Call Options Pile Up Before Alcoa Earnings

Aluminum specialist Alcoa Corp (NYSE:AA) is preparing to report earnings, due to announce after the close tomorrow, July 17. Options data shows heavy interest in calls before the event, since almost 144,000 are open at the moment, ranking right near an annual high. A large chunk of this sits at the October 24 call, which holds about 38,500 contracts.

As far as what to expect from earnings, the shares have closed in positive territory the day after earnings in four of the past eight quarters, but one of those negative reactions was in this quarter last year when the stock fell 13.3% after the report. The shares have averaged a post-earnings swing of 4.6% in the past two years, regardless of direction, and the options market is expecting almost twice that this time around, pricing in a 9.1% move for Thursday's session.

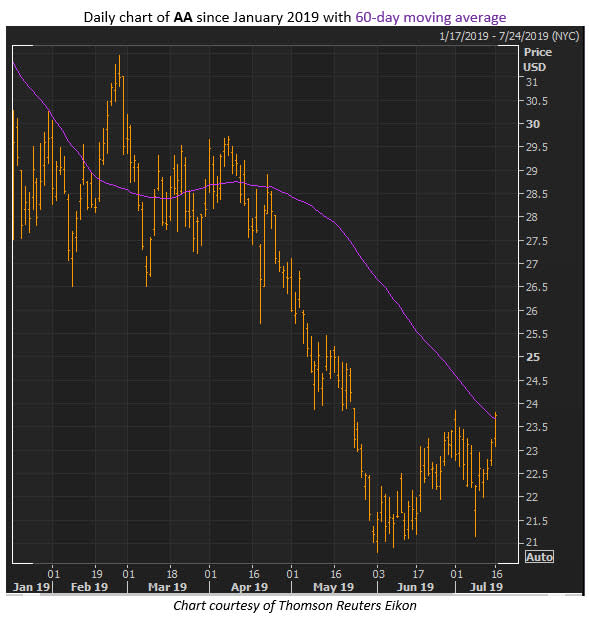

Turning to the charts, AA stock just appeared in a couple of studies run by our Senior Quantitative Analyst Rocky White. For starters, White pointed out that the equity is trading near its negative 50% year-over-year level, suggesting it could see technical support -- or if it breaches this mark, its downside could by sharp.

Also on the bearish side, White noted that the 60-day moving average has come into play, and the security has averaged a one-month loss of 3.3% following the past five run-ins with this trendline, and was positive only twice. The stock's already given up almost 18% in the past six months, last seen at $23.78.