Capital One (COF) Rides on Buyouts & Loans, Asset Quality Ails

Capital One Financial Corp. COF is well-poised for revenue growth on the back of strategic acquisitions and steady loan demand. Higher interest rates and a strong balance sheet position will continue to support its financials. However, rising expenses and weak asset quality remain major near-term concerns.

Capital One is focused on growing inorganically. In February 2024, COF announced a $35.3 billion all-stock deal to acquire Discover Financial DFS, with the aim to reshape the landscape of the credit card industry and increase shareholders’ value. According to the agreement, shareholders of Discover Financial will receive 1.0192 capital one shares for each DFS share. Capital One shareholders will own almost 60% and DFS shareholders will possess nearly 40% of the combined company.

Earlier in 2023, COF acquired Velocity Black to bolster its delivery of exceptional experiences for consumers due to its innovative technology. In 2021, the company acquired TripleTree, LLC, while in 2019, it acquired KippsDeSanto. Also, the buyouts of Beech Street Capital and GE's healthcare unit reflect the company’s revenue diversifying efforts.

The company’s revenues witnessed a five-year (2018-2023) compound annual growth rate (CAGR) of 5.6%, despite recording a decline in 2020. Given COF’s solid credit card and online banking businesses, along with decent loan demand, the revenue prospects look promising. Capital One’s net loans held for investment recorded a four-year (ended 2023) CAGR of 4.2% and we expect the metric to rise 2.4% in 2024. Further, we project total revenues to grow 2.7%, 3.2% and 7% in 2024, 2025 and 2026, respectively.

With the Federal Reserve expected to keep interest rates high in the near term, Capital One’s net interest income (NII) and net interest margin (NIM) are likely to witness improvements. However, higher funding costs might weigh on the metrics. Driven by the higher interest rates, NII witnessed a steady rise in the last three years. We expect NII to witness a CAGR of 4.3% over the three years ended 2026.

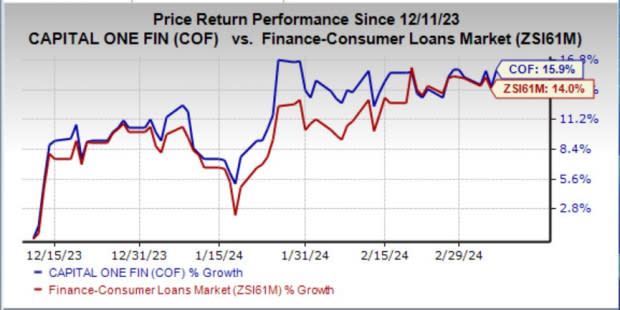

COF currently carries a Zacks Rank #3 (Hold). Shares of the company have climbed 15.9% over the past three months compared with the industry’s growth of 14%.

Image Source: Zacks Investment Research

Capital One’s asset quality has been deteriorating. Both provision for credit losses and net charge-offs have been rising amid the uncertain macroeconomic backdrop. The company’s credit quality is likely to remain under pressure in the near term, given the tough macroeconomic outlook. While we project provision for credit losses to decline in 2024 and 2025, the metric is expected to rise 7.7% in 2026. NCOs are expected to rise 16.3% in 2024.

Capital One has been witnessing a constant rise in expenses. Though expenses declined in 2020, the metric witnessed a CAGR of 6.4% over the last five years (ended 2023). The increase was mainly due to higher marketing costs and inflationary pressure. Given the company’s continued investments in technology, infrastructure and inorganic expansion efforts, the expenses are expected to remain elevated. We project total non-interest expenses to increase 1.4%, 3.9% and 2.5% in 2024, 2025 and 2026, respectively.

Stocks to Consider

Some better-ranked bank stocks are EZCORP, Inc. EZPW and Mr. Cooper Group Inc. COOP.

Earnings estimates for EZCORP for the current year have moved north by 8.2% in the past 60 days. The company’s shares have gained 20.5% over the past three months. At present, EZPW sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for Cooper Group for 2024 have been revised upward by 2.7% in the past 30 days. The stock has gained 12.1% over the past three months. Currently, COOP carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report