Cardinal Health (CAH) Hits 52-Week High: What's Aiding It?

Shares of Cardinal Health, Inc. CAH scaled a new 52-week high of $92.09 on Jun 20, 2023, before closing the session marginally lower at $91.24.

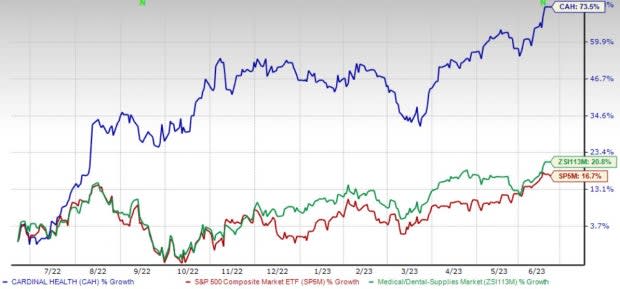

Over the past year, this Zacks Rank #3 (Hold) stock has gained 73.5% compared with 20.8% growth of the industry and a 16.7% rise of the S&P 500 composite.

Over the past five years, the company registered an earnings decline of 0.6% against the industry’s 8.3% growth. The company’s long-term expected growth rate of 13.2% compares with the industry’s growth projection of 12.1%. Cardinal Health’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 12.3%.

Image Source: Zacks Investment Research

Cardinal Health is witnessing an upward trend in its stock price, prompted by its diversified product portfolio. The optimism led by a solid third-quarter fiscal 2023 performance and the opening of a few distribution centers are expected to contribute further. However, stiff competition and the probability of losing a major customer persist.

Let’s delve deeper.

Key Growth Drivers

Diversified Product Portfolio: Investors are upbeat about Cardinal Health’s Medical and Pharmaceutical offerings, which provide the company with a competitive edge in the niche space. In May, the company launched modern payment solutions powered by Square to help independent pharmacies increase operational efficiency, stay updated with customer payment preferences and access integrated software tools for their business.

In April, Cardinal Health announced the launch of the Stray Away hair management drape for more efficient surgical procedure preparation.

Distribution Centers: Investors are optimistic about Cardinal Health’s opening of a few distribution centers in strategic areas over the past few months. This month, the company announced its plans to build a new distribution center in Greenville, SC to support its at-Home Solutions business, a home healthcare medical supplies provider serving people with chronic and serious health conditions in the United States.

In May, Cardinal Health Canada announced its plans to open a new distribution center in the Greater Toronto Area, thus expanding its distribution footprint to better meet the medical and surgical product demands of the Canadian healthcare system.

Strong Q3 Results: Cardinal Health’s impressive third-quarter fiscal 2023 results buoy optimism. The company’s robust top-line and bottom-line results and solid performance by the Pharmaceutical segment were encouraging. Per management, the segmental performance highlights branded pharmaceutical sales growth from existing Pharmaceutical Distribution and Specialty Solutions customers.

Downsides

Probabilities of Loss of a Major Customer: Cardinal Health faces the risk of losing considerable business if it loses a major customer, which will severely impair its revenues in the future. In this regard, post establishing a generic sourcing joint venture with CVS Caremark in 2014, Cardinal Health largely depends on the former for more than 20% of its revenues. Collectively, five of Cardinal Health’s main customers, including CVS, accounted for as much as 40% of its revenues.

Stiff Competition: Cardinal Health operates in a highly competitive environment in the distribution of pharmaceuticals and consumer healthcare products, as well as in the manufacturing and distribution of medical devices and surgical products. The company also competes on many levels, including price and service offerings.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 20.5% compared with the industry’s 15.8% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 59.5% compared with the industry’s 20.8% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 45.9% against the industry’s 20.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report