Carl Icahn Increases Stake in Southwest Gas Holdings Inc

Renowned activist investor Carl Icahn (Trades, Portfolio) recently expanded his portfolio with the acquisition of additional shares in Southwest Gas Holdings Inc. This article provides an in-depth analysis of the transaction, the investor's profile, and the traded company's performance.

Details of the Transaction

On September 27, 2023, Carl Icahn (Trades, Portfolio) added 5,936 shares of Southwest Gas Holdings Inc to his portfolio at a traded price of $61.98 per share. This transaction increased his total holdings in the company to 11,022,604 shares, representing 15.42% of the company's equity. The transaction had a 4.41% impact on Icahn's portfolio, further solidifying his position in the utilities sector.

Profile of Carl Icahn (Trades, Portfolio)

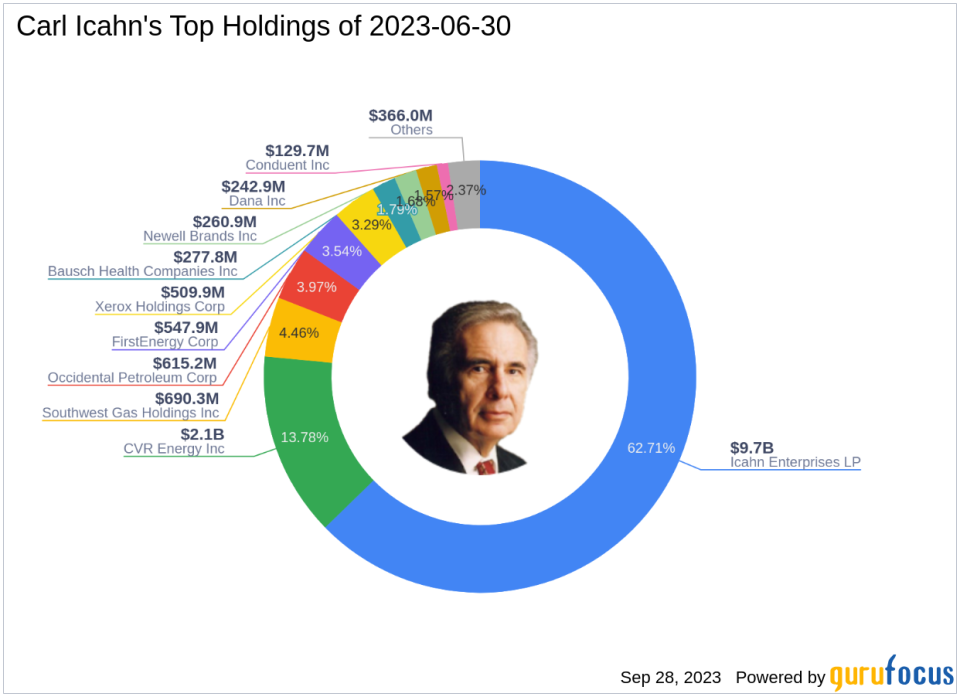

Carl Icahn (Trades, Portfolio) is a prominent activist investor known for acquiring significant stakes in public companies and advocating for change. He operates through three investment vehicles: Icahn Partners, American Real Estate Partners, and Icahn Management LP. GuruFocus tracks the third portfolio, which encompasses all stocks owned by Icahn Capital Management. Icahn's investment philosophy revolves around purchasing undervalued assets, often out of bankruptcy, and selling them when they regain favor. His top holdings include Icahn Enterprises LP, CVR Energy Inc, FirstEnergy Corp, Southwest Gas Holdings Inc, and Occidental Petroleum Corp. The energy and utilities sectors dominate his $15.48 billion equity portfolio.

Overview of Southwest Gas Holdings Inc

Southwest Gas Holdings Inc, listed under the symbol SWX, is a utility company primarily engaged in purchasing, distributing, and transporting natural gas in the American Southwest. The company operates through its natural gas operations and Utility Infrastructure Services units. With a market capitalization of $4.27 billion, the company's current stock price stands at $59.8. However, with a PE percentage of 0.00, the company is currently at a loss. According to GuruFocus, the company's GF Value is $90.95, indicating a possible value trap.

Analysis of Southwest Gas Holdings Inc's Performance

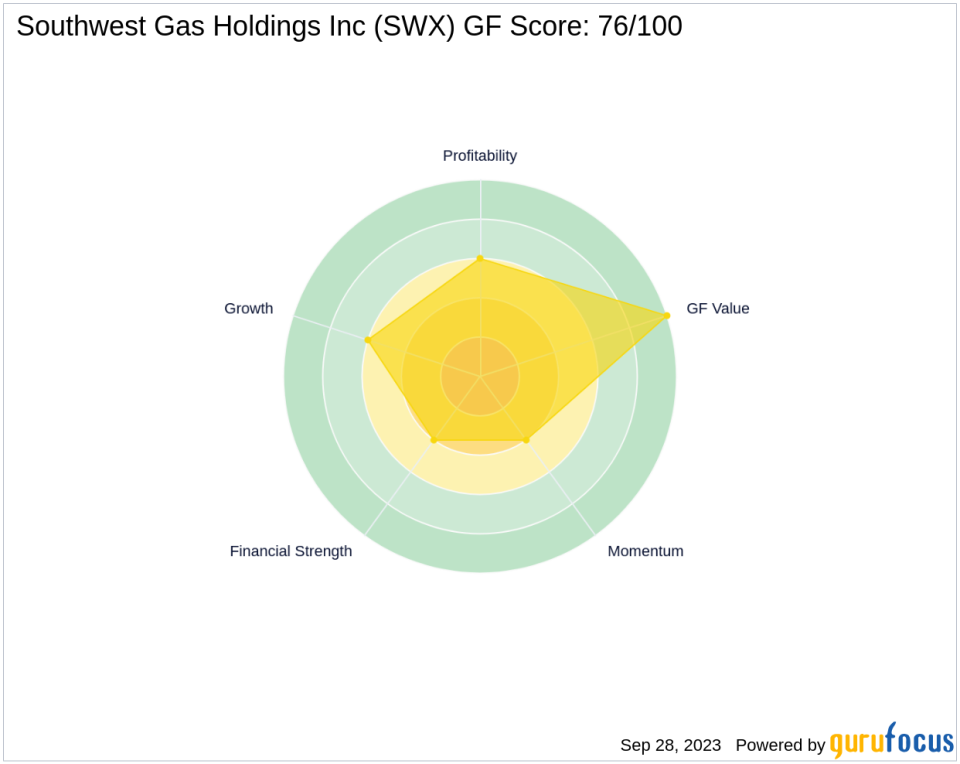

Southwest Gas Holdings Inc has a GF Score of 76/100, suggesting a likely average performance. The company's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank stand at 6/10. The company's Piotroski F-Score is 3, and its Altman Z score is 0.97, indicating potential financial distress. The company's interest coverage ratio is 1.76, ranking 355th in the industry.

Other Gurus' Positions in Southwest Gas Holdings Inc

Other notable gurus who hold shares in Southwest Gas Holdings Inc include Mario Gabelli (Trades, Portfolio), HOTCHKIS & WILEY, and Keeley-Teton Advisors, LLC (Trades, Portfolio). However, Icahn Capital Management LP holds the most significant stake in the company.

Conclusion

In conclusion, Carl Icahn (Trades, Portfolio)'s recent acquisition of additional shares in Southwest Gas Holdings Inc underscores his confidence in the company despite its current financial challenges. This transaction further strengthens his position in the utilities sector and diversifies his portfolio. However, given the company's current financial performance and potential value trap, value investors should exercise caution and conduct thorough research before following suit.

This article first appeared on GuruFocus.