CalMaine (CALM) Buys Egg Production Assets of Fassio Egg Farms

CalMaine Foods CALM has completed the acquisition of the commercial shell egg production and processing facilities of Fassio Egg Farms, Inc. The acquisition is in line with the company’s strategy of expanding its cage-free egg production capacity to capitalize on its solid demand prospects.

Fassio has been a leader in the egg production business since 1915. In addition to conventional white eggs, Fassio Egg Farms also offers organic, cage-free, vegetarian-fed, brown eggs.

The facilities acquired by CalMaine include a capacity of approximately 1.2 million laying hens, mainly cage-free, a feed mill, pullets, a fertilizer production and composting operation and land.

The demand for cage-free and organic egg products has been on the rise in recent years. 10 U.S. states have passed cage-free legislation or regulation for implementation by 2026. A significant number of CALM’s customers have announced goals to offer cage-free eggs exclusively on or before 2026. Some have recently changed those goals to 70% by 2030.

Percentage of U.S. households within cage-free mandated states is expected to continue to increase with the announcement of further mandates. Cal-Maine’s growth strategy is thus focused on boosting its cage-free egg production capacity. Since 2008, the company has committed $699 million of capital toward the expansion of its cage-free production capabilities. Of this, the company has spent $594 million till fiscal 2023.

Backed by its efforts, the company’s sales of cage-free eggs have increased and constitute a larger share of its product mix. Cage-free egg revenues accounted for around 33% of CalMaine’s total net shell egg revenues in the first quarter of fiscal 2024.

CalMaine reported total sales of $459 million the first quarter of fiscal 2024. Compared with the exceptionally strong first-quarter 2023 sales of $658 million, sales plunged 30%. This was primarily due to the lower average selling price for conventional eggs, which was partially offset by the increase in the net average selling price for specialty eggs. The company, however, noted that customer demand has been favorable, with conventional egg volumes being higher than a year ago, offset by the lower sales of specialty eggs.

Lower sales, increased labor and other input costs led to a 99% year-over-year slump in the company’s adjusted earnings per share to 2 cents in first-quarter fiscal 2024.

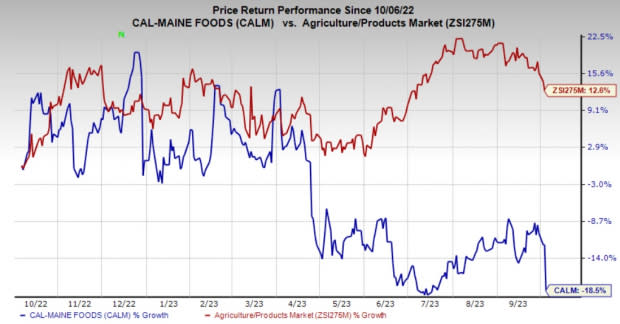

Price Performance

CALM shares have declined 18.5% in the past year against the industry’s 12.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

CalMaine currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. HWKN and CRS sport a Zacks Rank #1 (Strong Buy) at present, and FSTR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares have gained 58% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares have gained 109.6% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 98.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report