Canadian Tire Corp Ltd's Dividend Analysis

An In-Depth Look at Canadian Tire Corp Ltd's Upcoming Dividend Payout

Canadian Tire Corp Ltd (CDNAF) recently announced a dividend of $1.75 per share, payable on 2024-03-01, with the ex-dividend date set for 2024-01-30. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Canadian Tire Corp Ltd's dividend performance and assess its sustainability.

What Does Canadian Tire Corp Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

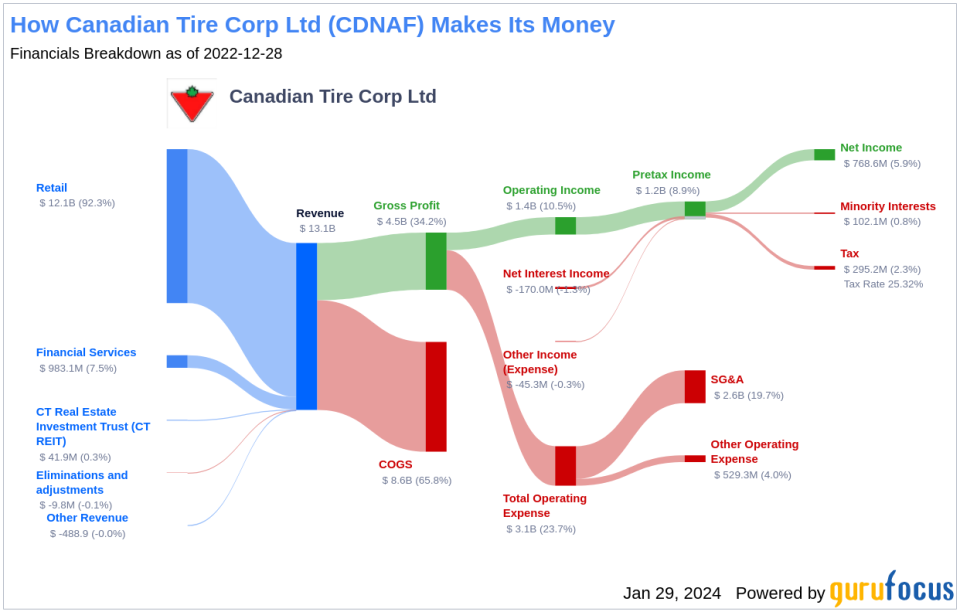

Canadian Tire is a renowned retailer selling a wide range of products including home goods, sporting equipment, apparel, and automotive parts across Canada. Its network spans approximately 1,700 stores under various banners such as Mark's, SportChek, and Party City. The company also owns the Norwegian brand Helly Hansen and operates a financing arm and a real estate investment trust (REIT), signifying a diverse business model with multiple revenue streams.

A Glimpse at Canadian Tire Corp Ltd's Dividend History

Canadian Tire Corp Ltd has a robust dividend track record, having paid dividends consistently since 2004. The company has not only maintained these payments but has also achieved the status of a dividend achiever by increasing its dividend annually since 2012. This demonstrates Canadian Tire Corp Ltd's commitment to returning value to its shareholders.

Below is a chart showing the annual Dividends Per Share for tracking historical trends.

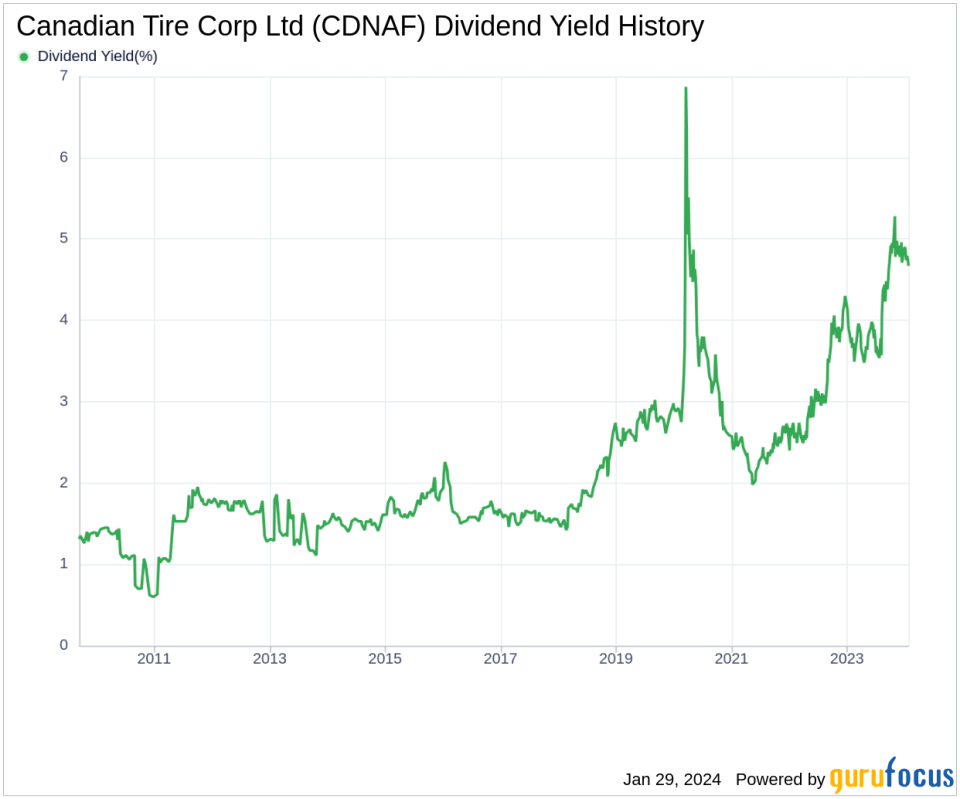

Breaking Down Canadian Tire Corp Ltd's Dividend Yield and Growth

Canadian Tire Corp Ltd currently boasts a trailing dividend yield of 4.61% and a forward dividend yield of 4.60%, indicating a stable outlook for dividend payouts. Over the past three, five, and ten years, the company has demonstrated impressive dividend growth rates of 12.10%, 15.20%, and 17.00% per annum, respectively. The 5-year yield on cost for Canadian Tire Corp Ltd is approximately 9.35%, highlighting the potential long-term benefits for investors.

The Sustainability Question: Payout Ratio and Profitability

When assessing dividend sustainability, the dividend payout ratio is a key metric. Canadian Tire Corp Ltd's current payout ratio is 0.70, which may raise concerns about the long-term sustainability of its dividend payments. However, the company's profitability rank of 9 out of 10 suggests strong earnings potential, supported by a decade of consistent net income.

Growth Metrics: The Future Outlook

Canadian Tire Corp Ltd's growth rank is an impressive 9 out of 10, indicating a robust growth trajectory. The company's revenue per share has increased by an average of 8.50% annually, outperforming approximately 63.29% of global competitors. Furthermore, Canadian Tire Corp Ltd's 3-year EPS growth rate of 14.20% and 5-year EBITDA growth rate of 12.70% indicate a solid foundation for future dividend payments.

Next Steps

In conclusion, Canadian Tire Corp Ltd's consistent dividend payments and growth rates, combined with its payout ratio and profitability, paint a picture of a company with a strong commitment to shareholder returns. While the payout ratio might signal the need for cautious optimism, the company's robust profitability and growth metrics suggest a capacity to sustain and potentially increase dividends in the future. Investors considering Canadian Tire Corp Ltd for its dividend prospects should weigh these factors carefully and monitor the company's ongoing financial performance.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.