Callon (CPE) Q4 Earnings Miss Estimates, Revenues Fall Y/Y

Callon Petroleum Company CPE reported fourth-quarter 2023 adjusted earnings of $1.62 per share, which missed the Zacks Consensus Estimate of $1.74. The bottom line declined from the $3.36 reported a year ago.

Operating revenues of $601.4 million beat the Zacks Consensus Estimate of $563 million. However, the top line declined from the year-ago quarter’s $704.2 million.

The weak quarterly earnings were driven by lower realized oil equivalent prices and production volumes.

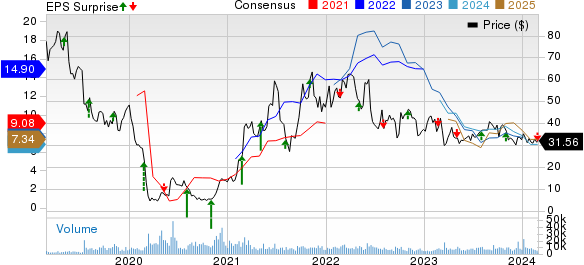

Callon Petroleum Company Price, Consensus and EPS Surprise

Callon Petroleum Company price-consensus-eps-surprise-chart | Callon Petroleum Company Quote

Production

In the fourth quarter, CPE’s net production volume was 103,426 barrels of oil-equivalent per day (Boe/d), down from the year-ago period’s 106,287 Boe/d. Our projection for the same was pinned at 101,554 Boe/d. Production volume increased year over year in the Permian Basin. Of the total fourth-quarter production, 57% was oil.

Callon’s oil production in the quarter totaled 5,402 thousand barrels (MBbls), down from the year-ago level of 6,092 MBbls. The figure beat our estimate of 5,272 MBbls.

Natural gas production increased to 12,096 million cubic feet (MMcf) from 10,543 MMcf reported in the year-ago quarter and beat our estimate of 11,608 MMcf.

Also, natural gas liquids (NGLs) production in the quarter under review totaled 2,097 MBbls, up from the year-ago figure of 1,930 MBbls. The metric slightly lagged our projection of 2,136.1 MBbls.

Price Realizations (Without Cash-Settled Derivative Impacts)

The average realized price per barrel of oil equivalent was $51.54. The figure declined from the year-ago quarter’s $62 and missed our estimate of $53.42.

The average realized price for oil was $79.05 per barrel compared with $84.33 a year ago. The average realized price per barrel for NGLs was $20.94, lower than the year-ago level of $25.79. The figure missed our estimate of $23.18.

The average realized price for natural gas was $1.60 per thousand cubic feet, down from $4.06 a year ago.

Total Expenses

Callon’s total operating expenses of $419.8 million increased from the year-ago level of $399.7 million.

Total lease operating costs increased to $77.9 million from the prior-year figure of $74.1 million. The company’s per-unit lease operating expenses increased to $8.19 per barrel of oil equivalent from $7.58 a year ago.

Capital Expenditure & Balance Sheet

The capital expenditure in the reported quarter amounted to $170.5 million. Callon generated an adjusted free cash flow of $120.2 million, significantly down from $165 million a year ago.

As of Dec 31, 2023, the company’s total cash and cash equivalents amounted to $3.3 million. The long-term debt totaled $1.9 billion.

Zacks Rank & Stocks to Consider

Callon currently carries a Zacks Rank #4 (Sell).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA Inc. MUSA is a leading independent retailer of motor fuel and convenience merchandise in the United States.

The Zacks Consensus Estimate for MUSA’s 2024 EPS is pegged at $25.58. The company has a Zacks Style Score of A for Growth and B for Value. It has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Subsea 7 S.A. SUBCY helps build underwater oil and gas fields. It is a top player in the Oil and Gas Equipment and Services market, which is expected to grow, as oil and gas production moves further offshore.

The Zacks Consensus Estimate for SUBCY’s 2024 EPS is pegged at 91 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 60 days. SUBCY’s 2024 earnings are expected to soar 277% year over year.

Energy Transfer ET is a publicly traded limited partnership focused on diverse energy assets in the United States. The company’s core operations involve natural gas midstream services, transportation, storage, crude oil facilities and marketing assets.

The Zacks Consensus Estimate for ET’s 2024 EPS is pegged at $1.44. The company has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ET’s 2024 earnings are expected to rise 12.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report