California Water Service Group (CWT) Faces Regulatory Delays Impacting 2023 Earnings

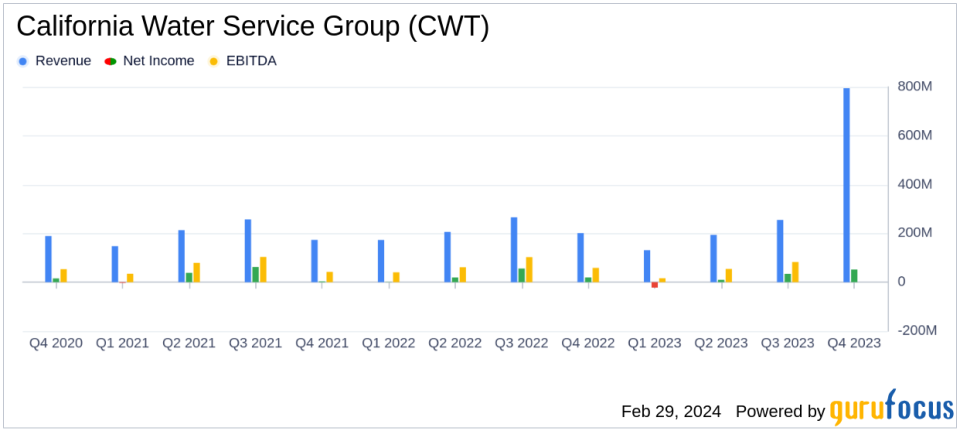

Net Income: CWT reported a decrease to $51.9 million in 2023 from $96.0 million in 2022.

Diluted Earnings Per Share (EPS): EPS fell to $0.91 in 2023, down from $1.77 in the previous year.

Operating Revenue: 2023 operating revenue decreased by $51.8 million to $794.6 million.

Operating Expenses: Slight decrease in total operating expenses to $717.5 million in 2023.

Dividends: The Board of Directors approved a 7.7% increase in quarterly cash dividend to $0.28 per share.

Capital Investments: CWT's capital investments rose by 17.1% to $383.7 million in 2023.

Liquidity and Financing: Maintained strong liquidity with $85.0 million in cash and $420.0 million in additional short-term borrowing capacity.

On February 29, 2024, California Water Service Group (NYSE:CWT) released its 8-K filing, disclosing its financial performance for the year and fourth quarter of 2023. The company, a leading U.S. water and utilities holding company operating primarily in California, faced a challenging year with a significant decrease in net income attributable to CWT, which was primarily due to regulatory delays impacting revenue recognition.

Regulatory Delays Weigh on Financials

The delayed final decision from the California Public Utilities Commission (CPUC) on the 2021 General Rate Case (GRC) has been a primary factor affecting CWT's financial results. The GRC, which determines new revenue, rates, and regulatory mechanisms, was not completed as scheduled, causing uncertainty and an inability to estimate the impact on 2023 operating revenue and expenses. Despite this, the company saw an $18.4 million increase in income tax benefit and a $12.1 million increase in net other income, which partially offset the negative impact of increased operating expenses.

Income Statement Highlights

Operating revenue for 2023 was down due to a decrease in Water Revenue Adjustment Mechanism (WRAM) and Modified Cost Balancing Account (MCBA) revenue, lower customer usage, and an increase in deferred revenue. However, this was partially offset by rate increases and revenue from new customers. Total operating expenses saw a marginal decrease, with water production costs rising due to rate increases in purchased power and pump taxes. Administrative and general expenses also increased, mainly due to higher employee wages and benefit costs.

Balance Sheet and Cash Flow

CWT's balance sheet shows a net utility plant value of $3.77 billion, with current assets totaling $296.3 million. The company's equity stands at $1.43 billion, supported by an increase in common stock and additional paid-in capital. CWT's liquidity remains robust, with $85.0 million in cash and significant short-term borrowing capacity. The company's capital investments for the year amounted to $383.7 million, a substantial increase from the previous year.

Looking Forward

Despite the setbacks, CWT's management remains optimistic about the future. Chairman and CEO Martin A. Kropelnicki expressed hope for a resolution to the regulatory delay and emphasized the company's focus on executing its strategy and serving its customers. The company's strong liquidity position and proactive capital investment strategy position it well for future growth once regulatory uncertainties are resolved.

Investors and stakeholders are invited to attend the conference call to discuss the earnings report and gain further insights into the company's performance and outlook.

For value investors, CWT's current challenges related to regulatory delays may present an opportunity to engage with a fundamentally strong company poised for recovery once external uncertainties are addressed. The company's commitment to maintaining a strong liquidity position and investing in capital improvements underscores its potential for long-term value creation.

For more detailed information and to stay updated on CWT's progress, visit GuruFocus.com for comprehensive financial analysis and the latest investment opportunities.

Explore the complete 8-K earnings release (here) from California Water Service Group for further details.

This article first appeared on GuruFocus.