Camping World (NYSE:CWH) Reports Sales Below Analyst Estimates In Q4 Earnings

Recreational vehicle (RV) and boat retailer Camping World (NYSE:CWH) fell short of analysts' expectations in Q4 FY2023, with revenue down 13.4% year on year to $1.11 billion. It made a GAAP loss of $0.49 per share, down from its loss of $0.20 per share in the same quarter last year.

Is now the time to buy Camping World? Find out by accessing our full research report, it's free.

Camping World (CWH) Q4 FY2023 Highlights:

Revenue: $1.11 billion vs analyst estimates of $1.14 billion (2.7% miss)

EPS: -$0.49 vs analyst expectations of -$0.48 (2.9% miss)

Free Cash Flow was -$267.9 million compared to -$370.6 million in the same quarter last year

Gross Margin (GAAP): 31%, up from 30.6% in the same quarter last year

Same-Store Sales were down 14.7% year on year

Store Locations: 202 at quarter end, increasing by 6 over the last 12 months

Market Capitalization: $1.15 billion

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “Beginning in December, our new vehicle same store unit growth turned positive, with January and February to date trending up from mid-single to low-double digits. We achieved our goal of significantly improving our new unit inventory position, with less than 7,500 new model year 2023’s remaining as of today. We believe we are outpacing the industry with close to 80% in 2024 models currently. We believe that successful negotiations in year-over-year pricing reductions on like-for-like new units has sparked early demand and new gross margin stabilization.”

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

Camping World is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

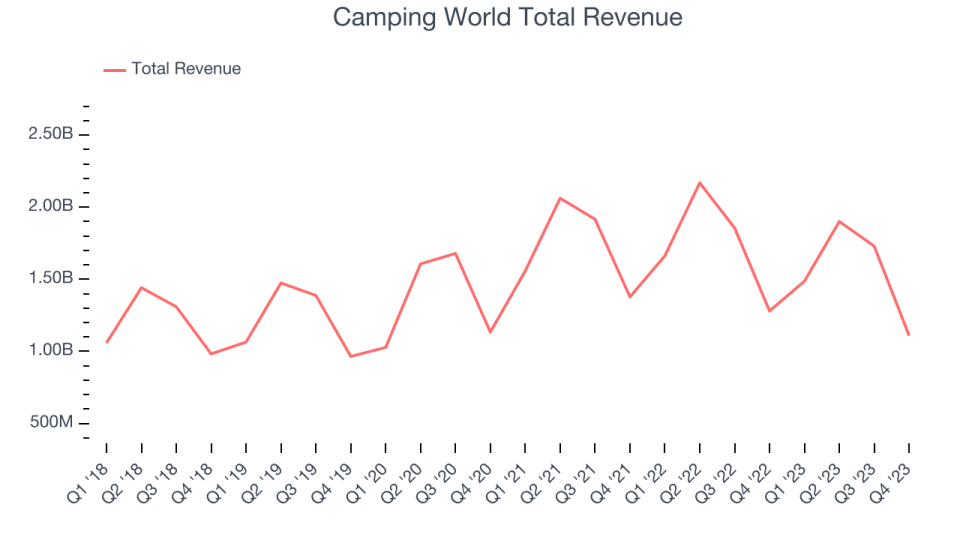

As you can see below, the company's annualized revenue growth rate of 6.2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, Camping World missed Wall Street's estimates and reported a rather uninspiring 13.4% year-on-year revenue decline, generating $1.11 billion in revenue. Looking ahead, Wall Street expects sales to grow 6.2% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

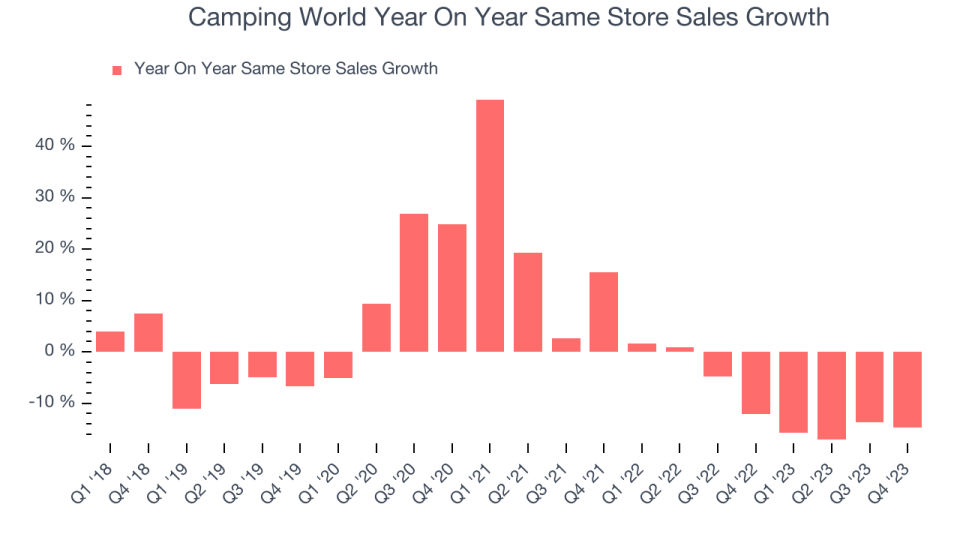

Camping World's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 9.5% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Camping World's same-store sales fell 14.7% year on year. This decrease was a further deceleration from the 12.1% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Camping World's Q4 Results

We enjoyed seeing Camping World exceed analysts' gross margin expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue unfortunately missed analysts' expectations as its same-store sales declined. Interestingly, its used vehicle revenue missed by a wide margin ($322 million vs estimates of $385 million) while its new vehicle revenue beat significantly ($449 million vs estimates of $402 million). Overall, this was a mediocre quarter for Camping World. The company is down 4.5% on the results and currently trades at $23.97 per share.

So should you invest in Camping World right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.