Campbell Soup's (CPB) Snacks Business Aids, High Costs Ail

Campbell Soup Company CPB has been benefiting from strength in its Snacks business. Also, a focus on the savings program and pricing has been working well for the company amid cost-related headwinds.

For fiscal 2023, Campbell Soup expects net sales and organic sales growth of 8.5-10%. Adjusted EBIT is forecast to be up 4.5-6.5%. Adjusted EPS is envisioned to be up 3.5-5% to come in the band of $2.95-$3.00.

Solid Snacks Business

Campbell Soup has been benefiting from its growing Snacks business. In the third quarter of fiscal 2023, net sales in the company’s snack division rose 12% (also organically) to $1,121 million. The upside can be attributed to sales of CPB’s eight power brands, which rose 16%. Sales growth was fueled by a rise in cookies and crackers, specifically Goldfish crackers, Lance sandwich crackers and salty snacks like Kettle Brand potato chips, among others.

The favorable net price realization contributed to the upside, which was partially offset by volume/mix declines. In-market dollar consumption increased 15% for the overall Snacks business due to power brands. The company expects to see continued strength in the Snacks business in fiscal 2024.

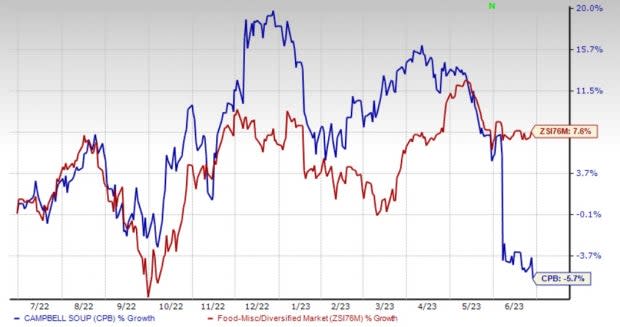

Image Source: Zacks Investment Research

Pricing Aids Sales

Campbell Soup reported impressive third-quarter fiscal 2023 results, with the top and bottom lines surpassing the Zacks Consensus Estimate and net sales increasing year over year. The results benefited from favorable net price realization and brand strength.

Net sales of $2,229 million increased 5% year over year and surpassed the Zacks Consensus Estimate of $2,219 million. Organic net sales grew 5% year over year. The upside can be attributed to favorable inflation-induced net price realization, somewhat offset by the soft volume/mix.

Cost Woes

In the third quarter of fiscal 2023, Campbell Soup’s adjusted gross profit margin contracted 60 basis points (bps) to 30.9% on an unfavorable volume/mix, ongoing cost inflation and increased other supply-chain costs. Adjusted EBIT declined 2% to $313 million due to higher marketing and selling expenses and adjusted administrative expenses. As a percentage of sales, marketing and selling expenses came in at nearly 9%.

The metric is likely to be at the lower end of the 9-10% range in fiscal 2023. Management’s fiscal 2023 outlook reflects planned investments in the fourth quarter. Shares of the company have declined 5.7% in the past year against the industry’s growth of 7.6%.

Wrapping Up

Campbell Soup is on track with efforts to counter inflation, such as supply-chain productivity enhancements and margin-improvement efforts. Through the third quarter of fiscal 2023, the Zacks Rank #3 (Hold) company generated $880 million in savings under its multi-year cost-saving program, including Snyder’s-Lance synergies. Management remains on track to deliver savings worth $1 billion by the fiscal 2025-end.

These factors, along with Campbell Soup’s prudent investment and strategic efforts toward product innovation and brand building, bode well.

Solid Staple Stocks

Some better-ranked consumer staple stocks are Nomad Foods NOMD, McCormick & Company, Incorporated MKC and Lamb Weston LW.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1 (Strong Buy). NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current fiscal-year sales suggests growth of around 8% from the year-ago reported figures.

McCormick, which operates as a manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors, currently carries a Zacks Rank #2 (Buy). MKC has a trailing four-quarter negative earnings surprise of 3.7%, on average.

The Zacks Consensus Estimate for McCormick’s current fiscal-year sales and earnings suggests growth of 6.4% and 3.6%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2. LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 30% and 117.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report