Canopy Growth Corp (CGC) Reports Q3 FY2024 Results: Margins and Medical Sales Hit Record Highs

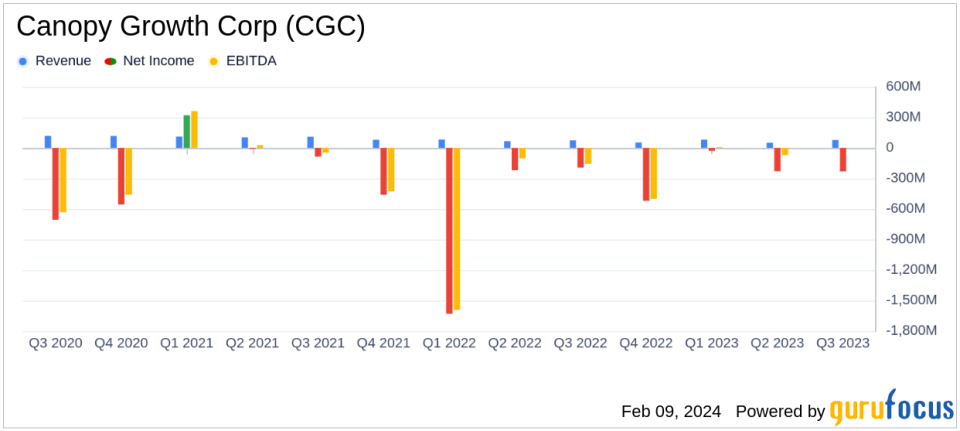

Net Revenue: Q3 FY2024 consolidated net revenue was $78.5 million, a 7% decrease year-over-year, but a 6% increase when excluding the impact of divestitures.

Gross Margin: Achieved consolidated gross margins of 36%, a significant increase from (11)% in Q3 FY2023.

Net Loss: Net loss from continuing operations narrowed to $(230.3) million, a slight improvement from the previous year.

Adjusted EBITDA: Adjusted EBITDA loss improved by 82% year-over-year, reporting a $(9.0) million loss in Q3 FY2024.

Free Cash Flow: Free cash flow from continuing operations improved by 57% year-over-year, reporting $(33.9) million in Q3 FY2024.

Balance Sheet: Ended the quarter with $186 million in cash and short-term investments, and reduced overall debt by $69 million.

Medical Cannabis Sales: Record net revenue for Canadian medical cannabis, up 11% year-over-year.

On February 9, 2024, Canopy Growth Corp (NASDAQ:CGC) released its 8-K filing, detailing the financial results for the third quarter ended December 31, 2023. The company, headquartered in Smiths Falls, Canada, is known for its diverse portfolio of cannabis and hemp products, including medicinal and recreational brands like Doja, 7ACRES, Tweed, and Deep Space, as well as non-THC products such as BioSteel sports drinks, This Works skincare, Martha Stewart CBD, and Storz & Bickel vaporizers. Canopy Growth is also in the process of restructuring its U.S. assets into Canopy USA, a separate holding company.

Financial Performance and Challenges

Canopy Growth's third quarter saw a year-over-year increase in adult-use cannabis business-to-business net revenue in Canada by 9% and medical cannabis net revenue by 11%. The company's focus on execution led to sustained margin improvement, with consolidated gross margins exceeding 30% for the second quarter in a row. Despite a 7% decline in consolidated net revenue year-over-year, the company achieved a 6% growth when excluding the impact of the divestiture of its Canada national retail business.

The Rest-of-World cannabis revenue saw an 81% increase, driven by growth in Australia and Europe, and a recovery from negative impacts in non-core markets from the previous year. Storz & Bickel also reported a 54% sequential increase in net revenue, attributed to strong sales of the new VENTY portable vaporizer and a successful Black Friday event.

However, the company still faces challenges, including a net loss from continuing operations of $(230.3) million, although this represents a slight improvement from the previous year. Management remains confident in the company's path towards a sustainable and profitable future, reaffirming expectations to achieve positive Adjusted EBITDA in each business unit by the end of FY2024.

Financial Achievements and Importance

Canopy Growth's financial achievements this quarter, particularly the improvement in gross margins and medical cannabis sales, are crucial for the company's long-term strategy. The growth in medical cannabis sales underscores the company's strength in a key segment of the market, while margin improvements reflect successful cost management and operational efficiency. These achievements are particularly important in the competitive and rapidly evolving Drug Manufacturers industry, where profitability and market share are critical for success.

Key Financial Metrics

Key financial details from the Income Statement and Balance Sheet include:

Financial Metric | Q3 FY2024 | Q3 FY2023 | Year-over-Year Change |

|---|---|---|---|

Consolidated Net Revenue | $78.5 million | $84.5 million | (7%) |

Consolidated Gross Margin | 36% | (11%) | 3,000 bps improvement |

Net Loss from Continuing Operations | $(230.3) million | $(235.1) million | (2%) |

Adjusted EBITDA | $(9.0) million | $(50.0) million | 82% improvement |

Free Cash Flow | $(33.9) million | $(78.6) million | 57% improvement |

These metrics are important as they provide insights into the company's operational efficiency, profitability, and financial health. The improvement in gross margin and reduced net loss are positive indicators of Canopy Growth's ability to manage costs and improve its bottom line. The significant improvement in free cash flow is also a key metric, as it reflects the company's ability to generate cash and fund its operations.

"This is the dawn of a new era at Canopy Growth. Were singularly focused on cannabis and demonstrating growth across all of our business units. With our Canopy USA strategy now moving forward, we expect to be the first and only U.S. listed company offering shareholders a unique opportunity to gain exposure to the fastest growing cannabis market in the world," said David Klein, Chief Executive Officer.

"Our Q3 FY2024 results demonstrate the substantial improvement in profitability and reduction in cash burn compared to the previous year as well as Q2 FY2024. Our right-sized business is consistently delivering profitability improvements as well as sequential growth. These results, paired with our ongoing actions to strengthen Can

Explore the complete 8-K earnings release (here) from Canopy Growth Corp for further details.

This article first appeared on GuruFocus.