The Cardtronics (NASDAQ:CATM) Share Price Is Down 33% So Some Shareholders Are Getting Worried

While not a mind-blowing move, it is good to see that the Cardtronics plc (NASDAQ:CATM) share price has gained 17% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 33% in the last three years, falling well short of the market return.

Check out our latest analysis for Cardtronics

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Cardtronics became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

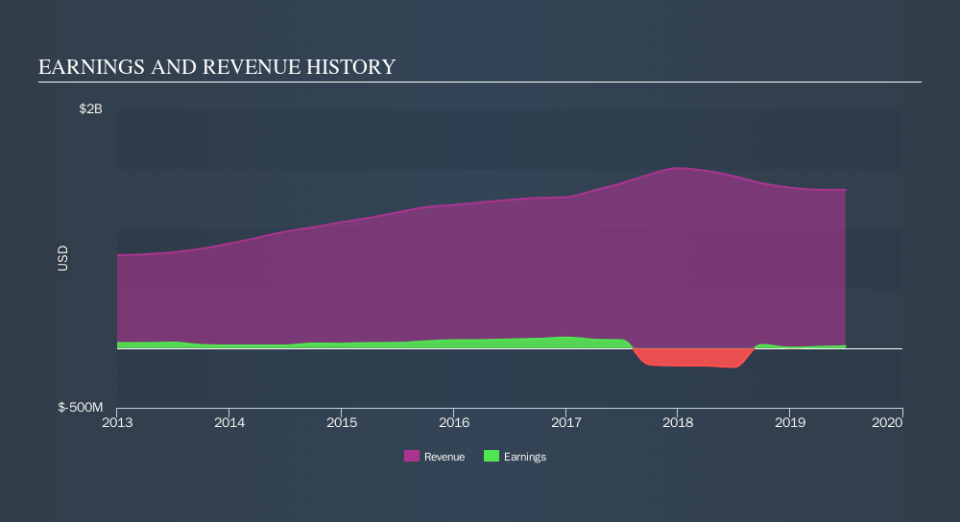

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Cardtronics has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Cardtronics will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that Cardtronics has rewarded shareholders with a total shareholder return of 16% in the last twelve months. That certainly beats the loss of about 1.3% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on Cardtronics it might be wise to click here to see if insiders have been buying or selling shares.

We will like Cardtronics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.