Capital World Investors Bolsters Stake in FirstEnergy Corp

Capital World Investors (Trades, Portfolio), a prominent investment firm, has recently increased its holdings in FirstEnergy Corp (NYSE:FE) by acquiring an additional 18,954,529 shares. The transaction, which took place on October 31, 2023, has raised the firm's total share count in FirstEnergy to 62,405,392. This move signifies a 0.13% impact on the firm's portfolio, with the shares purchased at an average price of $35.6. The firm now holds a 10.90% stake in FirstEnergy, representing 0.43% of its investment portfolio.

Capital World Investors (Trades, Portfolio): A Profile

Based in Los Angeles, Capital World Investors (Trades, Portfolio) operates with a keen focus on long-term value creation. With an investment philosophy that emphasizes sustainable growth, the firm manages a diverse portfolio across various sectors. As of the latest data, Capital World Investors (Trades, Portfolio) has significant positions in technology and healthcare, with top holdings including Broadcom Inc (NASDAQ:AVGO), Microsoft Corp (NASDAQ:MSFT), The Home Depot Inc (NYSE:HD), Eli Lilly and Co (NYSE:LLY), and UnitedHealth Group Inc (NYSE:UNH). The firm's equity assets total a staggering $519.89 billion, showcasing its substantial influence in the market.

FirstEnergy Corp: An Overview

FirstEnergy Corp, with the stock symbol FE, is an investor-owned holding company that operates one of the largest electric transmission systems in the United States. Since its IPO on November 10, 1997, the company has been serving customers across six mid-Atlantic and Midwestern states. FirstEnergy's business segments include Corporate/Other, Regulated Distribution, and Regulated Transmission. With a market capitalization of $21.02 billion and a current stock price of $36.63, the company is a significant player in the utilities-regulated industry.

Impact of the Trade on Capital World Investors (Trades, Portfolio)

The recent acquisition of FirstEnergy shares by Capital World Investors (Trades, Portfolio) has increased the firm's position in the company to 10.90%, making it a substantial stakeholder. The trade has a moderate impact on the firm's portfolio, given the 0.43% position. This strategic addition aligns with the firm's investment philosophy, potentially positioning it to benefit from FirstEnergy's market performance and future growth prospects.

FirstEnergy's Financial Health

FirstEnergy's current market capitalization stands at $21.02 billion, with a stock price of $36.63. The company's PE Percentage is 40.70, indicating its profitability in terms of earnings. According to GuruFocus's exclusive method, FirstEnergy is considered modestly undervalued with a GF Value of $42.82 and a Price to GF Value ratio of 0.86. The stock has experienced a 2.89% gain since the transaction date and a 45.41% increase since its IPO. However, the year-to-date performance shows a decline of 12.85%.

Performance Metrics and Comparative Analysis

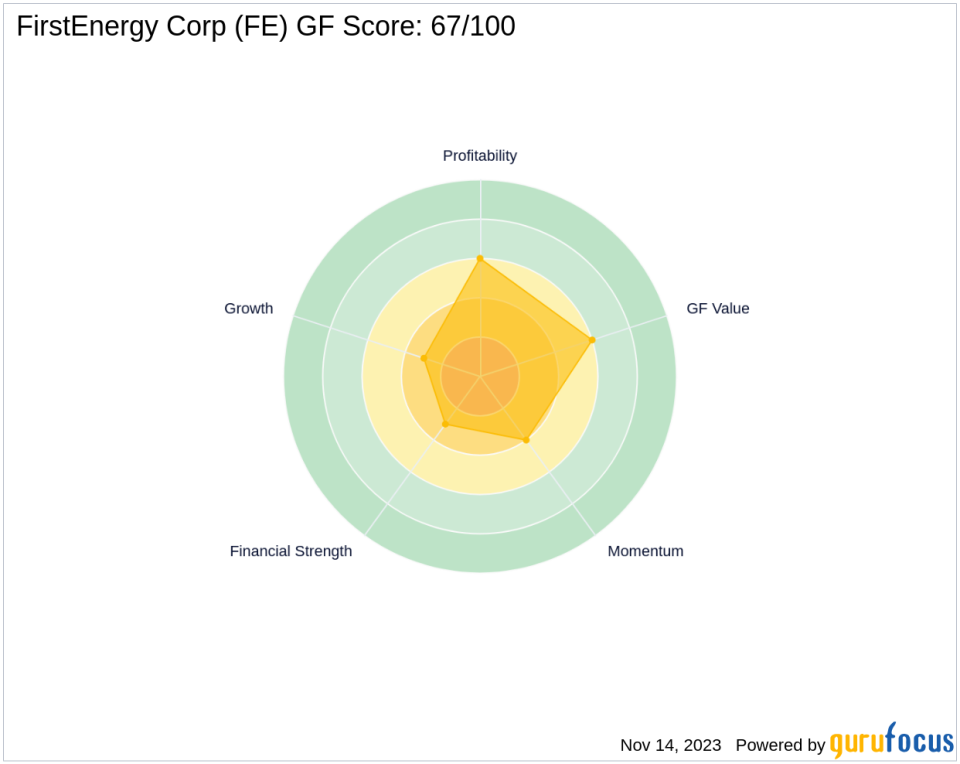

FirstEnergy's GF Score stands at 67 out of 100, suggesting a potential for average performance in the future. The company's financial strength is rated 3 out of 10, while its Profitability Rank is more favorable at 6 out of 10. Growth and GF Value Ranks are both positioned at 3 out of 10, indicating room for improvement. In comparison, other notable investors like Mario Gabelli (Trades, Portfolio), Private Capital (Trades, Portfolio), and Jefferies Group (Trades, Portfolio) also hold stakes in FirstEnergy, with Icahn Capital Management LP being the largest guru shareholder.

Market Context and Future Prospects

Since its IPO, FirstEnergy has seen a 45.41% increase in stock price, although the year-to-date metrics reflect a 12.85% decrease. The company's future performance potential, based on GF Value Rank and other metrics, suggests a cautious outlook. With a Momentum Rank of 4 out of 10, investors may be looking for signs of turnaround before committing further. Capital World Investors (Trades, Portfolio)' recent trade could be a vote of confidence in FirstEnergy's ability to navigate the current market conditions and leverage its position within the utilities sector for future growth.

In conclusion, Capital World Investors (Trades, Portfolio)' increased stake in FirstEnergy Corp represents a strategic investment decision that aligns with the firm's long-term value creation philosophy. As the market continues to evolve, the performance of FirstEnergy and the impact of this trade on Capital World Investors (Trades, Portfolio)' portfolio will be closely monitored by the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.