Cambium (CMBM) Issues Preliminary Q3 Results, Revenues Down

Cambium Networks Corporation CMBM recently issued preliminary third-quarter 2023 results. The selective preliminary metrics offer clarity regarding its business operations as it aims to navigate through a challenging macroeconomic environment.

Management expects third-quarter GAAP revenues of $40-$45 million compared with the earlier estimation of $62-$70 million. The lower revenue projection is primarily due to delays in government defense orders owing to a deadlock in the U.S. federal budget. This adversely impacted the Point-to-Point business. Additionally, soft revenues from the Point-to-Multi-Point business, lower enterprise orders and adverse EMEA market conditions are likely to result in lower-than-expected revenues.

Cambium currently expects net income to be below the lower end of the earlier guidance both on a GAAP and non-GAAP basis. The company had earlier expected non-GAAP earnings in the range of $3.7-$6.9 million or 13-25 cents per share. Cambium expects a cash balance in the vicinity of $27 million, with $45 million available in the revolving credit line. The company expects channel inventories to decline significantly with higher sales through distributors.

Despite short-term market aberrations, Cambium is well-positioned to benefit from proprietary software and product ramp-up, likely facilitating it to deliver a compelling combination of price, performance and spectrum efficiency. One of the major advantages of the company is its fixed wireless broadband networking infrastructure solutions, which are distinguished by embedded intelligence and scalability.

Continued investments in wireless fabric and embedded software capabilities with expanded channel partner relationships are the cornerstones of Cambium's long-term growth across a diverse set of markets. The company intends to augment its geographical footprint by collaborating with major network operators, thereby driving its product adoption across various end markets. Amid the rapid 5G shift, accretive investments in high-speed wireless networks are likely to position its portfolio to secure lucrative opportunities in the long run.

Over the past few years, it has benefited from investments related to gigabit wireless solutions such as 60 GHz millimeter wave products and Wi-Fi 6. The first phase of the Rural Digital Opportunity Fund is expected to boost the deployment of broadband service among underserved communities and help bridge the digital gap over the next 10 years.

Some of its competitive strengths are advanced RF signal algorithms that boost network performance with evolving technologies like noise filtering and frequency reuse and efficient wireless fabric that enables operators to strengthen their networks with incremental fixed wireless access points. Its cloud-based network management software acts as a major tailwind that simplifies the overall deployment process through hassle-free configuration and monitoring.

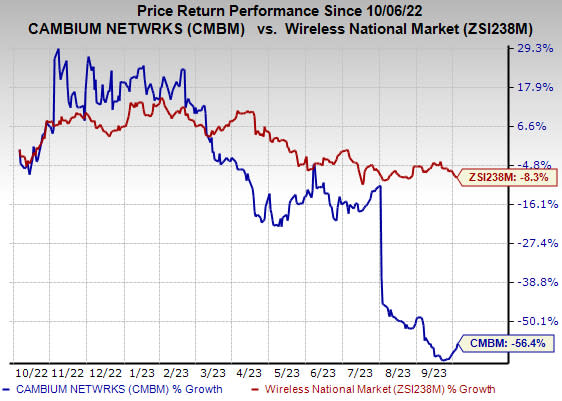

Shares of the company have lost 56.4% in the past year compared with the industry’s decline of 8.3%.

Image Source: Zacks Investment Research

Cambium presently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2, is another key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Cambium Networks Corporation (CMBM) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report