Capital City Bank (CCBG) Rewards Investors With Dividend Hike

Capital City Bank Group, Inc CCBG has increased its quarterly dividend. The bank announced a quarterly cash dividend of 21 cents per share, marking an increase of 5% from the prior payout. The dividend will be paid out on Mar 25, 2024, to shareholders of record as of Mar 11.

Prior to this, CCBG hiked its dividend by 11.1% to 20 cents per share on Aug 24, 2023. It has increased its dividend payout eight times in the past five years. Also, the company has five-year annualized dividend growth of 11.45%. Currently, Capital City Bank’s payout ratio is 25% of earnings.

Based on yesterday’s closing price of $28.35, Capital City Bank currently has a dividend yield of 2.96% compared with the industry’s yield of 2.80%.

The bank also has a share repurchase program in place. On Jan 25, 2024, CCBG’s board of directors approved a new stock repurchase program, under which the company is authorized to repurchase up to 0.75 million shares within the next five years.

At present, CCBG has approximately 16.9 million issued and outstanding shares. The shares authorized for repurchase under the new buyback plan represent approximately 4.4% of the company’s issued and outstanding shares of common stock.

The company had a total debt of $61.6 million and cash and cash equivalents of $312.1 million as of Dec 31, 2023. Capital City Bank’s strong liquidity and solid balance sheet position are likely to help sustain its capital distributions in the long run.

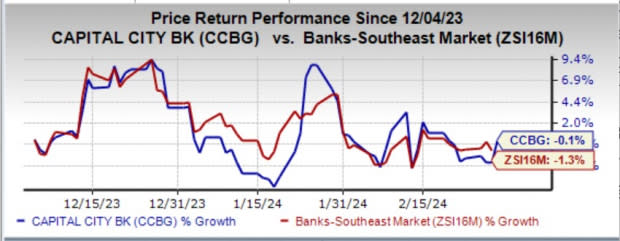

In the past three months, shares of CCBG have lost 0.1% compared with the industry’s 1.3% decline.

Image Source: Zacks Investment Research

Currently, Capital City Bank carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Taking Similar Steps

In February, WaFd, Inc. WAFD announced a quarterly cash dividend of 26 cents per share, marking an increase of 4% from the prior payout. This dividend will be paid out on Mar 8, 2024, to shareholders of record as of Feb 23.

Prior to this, WAFD hiked its dividend by 4.2% to 25 cents per share on Mar 10, 2023. The company has increased its dividend payout five times in the past five years.

Southside Bancshares, Inc. SBSI also announced a quarterly cash dividend of 36 cents per share, which is 2.9% higher than the prior payout. This dividend will be paid out on Feb 29, 2024, to shareholders on record as of Feb 15.

Prior to this, SBSI increased its dividend by 2.9% to 35 cents per share in February 2023. The current dividend marks the fourth hike in the past three years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Capital City Bank Group (CCBG) : Free Stock Analysis Report

WaFd, Inc. (WAFD) : Free Stock Analysis Report

Southside Bancshares, Inc. (SBSI) : Free Stock Analysis Report