Carl Icahn Bolsters Stake in Icahn Enterprises LP by 2.69%

Insight into the Billionaire Investor's Latest 13F Filing for Q4 2023

Renowned for his activist investment approach, Carl Icahn (Trades, Portfolio)'s latest 13F filing for the fourth quarter of 2023 unveils strategic moves within his portfolio. Icahn is known for acquiring substantial positions in undervalued companies, advocating for change to unlock shareholder value. His investment vehicles, including Icahn Partners and Icahn Management LP, reflect his philosophy of contrarian investingtargeting assets that are out of favor, enhancing their value, and divesting them at their peak.

Summary of New Buys

Carl Icahn (Trades, Portfolio)'s portfolio saw the addition of a new stock in the last quarter:

His most significant new position is in American Electric Power Co Inc (NASDAQ:AEP), acquiring 1,205,300 shares. This stake represents 0.9% of his portfolio, with a total value of $97.89 million.

Key Position Increases

Icahn has also strategically increased his holdings in existing investments:

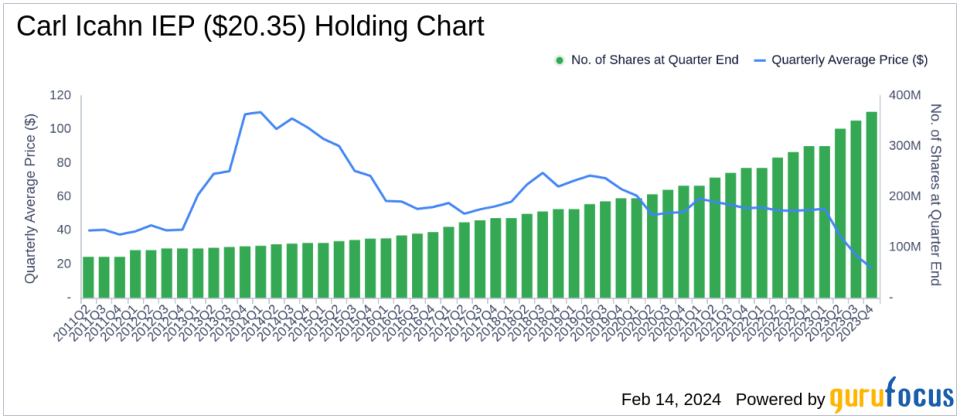

The most notable increase is in Icahn Enterprises LP (NASDAQ:IEP), where he added 17,060,798 shares. This brings his total to 367,879,902 shares, marking a 4.86% increase in share count and a 2.69% impact on his current portfolio, valued at $6.32 billion.

Summary of Sold Out Positions

Exiting positions is also part of Icahn's investment strategy:

He completely divested his stake in Crown Holdings Inc (NYSE:CCK), selling all 1,040,100 shares, which had a -0.76% impact on the portfolio.

Key Position Reductions

Portfolio adjustments included reducing stakes in certain companies:

Icahn reduced his position in FirstEnergy Corp (NYSE:FE) by 8,203,607 shares, resulting in a -58.22% decrease in shares and a -2.32% impact on the portfolio. During the quarter, FE traded at an average price of $36.2 and has seen a return of 1.99% over the past three months and 1.90% year-to-date.

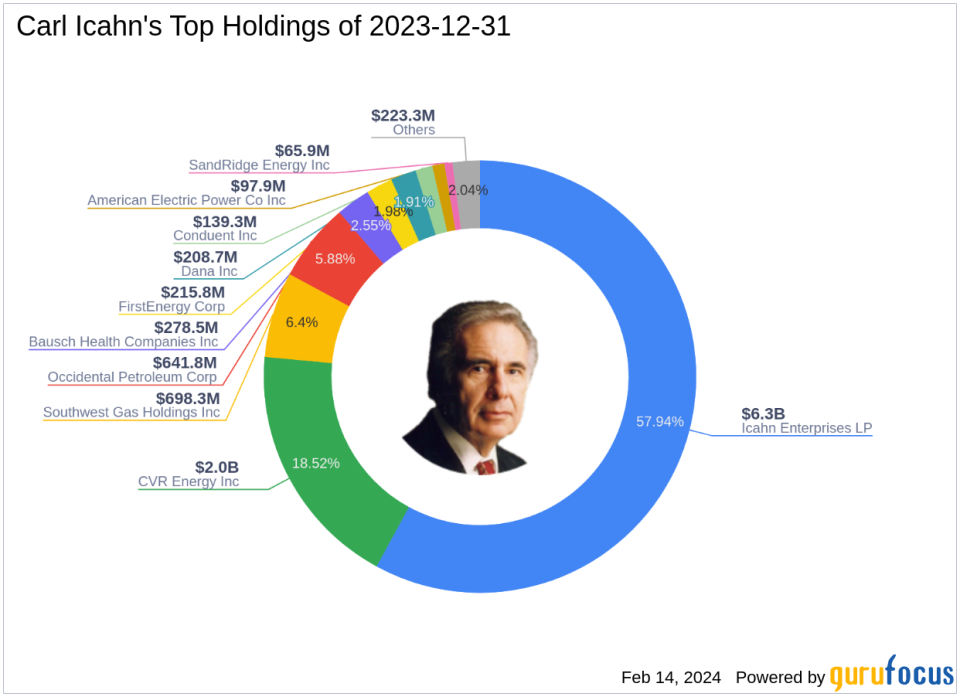

Portfolio Overview

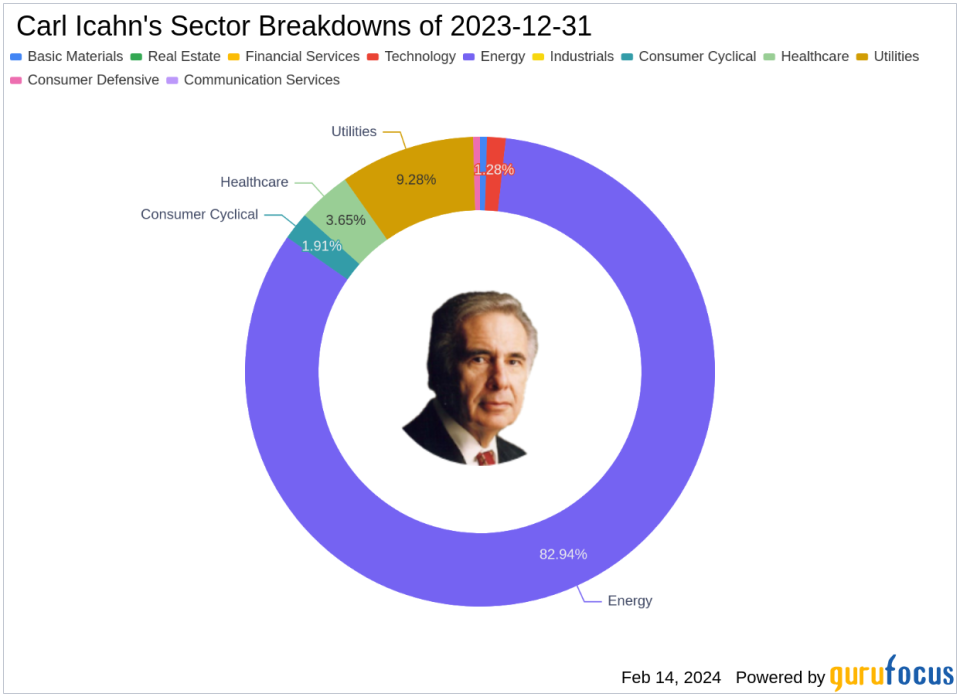

As of the fourth quarter of 2023, Carl Icahn (Trades, Portfolio)'s investment portfolio encompasses 14 stocks. His top holdings are heavily weighted in Icahn Enterprises LP (NASDAQ:IEP) at 57.94%, followed by CVR Energy Inc (NYSE:CVI) at 18.52%, and Southwest Gas Holdings Inc (NYSE:SWX) at 6.4%. Other significant holdings include Occidental Petroleum Corp (NYSE:OXY.WS) at 5.88% and Bausch Health Companies Inc (NYSE:BHC) at 2.55%. The portfolio is primarily concentrated across seven industries, with a focus on Energy, Utilities, Healthcare, Consumer Cyclical, Technology, Basic Materials, and Consumer Defensive sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.