Capri Holdings Ltd (CPRI) Reports Decline in Q3 Fiscal 2024 Revenue Amid Luxury Market Challenges

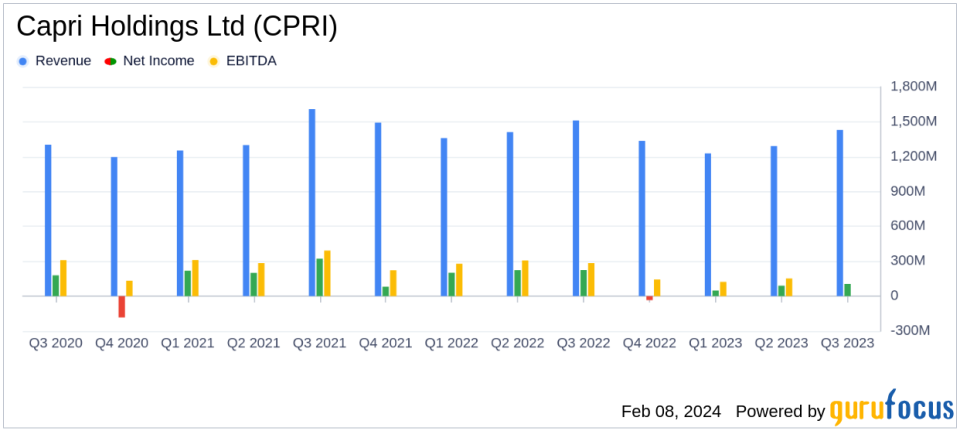

Revenue: Reported a decrease of 5.6% year-over-year to $1.43 billion.

Adjusted Operating Margin: Declined to 12.1% from 16.9% in the prior year.

Adjusted Earnings Per Share (EPS): Dropped to $1.20 from $1.84 year-over-year.

Net Inventory: Decreased by 14% compared to the prior year, reflecting strong inventory management.

Free Cash Flow: Reported an inflow of $313 million for the quarter.

Net Debt: Company aims to significantly reduce net debt by the end of the fiscal year.

Store Count: The total number of retail stores decreased to 1,270 from 1,294 year-over-year.

On February 8, 2024, Capri Holdings Ltd (NYSE:CPRI), the parent company of luxury fashion brands Michael Kors, Versace, and Jimmy Choo, released its 8-K filing detailing its financial results for the third quarter of Fiscal 2024 ended December 30, 2023. The company, led by CEO John Idol since 2003, faced a challenging quarter with a reported revenue decline and a drop in adjusted earnings per share.

Performance Overview

Capri Holdings Ltd (NYSE:CPRI) experienced a decrease in revenue by 5.6% on a reported basis and 6.6% in constant currency. The adjusted operating margin also saw a reduction to 12.1%, and adjusted EPS fell to $1.20. CEO John Idol attributed the performance to a softening demand for luxury goods, particularly in the Americas, and implementation issues with the Michael Kors Americas Ecommerce platform, which have since been resolved.

Despite these challenges, the company added 10.7 million new consumers across its databases, a 13% growth from the previous year, indicating strong brand equity. Capri Holdings also looks forward to a merger with Tapestry, expected to complete in the calendar year 2024, which Idol believes will provide value to shareholders and new opportunities for employees.

Financial Achievements and Challenges

The company's diligent inventory management resulted in a 14% decrease in net inventory compared to the prior year. Capri Holdings also generated a free cash flow inflow of $313 million for the quarter and repaid approximately $313 million of debt. However, the company's gross margin declined due to lower full price sell-throughs, and operating margin was impacted by unfavorable channel mix and higher store-related costs.

"Versace, Jimmy Choo, and Michael Kors continued to resonate with consumers as evidenced by the 10.7 million new consumers added across our databases, representing 13% growth versus last year. In fact, we achieved a new milestone, with our database surpassing 90 million customers. This reflects the strong brand equity and enduring value of our three iconic houses," said John D. Idol, Chairman and Chief Executive Officer of Capri Holdings.

Segment Performance

Versace's revenue decreased by 8.8% on a reported basis, with operating margin turning negative. Jimmy Choo's revenue saw a slight decrease of 1.2%, with operating margin also declining. Michael Kors, the largest brand within Capri Holdings, reported a revenue decrease of 5.6% on a reported basis, with a decrease in operating margin as well.

Capri Holdings continues to expect to generate strong free cash flow and aims to significantly reduce net debt by the end of the fiscal year. The company's focus on inventory management and debt repayment reflects its commitment to maintaining financial stability amid market challenges.

As Capri Holdings navigates a shifting luxury market landscape, the company's ability to adapt and leverage its strong brand equity will be critical to its success. The pending merger with Tapestry presents an opportunity for Capri Holdings to enhance its global reach and resources, which could be a strategic move in strengthening its position in the luxury fashion industry.

Explore the complete 8-K earnings release (here) from Capri Holdings Ltd for further details.

This article first appeared on GuruFocus.