Cardiff Oncology Inc (CRDF) Reports Q4 and Full Year 2023 Financial Results

Cash Position: $75 million in cash and equivalents as of December 31, 2023, with a projected runway into Q3 2025.

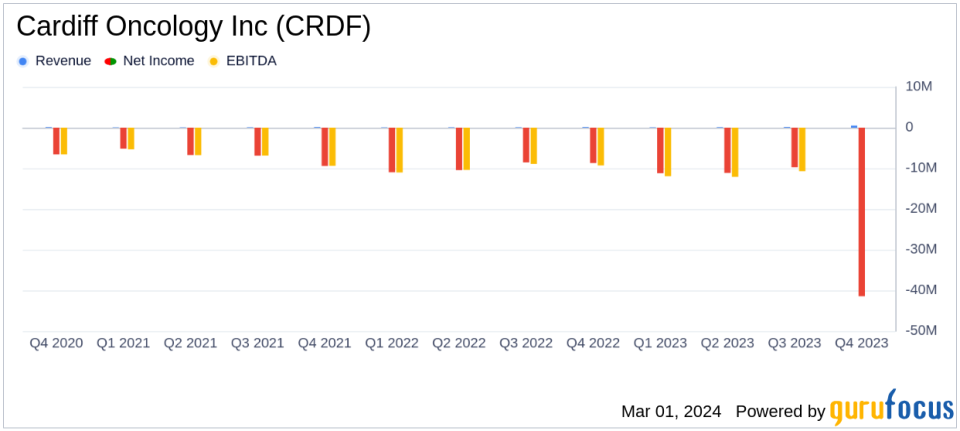

Operating Expenses: Increased to $45.9 million for the full year 2023, up from $40.3 million in 2022.

Net Loss: Reported a net loss of $41.4 million for the full year 2023, compared to a net loss of $38.7 million in 2022.

Research and Development: R&D expenses rose to $32.9 million, reflecting investment in clinical programs and development of lead drug candidate, onvansertib.

Revenue: Royalty revenues increased slightly to $488,000 in 2023 from $386,000 in 2022.

On February 29, 2024, Cardiff Oncology Inc (NASDAQ:CRDF) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023, and providing a business update. The clinical-stage biotechnology company, known for developing treatment options for cancer patients, particularly in indications with significant medical needs, has reported several key milestones and financial metrics that are critical for investors to understand.

Financial Performance and Strategic Highlights

Cardiff Oncology's financial results reflect a company in the midst of advancing its clinical programs, with a focus on its lead drug candidate, onvansertib. The company reported a net loss of $41.4 million for the full year 2023, which is an increase from the net loss of $38.7 million reported in the previous year. This loss is attributed to the increased operating expenses, which rose to $45.9 million for the year, up from $40.3 million in 2022. The increase in expenses was primarily due to the costs associated with clinical programs and the development of onvansertib.

Despite the increased net loss, Cardiff Oncology's cash position remains strong, with cash and equivalents totaling $75 million as of December 31, 2023. This positions the company with a projected cash runway into the third quarter of 2025, indicating a solid financial footing for the near term.

Operational Developments and Clinical Progress

Cardiff Oncology has made significant progress in its clinical trials, including the dosing of the first patient in a Phase 2 first-line trial for patients with RAS-mutated metastatic colorectal cancer (mCRC). The company expects interim topline data from this trial in mid-2024. Additionally, new clinical data from the second-line randomized ONSEMBLE trial has provided further evidence of the efficacy of onvansertib in combination with FOLFIRI/bev in bev naive RAS-mutated mCRC patients.

These developments are particularly important for a biotechnology company like Cardiff Oncology, as the success of clinical trials can significantly impact the company's ability to bring new therapies to market and generate revenue. The focus on RAS-mutated mCRC, a large cancer indication with no new therapies approved in the last 20 years, underscores the potential for onvansertib to meet a significant unmet medical need.

Financial Tables and Metrics

Key financial metrics from Cardiff Oncology's income statement and balance sheet include a slight increase in royalty revenues to $488,000 in 2023 from $386,000 in 2022. Research and development expenses, a critical metric for biotechnology companies, increased to $32.9 million, reflecting the company's investment in its clinical programs. The balance sheet shows a solid cash and short-term investments position, which is crucial for funding ongoing research and development activities.

Dr. Mark Erlander, CEO of Cardiff Oncology, commented on the company's progress and outlook, stating:

"2024 is a pivotal year for Cardiff Oncology and we are excited for our upcoming randomized data readout from our lead program in first-line mCRC later this year. The mCRC data we shared in August 2023, and the ONSEMBLE data we are disclosing today, demonstrates onvansertibs contribution to the standard of care of bevacizumab (bev) and chemotherapy in treating RAS-mutated mCRC."

Cardiff Oncology's performance in 2023 reflects a company that is actively investing in its future through clinical development, with a strong cash position to support its operations. The company's advancements in clinical trials are a promising sign for potential treatments in the oncology space, particularly for patients with RAS-mutated mCRC. As Cardiff Oncology continues to progress through its clinical trials, investors and stakeholders will be watching closely for the mid-2024 data readout, which could be a significant catalyst for the company.

For more detailed information on Cardiff Oncology's financial results and operational progress, interested parties are encouraged to join the conference call and webcast scheduled for today at 4:30 p.m. ET/1:30 p.m. PT. The webcast can be accessed through the "Investors" section of the company's website at www.cardiffoncology.com.

Explore the complete 8-K earnings release (here) from Cardiff Oncology Inc for further details.

This article first appeared on GuruFocus.