Cardlytics Inc (CDLX) Reports Growth in Revenue and Adjusted EBITDA for Q4 and Full Year 2023

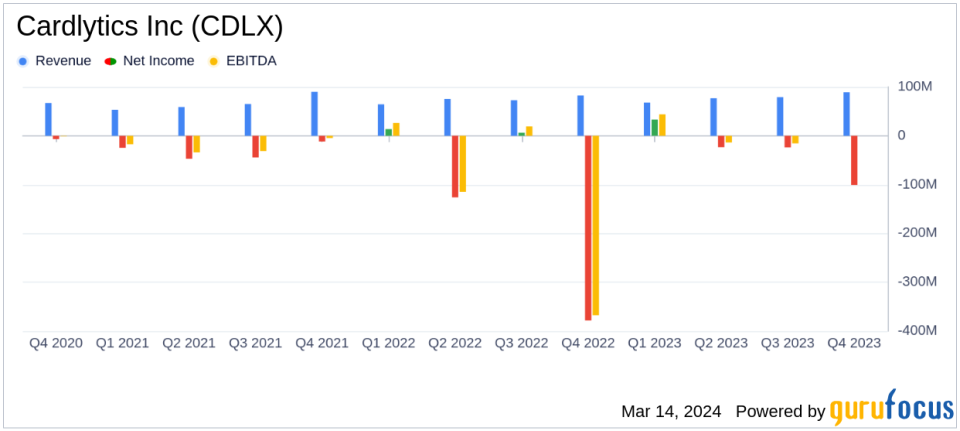

Total Revenue: Increased to $89.2 million in Q4 2023, up 8.1% year-over-year.

Adjusted EBITDA: Improved to $10.0 million in Q4 2023, a significant rise from a negative $6.1 million in Q4 2022.

Net Loss: Decreased to $(100.8) million in Q4 2023, or $(2.56) per diluted share, from $(378.3) million, or $(11.32) per diluted share in Q4 2022.

Billings: Grew by 4.6% to $131.9 million in Q4 2023 compared to the same period last year.

Free Cash Flow: Improved by $15.5 million to $(0.8) million in Q4 2023.

Monthly Active Users (MAUs): Increased to 168.0 million in Q4 2023, up 7.1% year-over-year.

On March 14, 2024, Cardlytics Inc (NASDAQ:CDLX) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates an advertising platform within financial institutions' digital channels, reported an increase in total revenue and a significant improvement in adjusted EBITDA, marking a transformational year for the company.

Company Overview

Cardlytics Inc operates through three segments: Cardlytics Direct U.S. and U.K., and the Bridg platform. The majority of its revenue is generated from the Cardlytics Direct segment, which leverages a proprietary native bank advertising channel. The Bridg platform contributes revenue through subscriptions to its cloud-based customer-data platform and associated professional services. The United States is the primary revenue source for the company.

Financial Highlights and Challenges

The company's financial results for Q4 2023 showed an 8.1% increase in total revenue to $89.2 million compared to $82.5 million in the same quarter of the previous year. Adjusted EBITDA turned positive at $10.0 million, a $16.1 million increase from the negative $6.1 million reported in Q4 2022. This marks the first full year of positive Adjusted EBITDA since 2019. Despite these achievements, Cardlytics Inc reported a net loss of $(100.8) million, or $(2.56) per diluted share, although this is a substantial improvement from the $(378.3) million net loss in the prior year's quarter.

Cardlytics' performance is crucial as it reflects the company's ability to navigate a challenging advertising market and demonstrates the effectiveness of its cost restructuring efforts. However, the company still faces challenges, including the need to maintain growth momentum and manage its net losses. These challenges could pose problems for the company if not addressed, as they may impact investor confidence and the company's long-term financial stability.

Financial Performance Analysis

Cardlytics' financial achievements, particularly the growth in billings and the improvement in free cash flow, are significant for a company in the Media - Diversified industry. These metrics indicate the company's ability to generate sales and manage its cash effectively, which are vital for sustaining operations and investing in future growth.

The company's net cash provided by operating activities was $2.9 million, a $16.0 million increase compared to the net cash used in operating activities of $(13.1) million in the fourth quarter of 2022. This positive cash flow is a key indicator of the company's operational efficiency and its ability to generate cash from its core business activities.

The fourth quarter capped a transformational year for Cardlytics," said Karim Temsamani, CEO of Cardlytics. "With our cost structure rebalanced, we can now focus on building a best-in-class platform with top-tier targeting and a differentiated user experience that will help deliver the best outcomes for our partners, their customers, and our advertisers."

Achieving growth and improving our capital structure are our top priorities," said Alexis DeSieno, CFO of Cardlytics. "In 2023, we turned to full year positive Adjusted EBITDA for the first time since 2019, and our Q1 guidance implies further acceleration. We are on a path to double-digit billings growth in 2024 and positive operating cash flow on an annual basis."

For the full year 2023, Cardlytics reported a total revenue of $309.2 million, a 3.6% increase from $298.5 million in 2022. Billings for the year were $453.4 million, up 2.5% from the previous year. The company's net loss for the full year was reduced to $(134.7) million, or $(3.69) per diluted share, from $(465.3) million, or $(13.92) per diluted share in 2022.

Looking Ahead

For the first quarter of 2024, Cardlytics anticipates billings to be in the range of $105.0 - $109.0 million, with revenue expected to be between $70.0 - $73.0 million. The company's adjusted contribution is forecasted to be between $37.0 - $39.0 million, and adjusted EBITDA is projected to be in the range of ($1.0) - $1.0 million.

Cardlytics' performance in the fourth quarter and full year 2023 demonstrates its resilience and strategic focus on growth and capital structure improvement. As the company looks forward to 2024, investors and stakeholders will be watching closely to see if these positive trends continue.

Explore the complete 8-K earnings release (here) from Cardlytics Inc for further details.

This article first appeared on GuruFocus.