Cameco Corp (CCJ) to Report Q3 Earnings: What to Expect

Cameco Corporation CCJ is expected to report an improvement in its earnings when it reports third-quarter 2023 results next week.

Q3 Estimates

The Zacks Consensus Estimate for the third-quarter earnings is pegged at 11 cents per share, which indicates a solid 450% improvement from earnings of 2 cents per share reported in the prior-year quarter. Over the past 30 days, the estimate has gone down from 27%.

Q2 Performance

Cameco Corp had reported an adjusted loss per share of 1 cent in the second quarter of 2023 against earnings per share of 18 cents in the comparable quarter last year. The company missed the Zacks Consensus Estimate of earnings of 16 cents per share in the second quarter. CCJ has a trailing four-quarter earnings surprise of 5.4%, on average.

Cameco Corporation Price and EPS Surprise

Cameco Corporation price-eps-surprise | Cameco Corporation Quote

Factors to Note

In September, Cameco had lowered its 2023 production guidance citing challenges at the Cigar Lake mine and Key Lake mill. The company expects the Cigar Lake mine to produce up to 16.3 million pounds of uranium concentrate at a 100% basis in 2023. Cameco had previously estimated the mine to generate 18 million pounds of uranium.

In the second quarter of 2023, mining operations at the Cigar Lake operation started from a new zone in the orebody (west pod), which affected the mine’s productivity. As mining activities continued in the west pod during the third quarter, equipment reliability challenges occurred, which further affected the performance. The mine began its annual maintenance closure, which lasted till September.

The McArthur River/Key Lake operations are expected to produce 14 million pounds of uranium (100% basis) in 2023, down from the earlier projected 15 million pounds of uranium.

Even though ramp-up activities are ongoing at the Key Lake mill, its performance remains affected by labor shortages and supply-chain issues. The McArthur River mine, however, continues to operate well.

These setbacks are expected have weighed on the company’s results in the third quarter of 2023.

Uranium prices had surged a 12-year high in the third quarter of 2023 amid robust demand and tight supply. The company’s results are likely to benefit from the higher average realized prices of uranium, which will negate the impact of low output. Also, higher fuel services sales will boost results.

Cameco Corp has been progressing in its endeavors to lower administration, exploration as well as operating costs, and capital expenditures. The company has been carrying out critical automation, digitization and other projects, executing maintenance readiness checks, and attaining sufficient recruitment and training to transition McArthur River/Key Lake from care and maintenance to its planned production capacity. It has been incurring operational readiness costs, which boosted its cost of sales. However, with the ongoing ramp-up at Key Lake and improved performance at the McArthur River mine, operational readiness costs are expected to have been lower in the to-be-reported quarter.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Cameco Corp this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Cameco Corp is -18.18%.

Zacks Rank: Cameco Corp currently carries a Zacks Rank of 3.

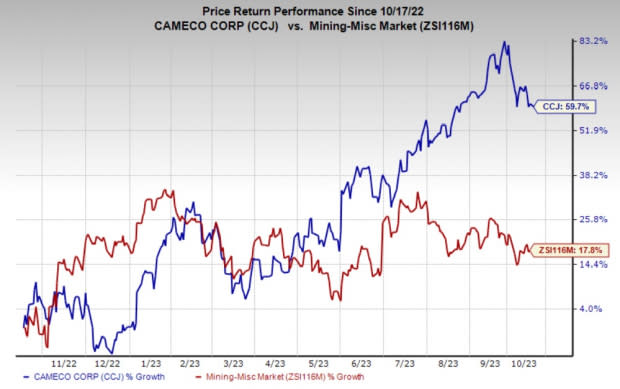

Price Performance

Shares of Cameco Corp have gained 59.7% over the past year compared with the industry’s 17.8% growth.

Image Source: Zacks Investment Research

Stocks Poised to Beat Estimates

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter:

Element Solutions Inc ESI, slated to release its earnings on Oct 25, has an Earnings ESP of +1.94% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for ESI’s third-quarter earnings per share is currently pegged at 34 cents per share.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +8.70%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 9 cents per share. KGC currently carries a Zacks Rank of 2.

Teck Resources TECK, slated to release earnings on Oct 24, has an Earnings ESP of +1.50% and a Zacks Rank of 2, at present.

The consensus mark for TECK’s third-quarter earnings is currently pegged at 76 cents per share.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report