CANNELL CAPITAL LLC Acquires Additional Shares in Sportsman's Warehouse Holdings Inc

On September 11, 2023, CANNELL CAPITAL LLC, a renowned investment firm, added 374,3541 shares to its portfolio in Sportsman's Warehouse Holdings Inc (NASDAQ:SPWH). This article provides an in-depth analysis of the transaction, the guru's profile, and the traded company's basic information.

Details of the Transaction

The transaction took place on September 11, 2023, with CANNELL CAPITAL LLC adding 54,169 shares of Sportsman's Warehouse Holdings Inc to its portfolio. The shares were traded at a price of $3.33 each. This addition had a 0.04% impact on the guru's portfolio, bringing the total shares held by the firm in SPWH to 3,743,541. This represents 2.49% of the guru's portfolio and 10.01% of the company's total shares.

Profile of the Guru: CANNELL CAPITAL LLC

CANNELL CAPITAL LLC is a prominent investment firm based in Jackson, Wyoming. The firm's investment philosophy is centered on value investing, with a focus on long-term capital appreciation. As of the transaction date, the firm held 66 stocks in its portfolio, with a total equity of $501 million. The firm's top holdings include Heritage-Crystal Clean Inc(NASDAQ:HCCI), Build-A-Bear Workshop Inc(NYSE:BBW), North American Construction Group Ltd(NYSE:NOA), Tidewater Inc(NYSE:TDW), and Arlo Technologies Inc(NYSE:ARLO). The firm's primary investment sectors are Consumer Cyclical and Communication Services.

Overview of the Traded Stock: Sportsman's Warehouse Holdings Inc

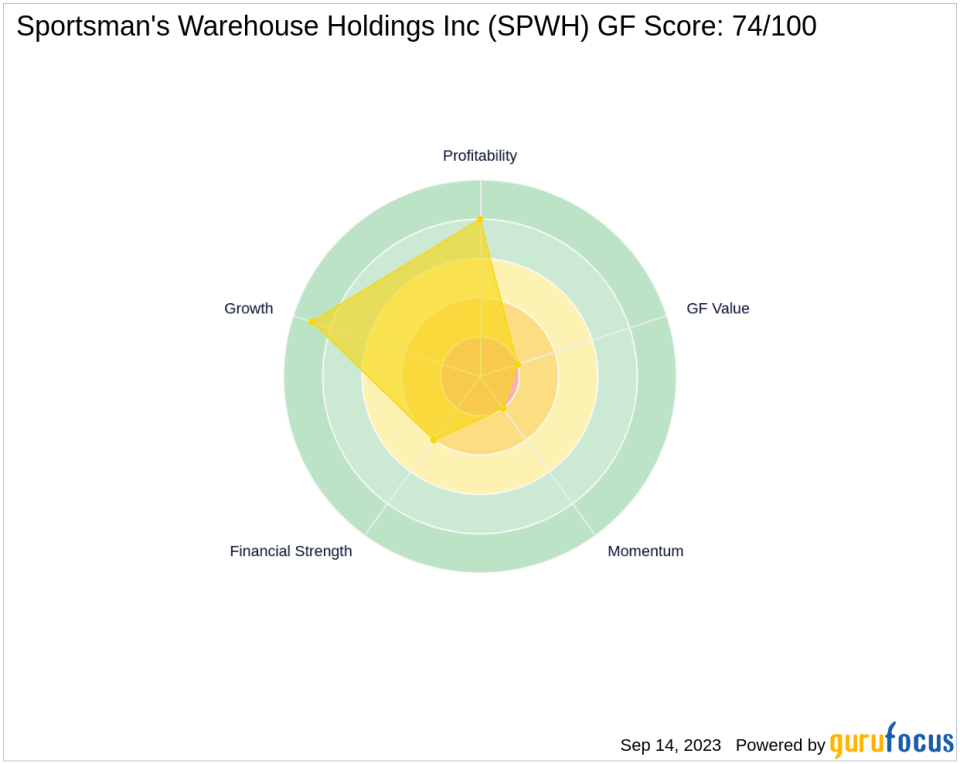

Sportsman's Warehouse Holdings Inc, a US-based company, operates as an outdoor sporting goods retailer. The company offers a one-stop shopping experience for customers seeking quality, brand name hunting, shooting, fishing, and camping gear. The company's market capitalization stands at $137.767 million, with a current stock price of $3.685. However, the stock's GF Valuation suggests it may be a possible value trap, urging investors to think twice before investing. The stock's GF Score is 74/100, indicating a likely average performance.

Performance and Valuation of the Stock

The stock's PE Percentage is 33.50, and it has a GF Value of 11.29. The stock's Balance Sheet Rank is 4/10, indicating a moderate level of financial strength. The stock's Profitability Rank is 8/10, suggesting a high level of profitability. The stock's Growth Rank is 9/10, indicating strong growth potential. However, the stock's GF Value Rank and Momentum Rank are both 2/10, suggesting a low valuation and momentum, respectively. The stock's Piotroski F-Score is 2, and its Altman Z score is 1.84.

Other Key Financial Metrics of the Stock

The stock's Cash to Debt ratio is 0.01, and its Interest Coverage is 1.67. The stock's ROE is 1.77, and its ROA is 0.54. The stock's Gross Margin Growth is -0.70, and its Operating Margin Growth is -1.10. Over the past three years, the stock has shown a Revenue Growth of 19.10%, an EBITDA Growth of 22.10%, and an Earning Growth of 29.50%.

Other Gurus' Involvement in the Stock

GAMCO Investors is the largest guru holding the stock. Other gurus also holding the stock include First Eagle Investment (Trades, Portfolio) and Jefferies Group (Trades, Portfolio).

Transaction Analysis

The addition of Sportsman's Warehouse Holdings Inc shares to CANNELL CAPITAL LLC's portfolio indicates the firm's confidence in the company's future performance. Despite the stock's low GF Value Rank and Momentum Rank, its strong Growth Rank and high Profitability Rank suggest potential for future growth. However, investors should consider the stock's GF Valuation and other financial metrics before making investment decisions.

All data and rankings are accurate as of September 14, 2023.

This article first appeared on GuruFocus.