Cantaloupe Inc (CTLP) Posts Strong Q2 Fiscal 2024 Results with Significant Growth in ...

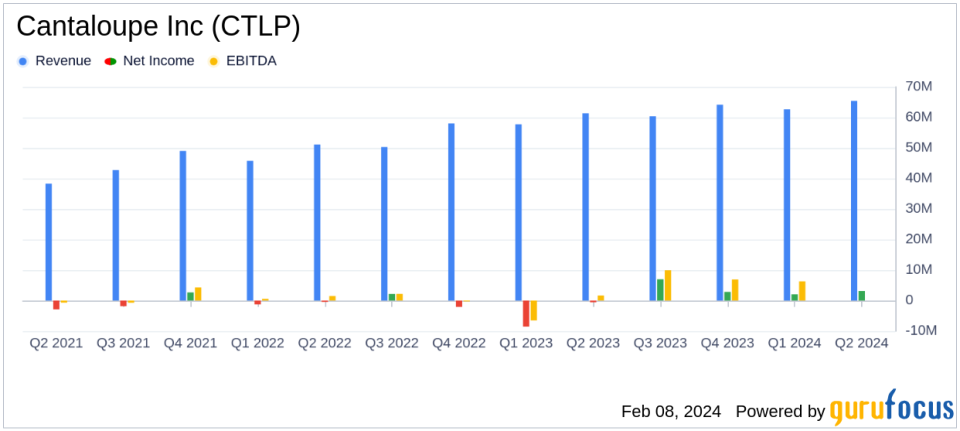

Revenue: $65.4 million, a 7% increase year over year.

Net Income: $3.1 million, a significant improvement from a net loss of $0.6 million in the prior year quarter.

Adjusted EBITDA: $8.5 million, more than double the $3.9 million from the same period last year.

Gross Margin: Improved to 37.2% from 30.1% in the prior year quarter.

Subscription and Transaction Fees: Grew by 15%, driving the revenue growth.

Active Customers and Devices: Increased by 14% and 7% respectively, indicating expanding market penetration.

On February 8, 2024, Cantaloupe Inc (NASDAQ:CTLP), a leader in digital payments and software services, announced its financial results for the second quarter ended December 31, 2023. The company reported a revenue of $65.4 million, marking a 7% increase year over year, driven by a significant growth in subscription and transaction fees. The detailed financial results are available in the company's 8-K filing.

Cantaloupe Inc operates in the small ticket electronic payments industry, providing a range of services including wireless, cashless, micro-transactions, and networking within the unattended Point of Sale (POS) market. The company's diverse product and service offerings, such as ePort Cashless devices and Value-added services, cater to various industries like vending, kiosk, and laundry, primarily generating revenue from subscription and transaction fees.

The second quarter saw a robust increase in net income applicable to common shares, which stood at $3.1 million, or $0.04 per share, a stark contrast to the net loss of $0.6 million, or $(0.01) per share, in the prior year quarter. Adjusted EBITDA also saw a substantial rise to $8.5 million from $3.9 million in the same quarter of the previous year, indicating strong profitability and operational efficiency.

Gross margin improved significantly to 37.2%, compared to 30.1% in the prior year quarter, with margins for subscription and transaction fees growing to 43.1% from 38.3%. This margin expansion is a testament to the company's ability to scale its operations effectively while maintaining cost control.

The company's financial achievements are particularly important as they reflect Cantaloupe's strategic focus on expanding operating leverage and driving profitability. With a robust domestic and international pipeline, the company is well-positioned to capitalize on favorable secular trends such as the acceleration of micro-markets and evolving consumer payment preferences.

"In the second quarter, we continued to execute on our strategy of expanding operating leverage and driving strong profitability," said Ravi Venkatesan, chief executive officer, Cantaloupe. "Our domestic and international pipeline is robust, driven by our go-to-market strategy and extensive product offering."

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight the company's performance. The total dollar volume of transactions increased by 12% year over year to $730.1 million, and the number of transactions totaled 286.7 million at the end of the second quarter of 2024. Average revenue per device also saw an uptick, totaling $181.91 for the quarter, compared to $160.46 in the prior year quarter.

Despite these positive results, Cantaloupe Inc faces challenges such as the dynamic nature of the technology industry, competitive pressures, and the need to continuously innovate. However, the company's recent business highlights, including an increase in active customers and devices, the launch of new analytics tools, and the acquisition of CHEQ, suggest that it is well-equipped to navigate these challenges and sustain growth.

For the full fiscal year 2024, Cantaloupe reiterates its outlook, expecting total revenue to be between $275 million and $285 million, with a combination of subscription and transaction fees to be between $234 million and $242 million. The company also anticipates total net income to be between $9 million and $15 million, with adjusted EBITDA to be between $28 million and $34 million, and total operating cash flow to be between $28 million and $38 million.

Overall, Cantaloupe Inc's second quarter fiscal year 2024 results demonstrate a solid financial performance, with significant growth in key areas that are critical for the company's long-term success. Value investors and potential GuruFocus.com members may find the company's strategic execution and market position appealing as they consider investment opportunities.

Explore the complete 8-K earnings release (here) from Cantaloupe Inc for further details.

This article first appeared on GuruFocus.