California Resources Corp Reports Robust 2023 Financial Results with Record Cash Flow

Net Income: Reported a net income of $564 million, or $7.78 per diluted share.

Free Cash Flow: Generated $468 million of free cash flow, demonstrating capital efficiency.

Production: Average annual net production was 86 MBoe/d, with oil production averaging 52 MBo/d.

Shareholder Returns: Returned $280 million to stakeholders through share repurchases, debt repurchases, and dividends.

Leverage Ratio: Improved to 0.1 times, down from 0.3 times at year-end 2022.

Cost Savings: Achieved $65 million in annual, sustainable cost savings through business transformation initiatives.

Carbon Management: Advanced in carbon management with the receipt of Californias first U.S. EPA draft Class VI well permits for CO2 injection and storage.

On February 27, 2024, California Resources Corp (NYSE:CRC) released its 8-K filing, detailing the company's financial and operating results for the fourth quarter and full year of 2023. CRC, an independent oil and natural gas exploration and production company operating exclusively within California, has reported a year of strong financial performance and strategic advancements.

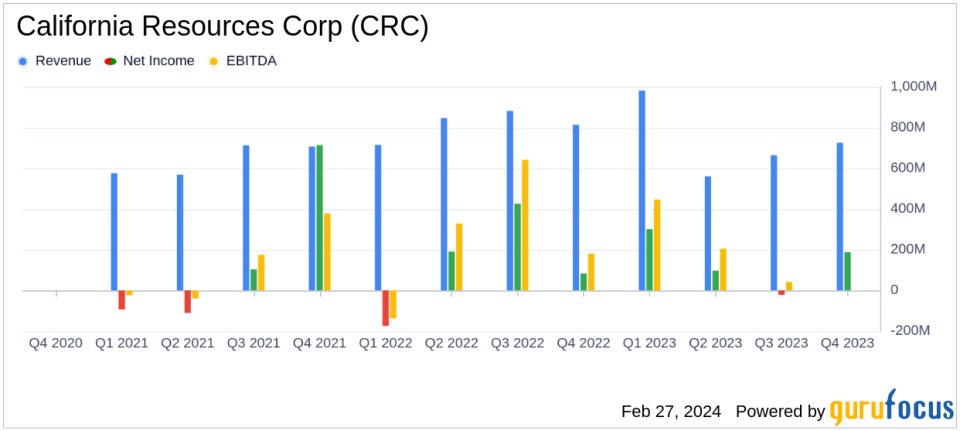

The company's focus on capital efficiency and cost savings has led to a record cash flow, with $653 million net cash from operating activities and $468 million of free cash flow. CRC's net income stood at $564 million, or $7.78 per diluted share, with adjusted net income at $372 million, or $5.13 per share. These figures reflect CRC's ability to generate significant profitability in the oil and gas sector, which is critical for sustaining operations and growth in a volatile market environment.

Financial and Operational Excellence

CRC's financial achievements are particularly noteworthy in the context of the oil and gas industry, where efficient capital deployment and cost management are essential for success. The company's leverage ratio improvement to 0.1 times, down from 0.3 times at year-end 2022, indicates a strong balance sheet and financial stability. This is crucial for CRC as it allows for greater flexibility in operations and strategic initiatives, such as the development of carbon capture and storage (CCS) projects.

Moreover, CRC's commitment to returning value to shareholders is evident through the $280 million returned in 2023, which is more than half of the free cash flow generated. This approach not only rewards shareholders but also reinforces investor confidence in CRC's financial management and future prospects.

Operational Highlights and Challenges

Operationally, CRC reported an average annual net production of 86 MBoe/d, with oil production averaging 52 MBo/d. The company's focus on maintaining a low production decline rate and its strategic capital investments have contributed to this steady production level. However, challenges such as the need for regulatory approvals and the impact of commodity price fluctuations remain inherent risks to CRC's operational performance and are factors that investors should monitor closely.

As CRC looks forward, the company's preliminary outlook for 2024, excluding the pending merger with Aera Energy, anticipates a total capital program ranging between $300 million and $340 million, assuming normal operating conditions. This forward-looking approach underscores CRC's commitment to strategic growth and operational excellence.

Advancing Carbon Management and Sustainability

CRC's advancements in carbon management, highlighted by the receipt of Californias first U.S. EPA draft Class VI well permits for CO2 injection and storage, position the company as a leader in the state's decarbonization efforts. This initiative not only supports environmental sustainability but also opens up new avenues for revenue generation and strategic partnerships in the emerging carbon management market.

In conclusion, California Resources Corp's 2023 financial results reflect a year of strong performance, underpinned by strategic capital efficiency, cost savings, and a focus on carbon management. The company's robust financial position and commitment to shareholder returns, coupled with its advancements in sustainability, set a positive tone for its future endeavors and potential growth opportunities.

For a detailed analysis of CRC's financial results and future outlook, investors and interested parties can access the full 8-K filing and join the upcoming conference call and webcast.

Explore the complete 8-K earnings release (here) from California Resources Corp for further details.

This article first appeared on GuruFocus.