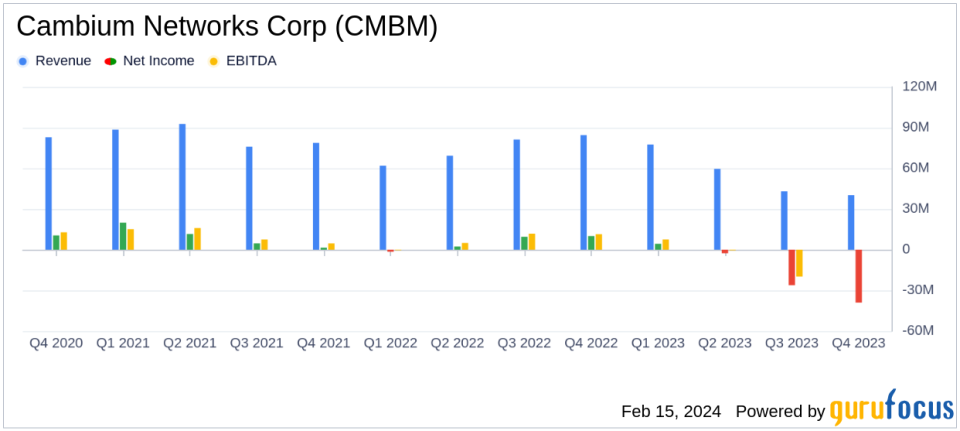

Cambium Networks Corp (CMBM) Faces Revenue Decline and Net Loss in Q4 and Full Year 2023

Revenue: Q4 revenue decreased by 52% year-over-year to $40.2 million.

Gross Margin: Q4 GAAP gross margin fell to (21.7)%, with non-GAAP gross margin at (19.4)%.

Net Loss: Q4 GAAP net loss of $39.0 million, with a loss of $1.41 per diluted share.

Adjusted EBITDA: Q4 adjusted EBITDA loss of $32.9 million, representing (81.8)% of revenues.

Full Year Performance: 2023 revenues declined to $220.2 million, a 26% decrease from 2022.

Operating Cash Flow: Net cash used in operating activities was $6.2 million in Q4.

Financial Outlook: Q1 2024 revenues projected between $43.0-$48.0 million.

On February 15, 2024, Cambium Networks Corp (NASDAQ:CMBM) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of wireless networking infrastructure solutions, reported a significant year-over-year decline in revenue and a transition from profitability to a net loss position.

Company Overview

Cambium Networks Corp provides advanced wireless broadband networking infrastructure solutions for network operators, including medium-sized wireless Internet service providers, enterprises, and government agencies. Its products connect people, places, and things across distances indoors and outdoors, using licensed and unlicensed spectrum. Headquartered outside Chicago, with R&D centers in the U.S., U.K., and India, Cambium Networks sells through a range of distributors globally.

Financial Performance and Challenges

The company's fourth-quarter revenue of $40.2 million represents a 7% sequential decrease and a 52% decrease compared to the same quarter in the previous year. The significant year-over-year revenue shortfall was attributed to an $11 million reduction in revenues, largely due to incentives and discounts provided to distributors related to the Enterprise business. Cambium Networks also faced challenges such as aggressive Enterprise product discounts to clear excess channel inventories, high stock rotations, slowing economies, and lower Point-to-Multi-Point revenues, particularly from regions outside of North America.

Despite these challenges, Cambium Networks saw a solid quarter of government defense shipments in its Point-to-Point business and received meaningful orders for its new 6 GHz products in the Point-to-Multi-Point business ahead of the FCC's approval. The company also made significant reductions in channel inventories for the Enterprise business.

Financial Achievements and Importance

The company's financial achievements in the context of the hardware industry are overshadowed by the reported losses. However, the increase in defense revenues and the anticipation of growth in the Point-to-Multi-Point business following FCC approval of 6 GHz spectrum are positive indicators for future performance. Cambium Networks is taking steps to rationalize business operations and improve operating efficiencies, which are crucial for the company's recovery and future growth.

Key Financial Metrics

Key metrics from the income statement and balance sheet highlight the company's financial health. The GAAP gross margin for the fourth quarter was negative at (21.7)%, reflecting the impact of price incentives and inventory reserves. The GAAP operating loss was $39.3 million, and the GAAP net loss was $39.0 million, or $1.41 per diluted share. The non-GAAP figures, which exclude certain expenses, also show a net loss, indicating the company's struggle to maintain profitability under current market conditions.

For the full year 2023, revenues decreased by $76.7 million compared to 2022, with a GAAP gross margin of 32.3%. The GAAP operating loss was $58.6 million, and the GAAP net loss was $63.6 million, or $2.31 per diluted share. These figures underscore the importance of cost management and the need for strategic initiatives to return to profitability.

Analysis of Company's Performance

The company's performance in 2023 reflects a challenging market environment, with significant declines in revenue and profitability. The negative gross margin in Q4 indicates that the cost of goods sold exceeded the revenue generated, a situation that is unsustainable in the long term. Cambium Networks' focus on reducing channel inventories and positioning itself for growth in the Point-to-Multi-Point business is a strategic move to stabilize and improve financial performance. However, the company will need to navigate economic headwinds and competitive pressures effectively to achieve a turnaround.

As Cambium Networks looks ahead to the first quarter of 2024, it projects revenues between $43.0-$48.0 million and anticipates improvements in gross margin and operating expenses. These projections suggest cautious optimism for a recovery, contingent on market conditions and the company's ability to execute its strategic plans.

Value investors and potential GuruFocus.com members interested in the wireless networking infrastructure sector may find Cambium Networks' situation a case study in managing through market downturns and preparing for potential rebounds. The company's ability to adapt and innovate in response to regulatory changes and market demands will be critical in determining its future success.

For more detailed financial information and the full earnings report, please refer to Cambium Networks' 8-K filing.

Explore the complete 8-K earnings release (here) from Cambium Networks Corp for further details.

This article first appeared on GuruFocus.