Caleres Inc's Meteoric Rise: Unpacking the 67% Surge in Just 3 Months

Caleres Inc (NYSE:CAL), a prominent footwear retailer in the United States, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by an impressive 66.50%, with an 18.63% increase in the past week alone. As of August 31, 2023, the company's stock price stands at $28.56, with a market cap of $1.04 billion. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Caleres Inc is $26.51, indicating that the stock is fairly valued. This is a significant improvement from three months ago when the stock was modestly undervalued with a GF Value of $27.14.

Company Overview

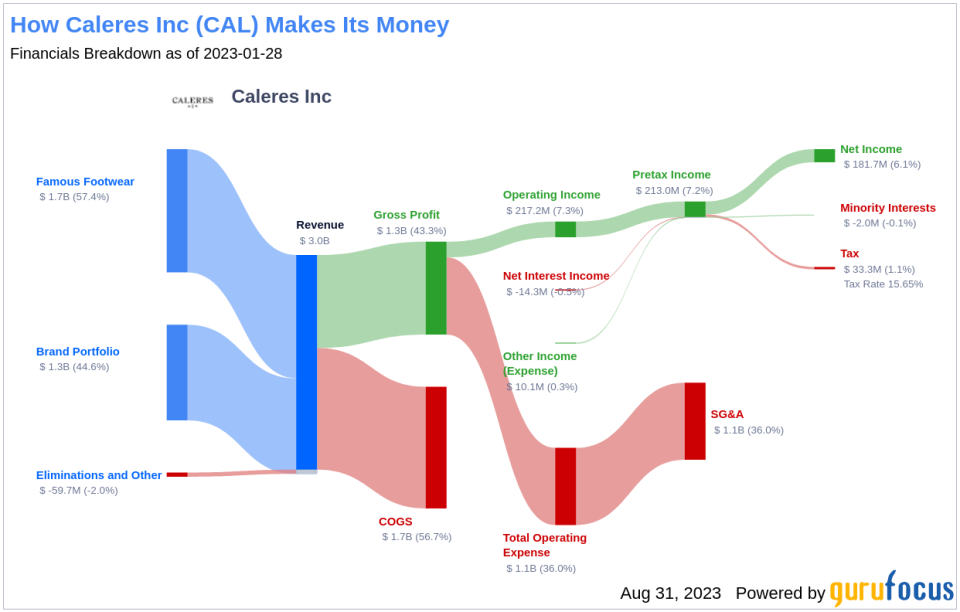

Caleres Inc operates in the cyclical retail industry, with its business organized into two reportable segments: Famous Footwear and Brand Portfolio. The Famous Footwear segment includes retail stores and online platforms, while the Brand Portfolio segment offers a carefully curated portfolio of top brands to various retailers and consumers. This segment designs, develops, sources, manufactures, markets, and distributes branded, licensed, and private-label footwear to online retailers, national chains, department stores, mass merchandisers, and independent retailers.

Profitability Analysis

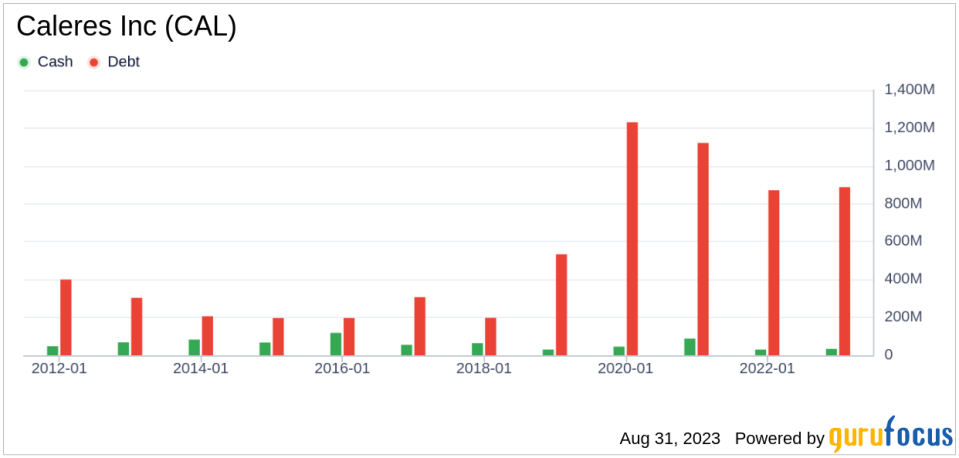

Caleres Inc's Profitability Rank stands at 6/10 as of April 30, 2023, indicating a strong profitability potential. The company's Operating Margin is 6.93%, better than 67.09% of the companies in the industry. The company's ROE is 41.56%, ROA is 8.68%, and ROIC is 11.68%, all of which are better than the majority of the companies in the industry. Over the past ten years, the company has demonstrated profitability for seven years, outperforming 48.24% of the companies in the industry.

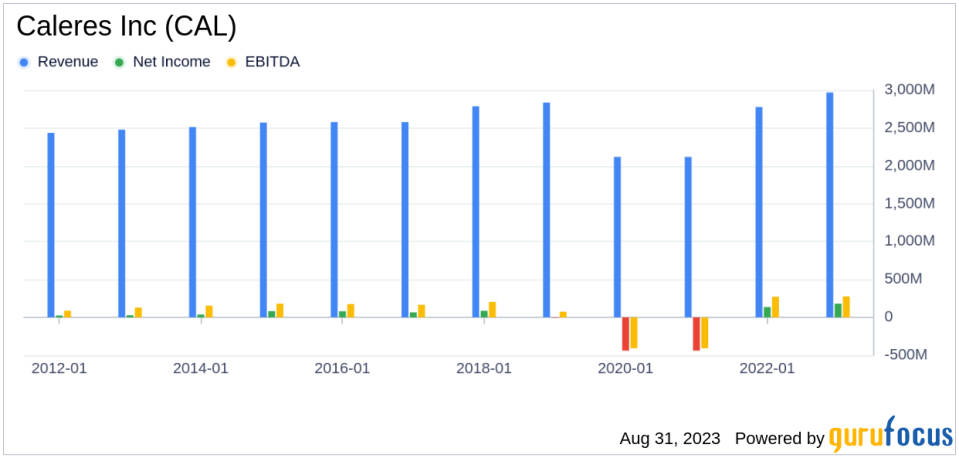

Growth Prospects

Caleres Inc's Growth Rank is 3/10, indicating moderate growth potential. The company's 3-Year Revenue Growth Rate per Share is 13.80%, better than 74.71% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 4.30%, outperforming 57.55% of the companies in the industry. The company's future total revenue growth rate estimate over a 3-year to 5-year period is 0.54%, better than 18.85% of the companies in the industry.

Major Stock Holders

Chuck Royce (Trades, Portfolio) is the largest holder of Caleres Inc's stock, holding 532,846 shares, which accounts for 1.47% of the company's stock. Jeremy Grantham (Trades, Portfolio) holds the second-largest number of shares, with 34,801 shares, accounting for 0.1% of the company's stock. Jim Simons (Trades, Portfolio) holds the third-largest number of shares, with 26,600 shares, accounting for 0.07% of the company's stock.

Competitive Landscape

Caleres Inc faces competition from several companies in the same industry. Chico's FAS Inc (NYSE:CHS) with a stock market cap of $641.957 million, Shoe Carnival Inc (NASDAQ:SCVL) with a stock market cap of $635.279 million, and Hibbett Inc (NASDAQ:HIBB) with a stock market cap of $580.859 million are the top three competitors of Caleres Inc.

Conclusion

In conclusion, Caleres Inc has demonstrated strong performance in the stock market over the past three months, with a significant surge in its stock price. The company's profitability and growth potential are promising, and it has a strong presence in the cyclical retail industry. The company's stock is held by prominent investors, and it faces competition from several companies in the same industry. Despite the competition, Caleres Inc's strong performance and growth prospects make it a company to watch in the future.

This article first appeared on GuruFocus.