Capital Bancorp Inc (CBNK) Reports Steady Earnings Amid Market Volatility

Net Income: Reported at $9.0 million, or $0.65 per diluted share.

Tangible Book Value Per Share: Increased by 15.6% year-over-year to $18.31.

Loan Growth: Portfolio loans grew by $40.7 million, an 8.7% annualized rate.

Dividend: Declared a cash dividend of $0.08 per share.

Net Interest Margin: Decreased to 6.40% from 6.71% in the previous quarter.

Efficiency Ratio: Slightly increased to 65.91% from 65.02% in the third quarter.

Capital Ratios: Common equity tier 1 capital ratio reported at 15.43%.

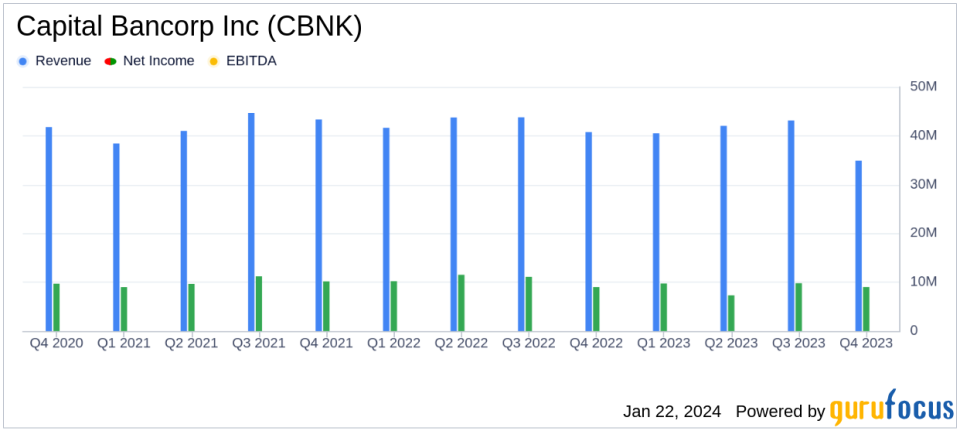

On January 22, 2024, Capital Bancorp Inc (NASDAQ:CBNK) released its 8-K filing, announcing its financial results for the fourth quarter of 2023. The bank holding company, which operates through divisions such as Commercial Banking, Capital Bank Home Loans, and OpenSky, reported a net income of $9.0 million, or $0.65 per diluted share, consistent with the fourth quarter of 2022 but down from $9.8 million, or $0.70 per diluted share, in the third quarter of 2023.

Despite the flat year-over-year net income, the company's tangible book value per share increased significantly, indicating a solid growth in shareholder value. The loan portfolio expanded, reflecting the bank's ability to generate new lending business in a competitive environment. However, the net interest margin, a key profitability metric for banks, saw a decline, which could be a concern if the trend continues.

Capital Bancorp's CEO, Ed Barry, expressed optimism about the bank's strategic growth and profitability, highlighting a 29% increase in book value over the past two years. Chairman Steven J. Schwartz pointed to the bank's stable core net interest margin and core deposits as indicators of potential outperformance relative to peers.

"Despite persistent market volatility, we continue to identify opportunities to generate attractive loans and core deposits and expand our talented team," said Ed Barry, CEO of Capital Bancorp Inc (NASDAQ:CBNK).

Financially, the bank's performance was mixed. While the loan growth was robust, the net interest income decreased compared to the previous quarter, primarily due to a decrease in interest income from credit card loans and an increase in interest expense reflecting the rising cost of interest-bearing deposits. The provision for credit losses also increased, suggesting a more cautious outlook on loan repayments.

Noninterest income saw a slight decrease due to lower credit card fees, and noninterest expenses decreased mainly due to adjustments in annual incentive-based compensation and lower professional fees. The efficiency ratio, which measures noninterest expenses as a percentage of revenue, increased slightly, indicating a decrease in efficiency.

Capital Bancorp's balance sheet showed a decrease in total assets, primarily due to a reduction in cash and cash equivalents. Deposits also decreased, which the company attributed to seasonal factors. The investment securities portfolio remained stable, and the bank maintained a strong capital position with a common equity tier 1 capital ratio of 15.43%.

Overall, Capital Bancorp Inc (NASDAQ:CBNK) demonstrated resilience in a challenging market, maintaining stable earnings and a strong capital position. The bank's focus on strategic growth and investment in technology bodes well for its future, but it will need to manage the pressures on net interest margin and efficiency to sustain profitability.

For more detailed financial analysis and the latest updates on Capital Bancorp Inc (NASDAQ:CBNK), investors and analysts are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Capital Bancorp Inc for further details.

This article first appeared on GuruFocus.