Capital One (COF) to Buy Discover Financial (DFS) for $35.3B

Capital One COF has inked an agreement to acquire Discover Financial Services DFS in an all-stock transaction valued at $35.3 billion. This strategic move is poised to reshape the landscape of the credit card industry, create a behemoth in the industry and unlock substantial value for shareholders while raising questions about regulatory scrutiny and competitive dynamics within the market.

In pre-market trading, shares of COF are down 4.5%, while DFS has jumped 13.5%.

The deal, expected to close in late 2024 or early 2025, is still subject to the satisfaction of customary closing conditions, including regulatory nods and approval by the shareholders of both companies.

Under the terms of the agreement, DFS shareholders will receive 1.0192 Capital One shares for each Discover Financial share. This reflects a premium of 26.6% based on Discover Financial's closing price of $110.49 on Feb 16, 2024.

Following the closure, Capital One shareholders will own almost 60%, and DFS shareholders will own nearly 40% of the combined company. Further, three members from Discover Financial’s board of directors will join Capital One.

Unlocking Synergies and Driving Growth

At the heart of this acquisition lies a powerful strategic rationale aimed at delivering value to consumers, small businesses and merchants. By combining the strengths of Capital One and Discover Financial, the merged entity will boast a formidable global payments network, enhanced card businesses and a scalable digital banking platform.

Discover Financial's extensive global payments network, spanning 70 million merchant acceptance points across more than 200 countries and territories, presents a valuable asset that will receive a significant boost from COF's investment and scale. This expansion is crucial for Capital One's ambition to build a globally competitive payments network, enabling it to better compete with bigger industry players like Visa V and Mastercard MA.

Similar to V and MA, Capital One will now be able to generate revenues from fees charged for every merchant transaction that runs on the network.

Capital One's "Digital First" banking model, characterized by its iconic customer experience and fee-free offerings, will be further bolstered by DFS’ national direct savings bank. This synergy will increase the combined company's ability to compete with the nation's largest banks while accelerating national banking growth.

Financial Implications and Regulatory Scrutiny

This acquisition is expected to generate and deliver attractive accretion and returns for shareholders. Expense synergies of $1.5 billion in 2027, coupled with network synergies of $1.2 billion, underscore the value-creation potential of the merger. The transaction will result in a more than 15% accretion to adjusted non-GAAP EPS by 2027.

Moreover, the deal is anticipated to yield a return on invested capital of 16% in 2027, accompanied by an internal rate of return exceeding 20%. These robust financial metrics underscore the strategic rationale behind the acquisition and highlight the potential for long-term value creation.

The transaction will bolster Capital One's balance sheet. On a pro forma basis, the combined company would have a CET1 ratio of roughly 14% at closing, and 84% of company deposits would be insured as of Dec 31, 2023.

However, the deal is likely to face intense regulatory scrutiny, given its implications for market competition and potential antitrust concerns. The current administration's focus on promoting competition across all sectors of the economy, along with increased regulatory scrutiny of bank mergers, sets the stage for a rigorous review process.

Regulators are expected to closely evaluate the impact of the acquisition on market competition, particularly within the credit card issuer market. Concerns may arise regarding the vertical integration of Capital One's credit card lending with Discover Financial's credit card network, prompting a thorough examination of potential anti-competitive effects.

Despite regulatory challenges, COF remains confident in the strategic rationale behind the acquisition and its ability to navigate the regulatory landscape effectively.

Conclusion

The acquisition of DFS positions Capital One as a formidable player in the credit card industry. By harnessing the combined strengths of both companies, COF aims to capture a larger share of the credit card market and drive sustainable growth in the long term.

Richard Fairbank, founder, chairman and CEO of Capital One said, “Through this combination, we're creating a company that is exceptionally well-positioned to create significant value for consumers, small businesses, merchants, and shareholders as technology continues to transform the payments and banking marketplace.”

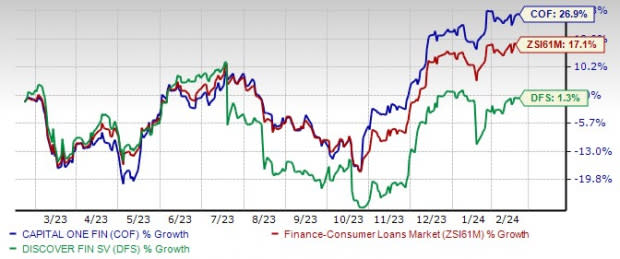

Over the past year, shares of Capital One and Discover Financial have rallied 26.9% and 1.3%, respectively. In the same time frame, the industry has soared 17.1%.

One-year Price Performance

Image Source: Zacks Investment Research

Currently, both COF and DFS carry a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report