Is Capital One Stock a Buy?

Bank stocks have had a tough go of it in recent years, but things seem to be improving, judging by their recent stock performance. Capital One (NYSE: COF) is one bank that faced pressure as multidecade-high interest rates weighed on the sector as a whole, but its stock has performed much better recently.

The bank made big news in February when it agreed to acquire Discover Financial Services, creating an intriguing opportunity for investors. Here's what you need to know about the acquisition and Capital One's business before buying it today.

Capital One's huge credit card business

Capital One provides banking to customers, but its bread-and-butter business is credit cards. According to The Nilson Report, a newsletter covering the global payment industry, Capital One is the fourth-largest credit card company in the U.S. Only JPMorgan Chase, American Express, and Citigroup issued more credit cards.

Capital One works with payment processors, such as Visa and Mastercard, to provide debit and credit cards to customers. The company then earns processing and interchange fees for authorizing and providing settlement on all card transactions processed through those payment networks.

Last year, interchange fees accounted for $4.8 billion of its $36.8 billion in revenue. Net interest income, or the interest earned on credit cards and other loans minus interest paid out on its liabilities, makes up the bulk of Capital One's revenue, accounting for $29.2 billion last year.

Capital One's acquisition of Discover could be huge

Capital One's agreement to buy Discover Financial Services in a $35 billion all-stock deal attracted a lot of attention, including from regulators -- and for good reason. If the deal goes through, Capital One could become the largest credit card lender in the U.S.

Capital One's acquisition would give it Discover's payment network, including Discover Network, Diners Club, and Pulse debit network, which compete with Visa and Mastercard for processing payments. Capital One could move its cards to Discover's network and create a closed-loop payment network to save money and better compete with Visa and Mastercard if the deal goes through.

A Capital One-Discover combination could be a big win for shareholders, but the deal will be heavily scrutinized by consumer groups and lawmakers on both sides of the aisle before being approved.

Senator Elizabeth Warren (D-Mass.) said that the merger "threatens our financial stability, reduces competition, and would increase fees and credit costs for American families" and asked regulators to "block it immediately." Senator Josh Hawley (R-Mo.) said, "This merger will create a new juggernaut in the credit card market, with unprecedented powers to extort American consumers. That cannot be allowed to happen."

Keep an eye on the consumer

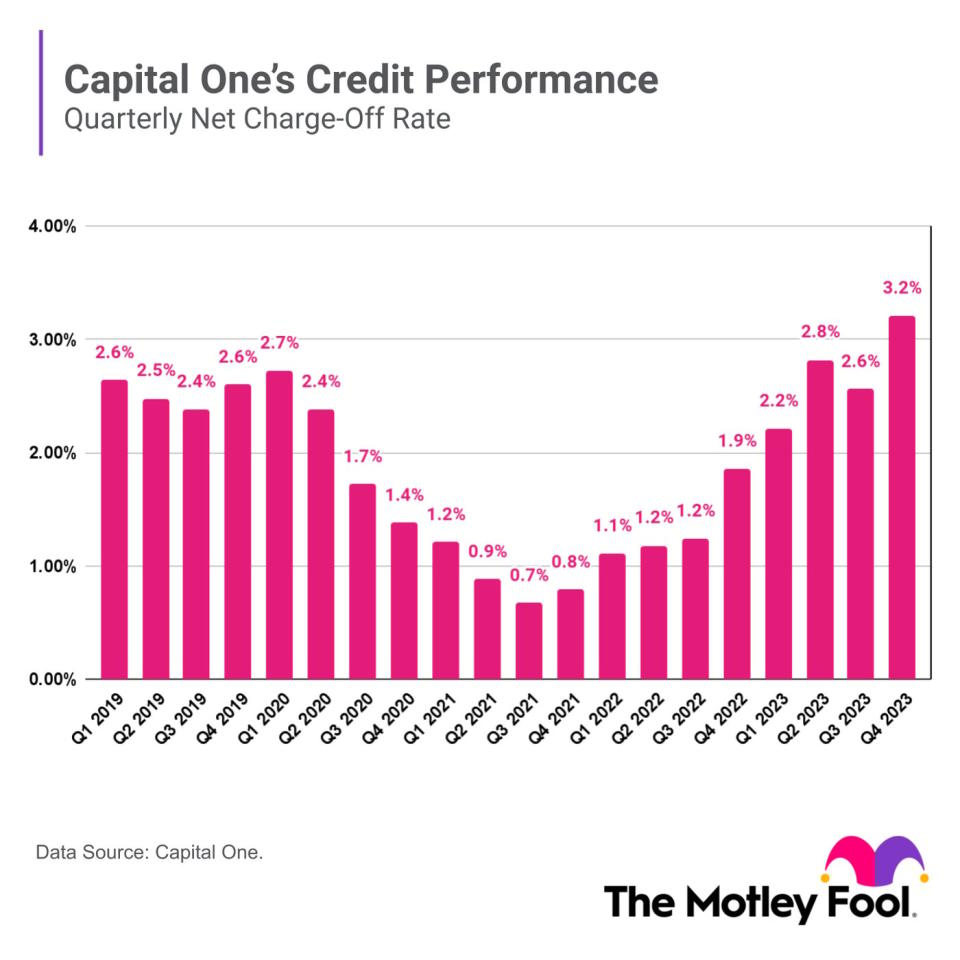

Another thing to consider before investing in Capital One is its credit metrics. Because of its sizable credit card business, shifting consumer behavior could have a significant impact on its bottom line. Capital One's customer base, which tends to be on the lower end of the credit score spectrum, also could be more vulnerable if there is an economic downturn.

Net charge-offs for banks have risen during the past several quarters. Capital One charged off $2.5 billion in the fourth quarter last year, and its net charge-off rate was 3.21%, up from 1.86% one year before and above pre-pandemic levels. In February, its net charge-offs on credit card loans were 5.95%, a 62 basis point jump from Q4.

The company has set aside funds, also known as an allowance for credit losses, to account for potential future losses on its portfolio. At the end of the fourth quarter, Capital One set aside $15.3 billion in allowance for credit losses, giving it an allowance coverage ratio of 4.77%.

Given the rise in delinquencies and net charge-offs, Capital One's business may face headwinds over the next few quarters. The stock has also run up more than 40% since its low point in November and isn't the value deal it was last year. Today, Capital One stock is priced at 1.25 times tangible book value after being priced at a 10% discount to book value at several points last year.

Is Capital One a buy?

The bank's acquisition of Discover will make it a compelling investing opportunity, but it still has several hoops to jump through and the transaction likely won't be approved until late this year or 2025 -- if it gets approved at all.

Near-term consumer headwinds and the recent rapid increase in its stock price make Capital One a stock that investors should avoid for now. However, its long-term potential is solid, so a dip in the stock price from here over the next year could be an appealing buying opportunity for investors with a long-term outlook.

Should you invest $1,000 in Capital One Financial right now?

Before you buy stock in Capital One Financial, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Capital One Financial wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase, Mastercard, and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Is Capital One Stock a Buy? was originally published by The Motley Fool