Cardinal Health (CAH) Beats on Q1 Earnings, Ups '24 EPS View

Cardinal Health, Inc. CAH reported first-quarter fiscal 2024 adjusted earnings per share (EPS) of $1.73, which beat the Zacks Consensus Estimate of $1.40 by 23.6%. The bottom line also improved 44.2% year over year.

GAAP EPS in the quarter was 2 cents compared with the year-ago period’s level of 40 cents. The significant decline was led by a goodwill impairment charge of $537 million in the Medical segment.

Revenue Details

Sales improved 10.4% on a year-over-year basis to $54.76 billion. The top line also outpaced the Zacks Consensus Estimate by 0.4%.

Segmental Analysis

Pharmaceutical Segment

In the reported quarter, pharmaceutical revenues increased 11% to $51 billion on a year-over-year basis. The performance highlights branded pharmaceutical sales growth from existing Pharmaceutical Distribution and Specialty Solutions customers.

Pharmaceutical profit totaled $507 million, up 18% from the year-ago quarter’s level. The upside was driven by generics program performance and higher contributions from brand and specialty products.

Medical Segment

Revenues at this segment totaled $3.8 billion, flat year over year, as lower PPE volumes and pricing were completely offset by at-home Solutions growth.

The segment reported a profit of $71 million against a loss of $8 million in the year-ago quarter. This upside was driven by an improvement in net inflationary impacts, including mitigation initiatives.

Margin Analysis

Gross profit increased 9.5% year over year to $1.77 billion.

As a percentage of revenues, the gross margin in the reported quarter was 3.2%, almost flat on a year-over-year basis.

Distribution, selling, general and administrative expenses totaled $1.2 billion, flat year over year.

Operating loss amounted to $14 million against the year-ago quarter’s operating income of $137 million. The company recorded Impairments and loss on disposal of assets of $537 million compared with $153 million in the prior-year quarter.

Financial Update

The company exited the reported quarter with cash and cash equivalents of $3.85 billion compared with $4.04 billion in the fiscal fourth quarter of 2023.

Cumulative net cash provided by operating activities totaled $545 million compared with $23 million in the year-ago period.

2024 Guidance Raised

Cardinal Health raised its fiscal 2024 guidance for earnings. The company anticipates adjusted EPS between $6.75 and $7.00, up from the previous guidance of $6.50-$6.75. The Zacks Consensus Estimate for the same is pegged at $6.66.

CAH also raised its guidance for the Pharmaceutical segment’s profit. It now expects growth in the band of 7-9% compared with the earlier projection of 4-6%.

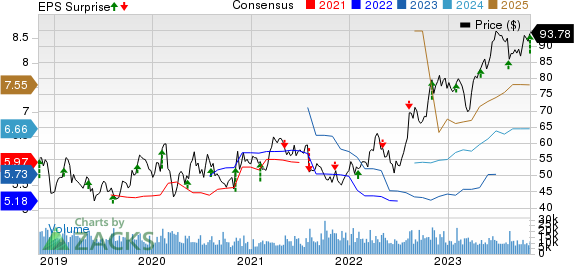

Cardinal Health, Inc. Price, Consensus and EPS Surprise

Cardinal Health, Inc. price-consensus-eps-surprise-chart | Cardinal Health, Inc. Quote

Conclusion

Cardinal Health exited the fiscal first quarter on a strong note with better-than-expected earnings and revenues. The company also witnessed revenue growth in its Pharmaceutical segment. Recovery in the Medical segment is encouraging.

However, intense competition and customer concentration are concerning.

Zacks Rank and Stocks to Consider

Cardinal Health carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, DexCom DXCM and Integer Holdings ITGR.

Abbott, carrying a Zacks Rank #2 (Buy) at present, reported third-quarter 2023 adjusted EPS of $1.14, which beat the Zacks Consensus Estimate by 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $10.14 billion outpaced the consensus mark by 3.6%.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 6.76%.

DexCom reported third-quarter 2023 adjusted EPS of 50 cents, which beat the Zacks Consensus Estimate by 47.1%. Revenues of $975 million beat the Zacks Consensus Estimate by 4%. The company currently carries a Zacks Rank #2.

DXCM has a long-term estimated growth rate of 33.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.43%.

Integer Holdings reported third-quarter 2023 adjusted EPS of $1.27 and revenues of $405 million, which beat their respective Zacks Consensus Estimate by 21% and 8.7%. It currently carries a Zacks Rank #2.

ITGR has a long-term estimated growth rate of 15.8%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.98%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report