prudent financial management as key factors in their investment decisions.

For a more detailed breakdown of Caleres Inc's financial results and future outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Caleres Inc for further details.

This article first appeared on GuruFocus.