Caligan Partners LP Reduces Stake in Alimera Sciences Inc

Caligan Partners LP (Trades, Portfolio), a New York-based investment firm, recently made a significant transaction in its portfolio. The firm reduced its stake in Alimera Sciences Inc, a commercial-stage pharmaceutical company. This article will delve into the details of this transaction, provide an overview of both entities involved, and analyze the potential implications of this move.

Details of the Transaction

On September 14, 2023, Caligan Partners LP (Trades, Portfolio) reduced its holdings in Alimera Sciences Inc by 800,000 shares, representing a 4.54% change in the firm's portfolio. The shares were traded at a price of $3.39 each. Following this transaction, Caligan Partners LP (Trades, Portfolio) now holds 16,835,154 shares in Alimera Sciences Inc, accounting for 32.59% of its portfolio and 32.12% of the company's total shares.

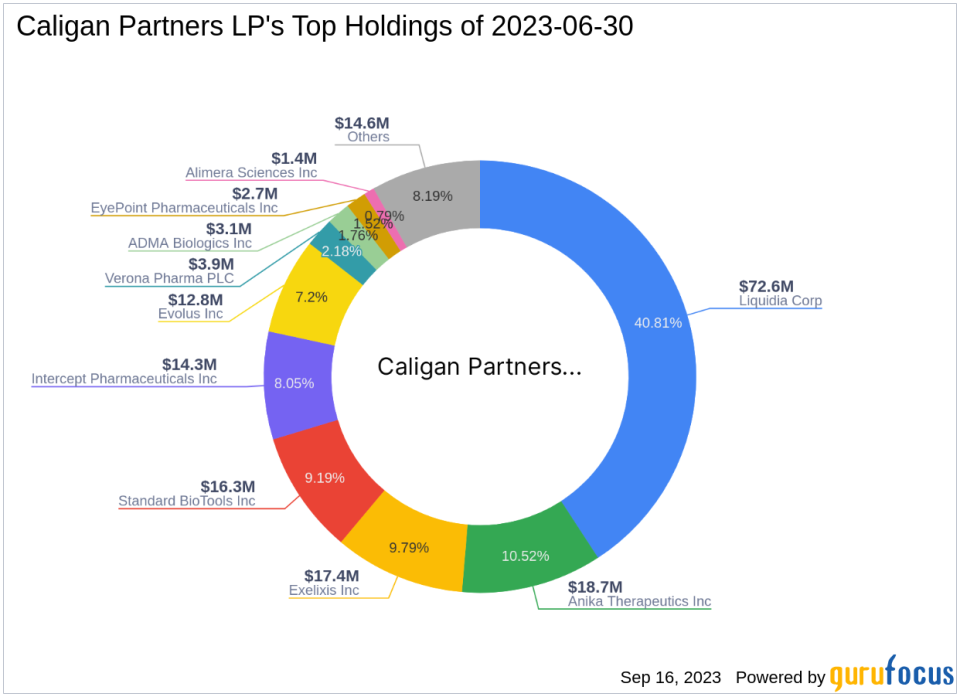

Profile of Caligan Partners LP (Trades, Portfolio)

Caligan Partners LP (Trades, Portfolio) is an investment firm located at 515 Madison Avenue, New York. The firm's portfolio consists of 13 stocks, with a total equity of $178 million. Its top holdings include Anika Therapeutics Inc, Exelixis Inc, Standard BioTools Inc, Intercept Pharmaceuticals Inc, and Liquidia Corp.

Overview of Alimera Sciences Inc

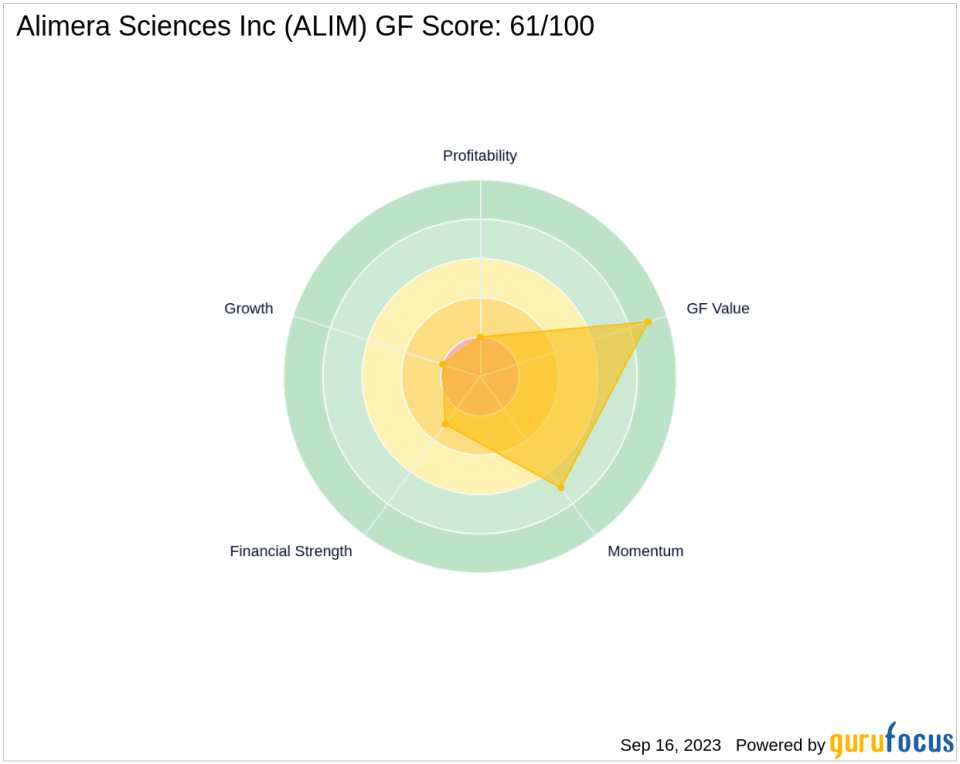

Alimera Sciences Inc, listed under the symbol ALIM, is a US-based pharmaceutical company. The company specializes in the development and commercialization of ILUVIEN, a treatment for diabetic macular edema and non-infectious uveitis affecting the posterior segment of the eye. Alimera Sciences Inc has a market capitalization of $174.031 million and its stock is currently priced at $3.32. The company's GF Score is 61/100, indicating a poor future performance potential.

Analysis of Alimera Sciences Inc's Stock Performance

Alimera Sciences Inc's stock performance has been underwhelming, with a year-to-date price change ratio of 11.04%. Since its Initial Public Offering (IPO) in 2010, the stock has seen a price change ratio of -97.99%. The company's GF Valuation suggests a possible value trap, with a GF Value of 4.72 and a Price to GF Value of 0.70. This indicates that the stock is currently undervalued.

Evaluation of Alimera Sciences Inc's Financial Health

Alimera Sciences Inc's financial health is a mixed bag. The company has a Balance Sheet Rank of 3/10, a Profitability Rank of 2/10, and a Growth Rank of 2/10. Its Piotroski F-Score is 3, and its Altman Z Score is -2.50, indicating financial distress. However, the company's Cash to Debt ratio is 0.29, which is relatively healthy.

Analysis of Alimera Sciences Inc's Industry Position

Operating in the Drug Manufacturers industry, Alimera Sciences Inc has a Return on Equity (ROE) of 0.00% and a Return on Assets (ROA) of -35.68%. The company's gross margin growth is -1.10%, while its operating margin growth is 42.20%. Over the past three years, the company's revenue growth has been -11.90%, and its EBITDA growth has been -33.50%.

Conclusion

In conclusion, Caligan Partners LP (Trades, Portfolio)'s decision to reduce its stake in Alimera Sciences Inc could be seen as a strategic move given the company's underwhelming stock performance and mixed financial health. However, the firm still holds a significant stake in the company, indicating a level of confidence in its long-term prospects. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.