Calm Waters and U.S. Crude Oil

U.S. Crude Oil has turned consolidated after running into strong resistance. Crude Oil Inventories from the U.S will factor into the commodity’s trading the next two days in an important manner.

Opportunities in U.S. Crude Oil Next Two Days

While experienced traders may chuckle at the notion U.S Crude Oil offers a calm trading environment, opportunities are developing. The past few days of trading in the broad markets have proven volatile, as Crude Oil has become consolidated.

U.S Crude Oil continues to trade slightly above 50.00 U.S Dollars a barrel and supply numbers will be presented today. And now that the hurricane season has diminished, and production is starting to return to normal, the inventory numbers may prove important.

Rise Hits Resistance and Consolidation

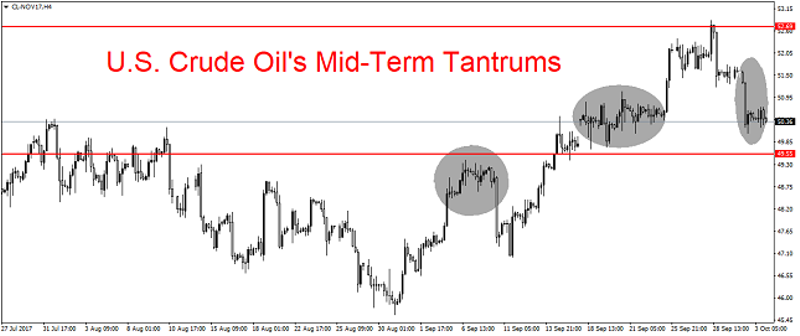

Crude Oil has enjoyed a nice rise in value since late August, however, the past week of trading has seen the U.S. commodity return to a well-practiced short-term range, while remaining solidly in its mid-term price pattern.

U.S Crude Oil has slipped slightly the past week and traders may believe it has been overbought. The 49.50 U.S Dollars a barrel mark could act as the next important support level to be tested.

U.S. Crude Oil Inventories Coming

As Crude Oil has become relatively calm, the commodity offers the opportunity for selective speculation.

We expect today and tomorrow will prove important for U.S Crude Oil and it may see a substantial test of its short-term range. A surprise outcome from the U.S Crude Oil Inventories report today should be looked for, and we suspect supply might be stronger than expected.

In the short term, we believe U.S Crude Oil may be negative. Mid-term and Long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire