Caligan Partners LP Boosts Stake in Anika Therapeutics Inc

Caligan Partners LP, a New York-based investment firm, has recently increased its holdings in Anika Therapeutics Inc (NASDAQ:ANIK). The transaction, which took place on August 9, 2023, saw the firm add 181,795 shares to its portfolio, representing a 25.24% increase in its holdings. The shares were acquired at a price of $20.01 each, bringing Caligan Partners LP's total holdings in Anika Therapeutics to 902,086 shares. This transaction has a 9.95% impact on the firm's portfolio and represents 6.20% of Anika Therapeutics' total shares.

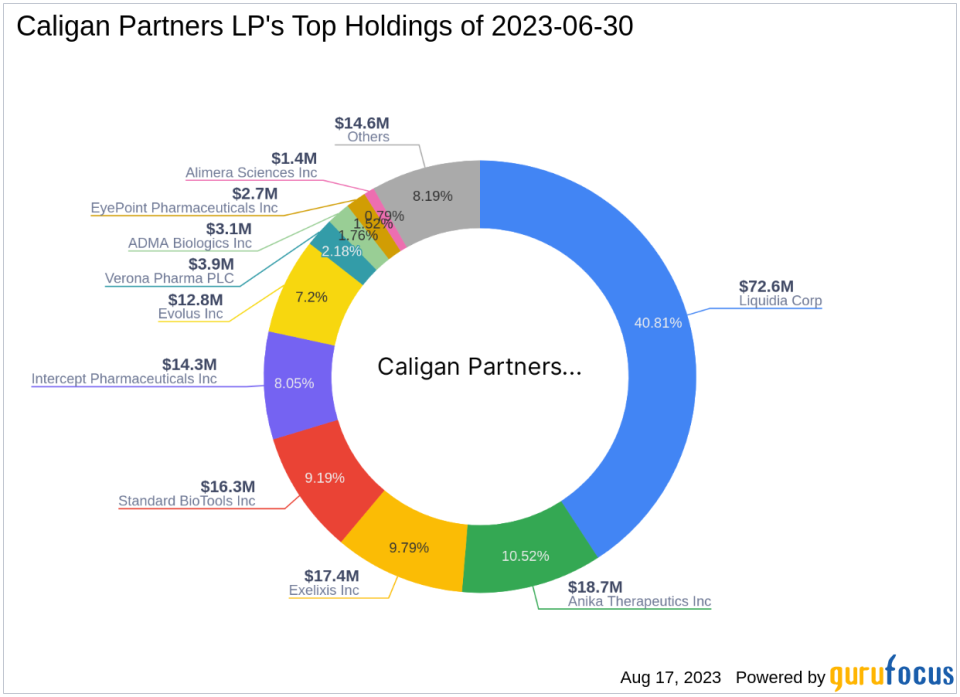

Profile of Caligan Partners LP

Caligan Partners LP is an investment firm located at 515 Madison Avenue, New York. The firm's top holdings include Anika Therapeutics Inc (NASDAQ:ANIK), Exelixis Inc (NASDAQ:EXEL), Standard BioTools Inc (NASDAQ:LAB), Intercept Pharmaceuticals Inc (NASDAQ:ICPT), and Liquidia Corp (NASDAQ:LQDA). The firm currently holds 13 stocks in its portfolio, with a total equity of $178 million.

Anika Therapeutics Inc Overview

Anika Therapeutics Inc is a US-based orthopedic medicines company. The company focuses on improving the lives of patients with degenerative orthopedic diseases and traumatic conditions through clinically meaningful therapies. Its business segments include Joint Preservation and Restoration, NonOrthopedics, Osteoarthritis Pain Management, Non-Orthopedic, and Osteoarthritis (OA) Pain Management. The majority of its revenue is derived from the United States. The company has a market capitalization of $275.504 million and its current stock price is $18.83.

Stock Performance and Valuation

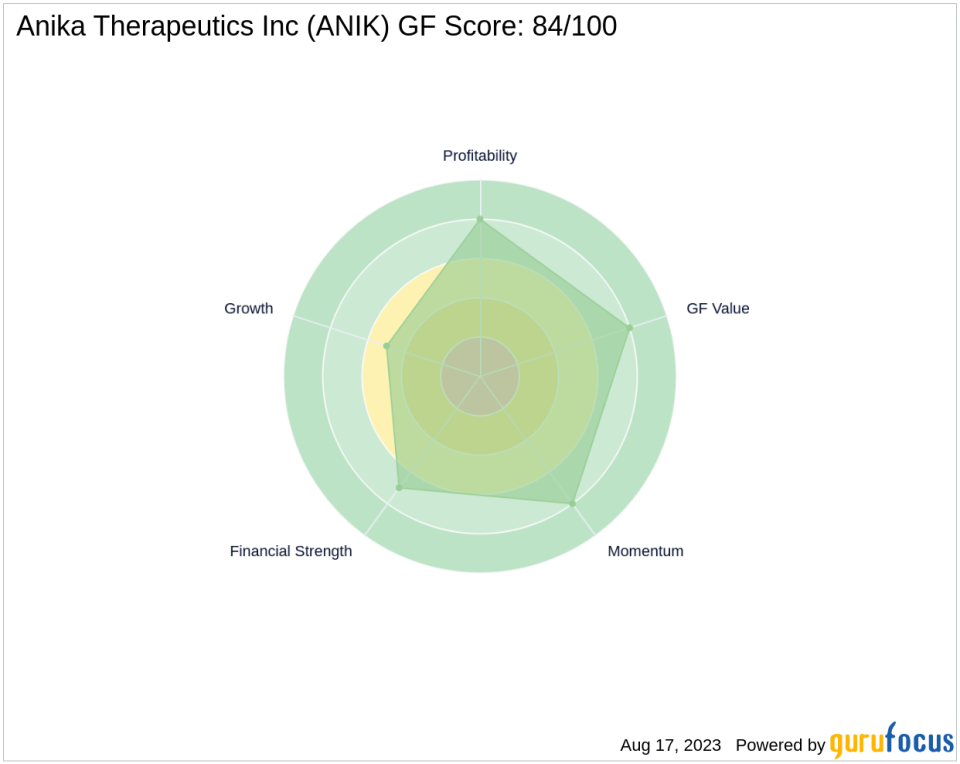

Anika Therapeutics Inc's stock performance has been underwhelming, with a year-to-date price change ratio of -36.13%. Since its Initial Public Offering (IPO) in 1993, the stock has seen a price change ratio of 438%. Despite the recent downturn, the company's GF-Score of 84/100 suggests good outperformance potential. The company's Financial Strength is ranked 7/10, its Profitability Rank is 8/10, its Growth Rank is 5/10, its GF Value Rank is 8/10, and its Momentum Rank is 8/10.

Financial Health and Industry Position

Anika Therapeutics Inc's financial health is moderate, with a Piotroski F-Score of 5 and an Altman Z score of 4.49. The company's cash to debt ratio is 2.18, ranking it 446th in the industry. Despite a negative return on equity (ROE) of -7.87% and a negative return on assets (ROA) of -6.45%, the company has seen a 3-year revenue growth of 10.40%. However, its gross margin growth is -6.10% and its operating margin growth is 0.00%.

Stock Momentum and Predictability

The company's stock momentum is currently low, with a 5-day Relative Strength Index (RSI) of 21.01, a 9-day RSI of 18.26, and a 14-day RSI of 19.03. Its 6 - 1 month momentum index is -16.73, and its 12 - 1 month momentum index is 7.83. The company's 14-day RSI rank is 25, and its 6 - 1 month momentum index rank is 560. The company's predictability rank is not available.

Largest Guru Holder of Anika Therapeutics Inc

The largest guru holder of Anika Therapeutics Inc is Fisher Asset Management, LLC. The exact share percentage held by the firm is not available at this time.

In conclusion, Caligan Partners LP's recent acquisition of Anika Therapeutics Inc shares represents a significant addition to its portfolio. Despite the company's recent underperformance, its GF-Score suggests potential for future growth. However, investors should be aware of the company's negative ROE and ROA, as well as its low stock momentum.

This article first appeared on GuruFocus.