Campbell Soup (CPB) Benefits From Savings Plan Amid High Costs

Campbell Soup Company CPB is benefiting from its growing Snacks business. The branded convenience food products company is on track with strategic pricing actions and cost-saving plans amid an inflationary environment.

Let’s delve deeper.

Solid Snacks Business: Key Driver

The Zacks Rank #3 (Hold) company is gaining on strength in its Snacks business. In the fourth quarter of fiscal 2023, net sales in the division rose 8% (up 9% organically) to $1,132 million. The upside can be attributed to sales of power brands, which rose 13%. Sales growth was fueled by a rise in cookies and crackers, specifically Goldfish crackers, Lance sandwich crackers and salty snacks like Kettle Brand and Cape Cod potato chips. Favorable net price realization contributed to the upside. Management expects the Snacks business to keep delivering solid top and margin momentum driven by the Snyder's-Lance acquisition.

Pricing Actions Drives Q4 Sales

Solid pricing initiatives have aided Campbell Soup for a while now. This was seen in fourth-quarter fiscal 2023, with organic net sales rising 5% on inflation-driven net price realization and solid in-market performance, stemming from robust supply-chain investments and effective marketing and selling investments. Quarterly consumption increased 3% year over year. The solid results reflect the ongoing execution of the company’s focused strategy and sustained consumer demand for its brands.

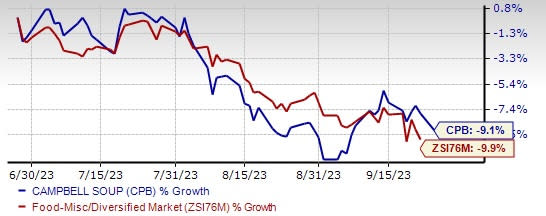

Image Source: Zacks Investment Research

Will Cost hurdles be Countered?

Campbell Soup is grappling with cost inflation and increased supply-chain costs, which is marring its margin performance. In fourth-quarter fiscal 2023, the company’s adjusted gross margin contracted 70 basis points (bps) due to the adverse volume/mix, ongoing cost inflation and increased supply-chain costs.

Management exited the quarter with core inflation of 6% and expects the metric to be in the low-single-digit in fiscal 2024. Higher adjusted marketing and selling expenses have been a deterrent. The company’s quarterly adjusted marketing and selling expenses rose 9% to $194 million due to increased advertising and consumer promotion expenses and elevated selling expenses.

The company’s strategy of concentrating on supply-chain efficiencies along with curtailing costs and reinvesting part of these savings in areas with high-growth potential is noteworthy. Through the fiscal fourth quarter, it generated $890 million in savings under its multi-year cost-saving program, including Snyder’s-Lance synergies. Management is on track to deliver savings worth $1 billion by fiscal 2025-end.

Shares of the company have dropped 9.1% compared with the industry’s 9.9% decline.

Appetizing Food Picks

MGP Ingredients MGPI, which produces and markets ingredients and distillery products, currently sports a Zacks Rank #1 (Strong Buy). MGPI has a trailing four-quarter earnings surprise of 18% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings per share suggests growth of 5.8% and 10.4%, respectively, from the corresponding year-ago reported figures.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 170.7%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report