Canadian Solar's (CSIQ) Arm Buys Solar Portfolio in Spain

Canadian Solar Inc.’s CSIQ subsidiary, Recurrent Energy, recently completed the acquisition of a solar photovoltaic (PV) portfolio in the south of Spain. The portfolio has a generation capacity of more than 420 megawatt peak (MWp).

This buyout will put Recurrent Energy a step ahead in completing its projection to start construction on more than 1 GW of solar projects in Spain in 2024.

Details of the Project

The acquired portfolio, located in Carmona, a municipality in Seville, is currently under construction. It comprises a cluster of four projects, Rey I, II, III and IV, wherein Canadian Solar’s TopBiHiKu7 N-type bifacial Tunnel Oxide Passivated Contact modules will be deployed.

The Rey solar portfolio is expected to generate clean electricity of approximately 916 gigawatt-hours (GWh) per year, which will replace around 184,000 tons of carbon dioxide emissions. The electricity generated from the Rey portfolio will light up the homes of 275,000 individuals in the Carmona region.

Canadian Solar’s Prospects in Europe’s Solar Market

In line with other regions across the globe, Europe has been rapidly expanding its renewable energy portfolio to promote green energy. To this end, it is imperative to mention that Canadian Solar has been steadily expanding its footprint in Europe’s solar market. Evidently, the Europe, Middle East, and Africa (EMEA) region contributed 25% to the total revenues of the company in 2023.

In this context, Canadian Solar’s endeavors, like the latest solar portfolio acquisition, should bolster its footprint in the European solar market. As of Jan 31, 2024, Canadian Solar’s Recurrent Energy had a solar development project pipeline of 9,915 MWp in the EMEA region.

Such endeavors are likely to provide meaningful gains to the company in the days ahead, which can be further gauged by a recent projection from SolarPower Europe. Per the report, 56 GW of solar installations were made in Europe in 2023 and is expected to reach 62 GW in 2024, registering year-over-year growth of 11%.

Such growth expectations and the company’s expansion efforts across Europe, including the recent purchase, should potentially enhance its revenue generation prospects in the region.

Peer Moves

The promising growth outlook for Europe’s solar market should also benefit other companies that have significant involvement in this region’s solar market:

Enphase Energy ENPH: The company has been steadily expanding in Europe. In the fourth-quarter 2023, Enphase introduced its IQ8 Microinverters into more countries in like Austria, Italy and Belgium and launched IQ Battery 5P in Italy. In 2023, approximately 31% of its total revenues came from Europe.

ENPH’s long-term (three-to five-years) earnings growth rate is 17.3%. The firm delivered an average earnings surprise of 7.24% in the last four quarters.

SolarEdge SEDG: SolarEdge has a strong presence in Germany, the U.K. and Switzerland. With its revenues from Europe comprising 64% of the total revenues in 2023, the company shipped 8,321 MW of energy to the continent. On Mar 18, 2024, SolarEdge started the order for its first commercial storage system for PV applications in Italy.

SEDG’s long-term earnings growth rate is 14.8%. Its shares have risen 76.3% in the past five years.

Emeren Group SOL: Emeren has a presence in Europe since 2012 and comprised 68% of the total revenues during third-quarter 2023. As of September 2023, it had 1,503 megawatts (MW) of advanced-stage project pipeline and 6.44 GWh of advanced-stage storage pipeline in Europe.

The Zacks Consensus Estimate for SOL’s 2024 sales implies a rise of 48.8% over 2023’s estimated figure. Its share price has jumped 14.7% in the past five years.

Price Performance

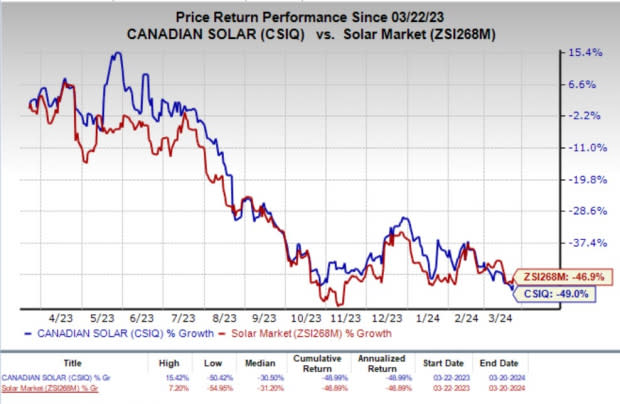

Over the past year, shares of CSIQ have lost 49% compared with the industry’s 46.9% decline.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report