Carl Icahn Acquires New Stake in CVR Partners LP

Introduction to the Transaction

On March 18, 2024, Carl Icahn (Trades, Portfolio)'s firm made a significant move in the stock market by purchasing 3,892,000 shares of CVR Partners LP (NYSE:UAN), marking a new holding for the investment portfolio. The transaction had a notable impact of 2.22% on the portfolio, with the shares acquired at a price of $63.72 each. This investment not only reflects the firm's confidence in CVR Partners LP but also represents a substantial 36.80% ownership stake in the company.

Profile of Carl Icahn (Trades, Portfolio)

Carl Icahn (Trades, Portfolio) is renowned as an activist investor, known for taking considerable positions in public companies and advocating for change. The firm operates through various investment vehicles, including Icahn Partners, American Real Estate Partners, and Icahn Management LP. GuruFocus closely monitors the latter, Icahn Capital Management, which encompasses all stocks owned by the firm. With a total equity of $10.91 billion, the firm's top holdings include Icahn Enterprises LP (NASDAQ:IEP), CVR Energy Inc (NYSE:CVI), and others, with a strong inclination towards the Energy and Utilities sectors.

Carl Icahn (Trades, Portfolio)'s Investment Philosophy

The investment strategy of Carl Icahn (Trades, Portfolio)'s firm is to identify and purchase undervalued assets, often those emerging from bankruptcy, and to revitalize them for sale when they regain favor in the market. The firm adopts a contrarian approach, challenging consensus thinking and investing in companies and industries that are currently out of favor, with the belief that such investments will yield significant returns once the momentum shifts.

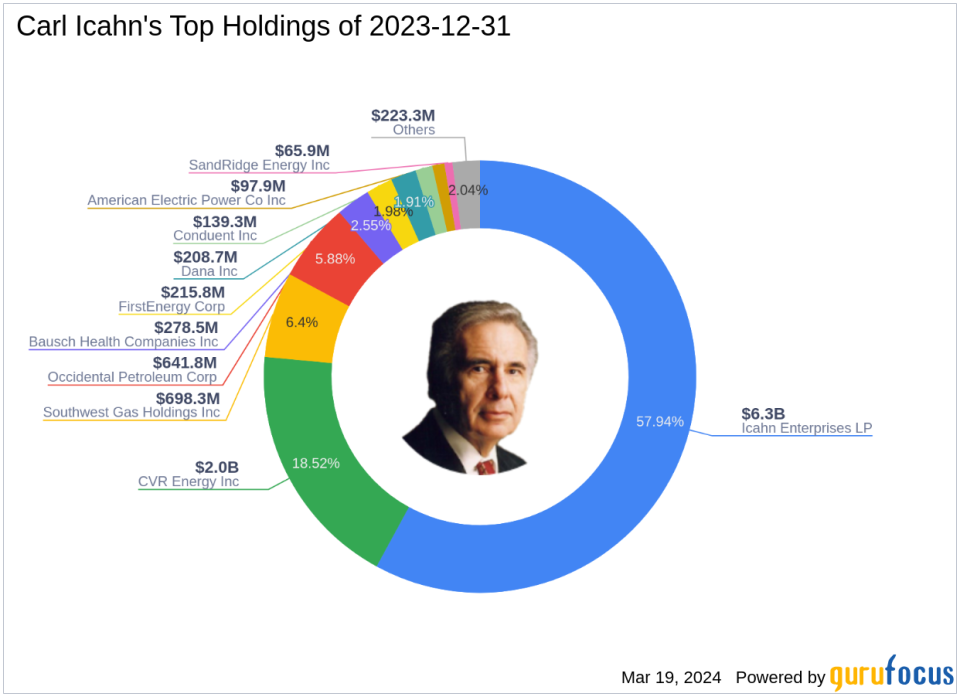

Carl Icahn (Trades, Portfolio)'s Portfolio Composition

Carl Icahn (Trades, Portfolio)'s firm currently holds 14 stocks in its investment portfolio. The firm's top holdings reflect a strategic focus on the Energy and Utilities sectors, which align with the firm's expertise and investment philosophy.

Overview of CVR Partners LP

CVR Partners LP, trading under the stock symbol UAN, is a key player in the manufacturing and supply of nitrogen fertilizer products, including Urea Ammonium Nitrate (NYSE:UAN) and ammonia. Since its IPO on April 8, 2011, the company has established a strong market presence, particularly in the agricultural sector across several U.S. states. CVR Partners LP's business operations are critical to the agriculture industry, providing essential products for crop production.

Financial Analysis of CVR Partners LP

With a market capitalization of $756.363 million and a current stock price of $71.56, CVR Partners LP is considered significantly undervalued according to the GF Value assessment, which sets the intrinsic value at $103.47. The stock's price-to-earnings ratio stands at 4.39, and it has experienced a 12.3% gain since the transaction date. Year-to-date, the stock has seen a 5.42% change, despite a -60.24% change since its IPO.

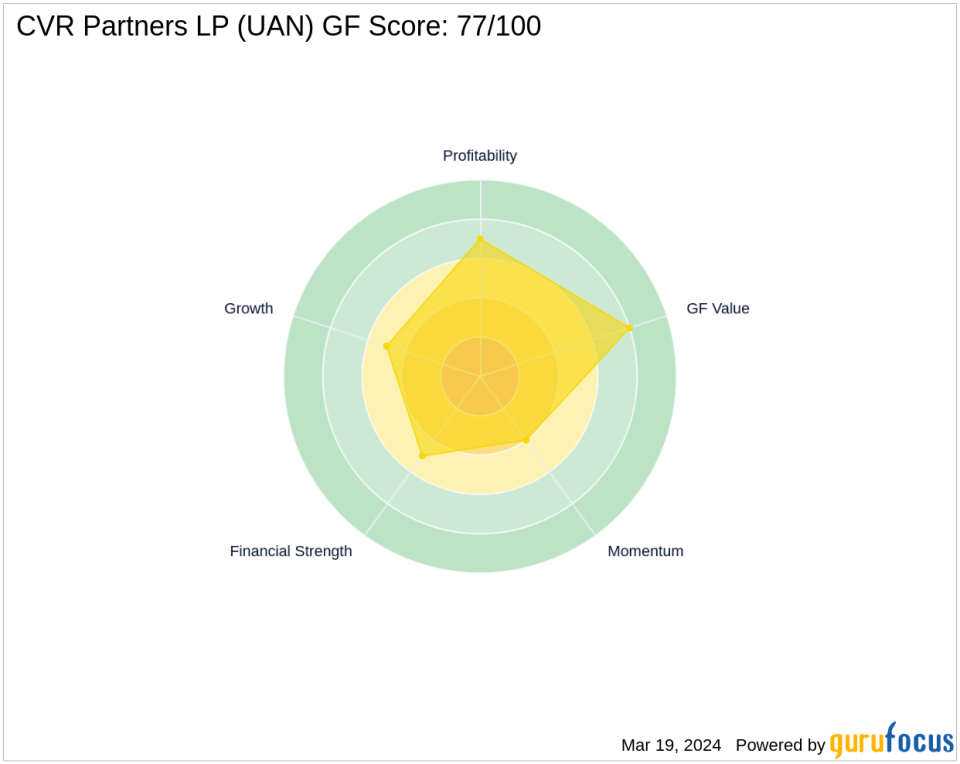

CVR Partners LP's Market Position and Performance Rankings

CVR Partners LP's financial strength is reflected in its balance sheet rank of 5/10, while its profitability rank stands at 7/10. The company's growth rank is 5/10, and it has a GF Value rank of 8/10. Despite a momentum rank of 4/10, the company's strong return on equity (ROE) of 48.46% and return on assets (ROA) of 16.48% indicate robust profitability and asset utilization.

Comparative Analysis with Largest Guru Shareholder

Carl Icahn (Trades, Portfolio)'s firm, Icahn Capital Management LP, is now the largest guru shareholder of CVR Partners LP, holding a commanding 36.80% of the company's shares. This position underscores the firm's significant influence and potential for driving strategic changes within CVR Partners LP.

Transaction Analysis

The recent acquisition by Carl Icahn (Trades, Portfolio)'s firm has not only expanded its portfolio but also solidified its position in the agriculture industry. The investment in CVR Partners LP aligns with the firm's philosophy of buying undervalued assets and may signal a strategic move to leverage the company's potential for growth and profitability. As the largest guru shareholder, the firm's influence on CVR Partners LP's future direction is likely to be substantial, potentially leading to value creation for both the firm and other shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.