Carl Icahn Increases Stake in Southwest Gas Holdings Inc

On September 12, 2023, renowned investor Carl Icahn (Trades, Portfolio) added to his position in Southwest Gas Holdings Inc (NYSE:SWX), a leading utility company in the American Southwest. This article provides an in-depth analysis of the transaction, the investor's profile, and the traded company's financial performance.

Details of the Transaction

The transaction saw Carl Icahn (Trades, Portfolio) acquire an additional 127,731 shares of Southwest Gas Holdings Inc at a trade price of $61.45 per share. This move increased his total holdings in the company to 10,972,412 shares, representing 15.35% of his portfolio. The transaction had a 0.05% impact on his portfolio and increased his stake in the company by 1.18%.

Profile of Carl Icahn (Trades, Portfolio)

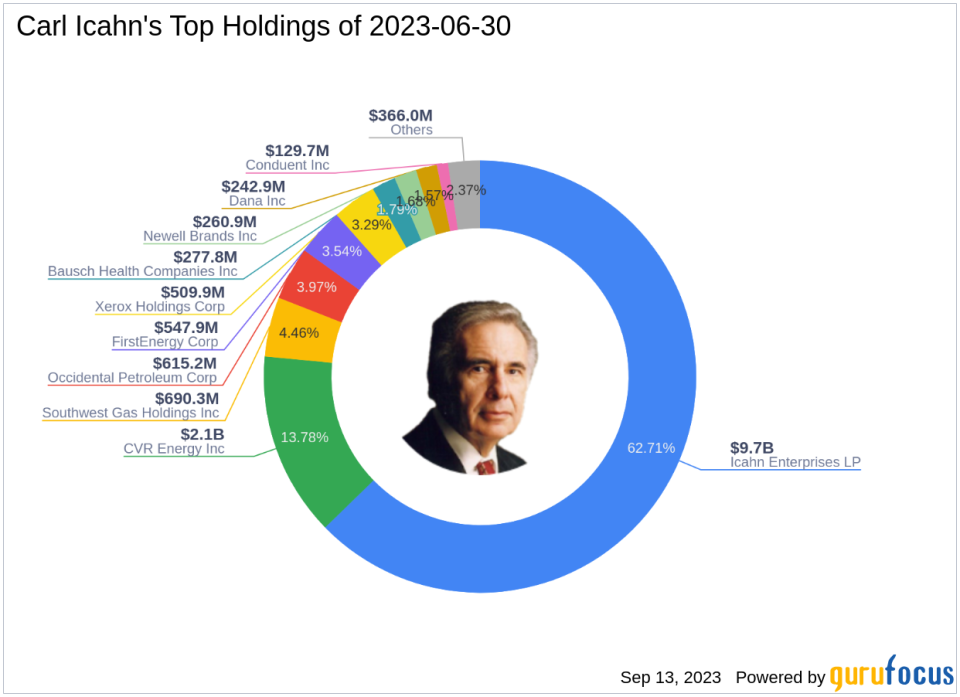

Carl Icahn (Trades, Portfolio) is a prominent activist investor known for taking significant stakes in public companies and advocating for change. He operates through three investment vehicles: Icahn Partners, American Real Estate Partners, and Icahn Management LP. This article focuses on the stocks owned by Icahn Capital Management. Icahn's investment philosophy revolves around purchasing undervalued assets, often out of bankruptcy, and selling them when they regain favor. His portfolio, valued at $15.48 billion, comprises 15 stocks, with the energy and utilities sectors being the most represented. His top holdings include Icahn Enterprises LP (NASDAQ:IEP), CVR Energy Inc (NYSE:CVI), FirstEnergy Corp (NYSE:FE), Southwest Gas Holdings Inc (NYSE:SWX), and Occidental Petroleum Corp (NYSE:OXY.WS).

Overview of Southwest Gas Holdings Inc

Southwest Gas Holdings Inc, with a market capitalization of $4.5 billion, is primarily engaged in purchasing, distributing, and transporting natural gas in the American Southwest. The company operates through its Natural Gas Distribution, Pipeline and Storage, Utility Infrastructure Services, and Intersegment revenues segments. Despite a current PE percentage of 0.00, indicating a loss, the company's GF Value is $90.60, suggesting a possible value trap. The company's stock price stands at $62.97, representing a 2.47% gain since the transaction and a 362% increase since its IPO in 1972. The stock's year-to-date performance is 1.93%.

Performance of Southwest Gas Holdings Inc

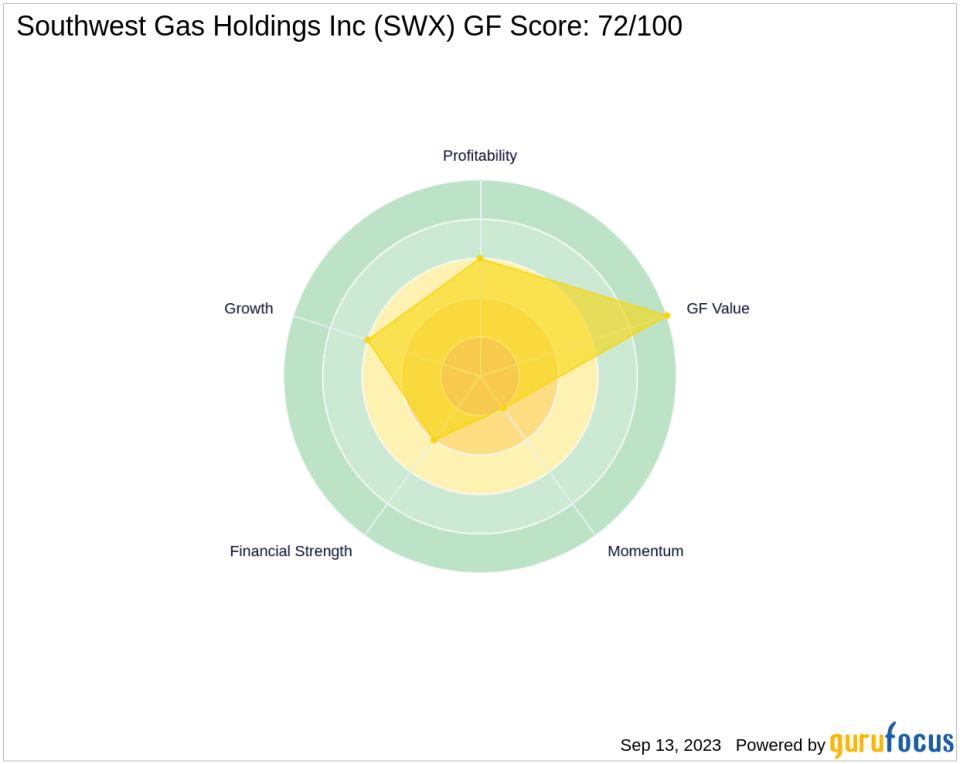

Southwest Gas Holdings Inc has a GF Score of 72/100, indicating average future performance potential. The company's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are both 6/10. The company's Piotroski F-Score is 3, and its Altman Z score is 0.97, indicating financial stability. However, its cash to debt ratio of 0.04 is relatively low, ranking 400th in the industry.

Analysis of Southwest Gas Holdings Inc's Financials

The company's return on equity (ROE) and return on assets (ROA) stand at -6.61% and -1.73%, respectively. Over the past three years, the company has seen a revenue growth of 9.60%, but its EBITDA has declined by 19.00%. The company's gross margin growth is -3.60%, and its operating margin growth is -7.60%. The company's 14-day RSI is 44.41, and its 6 - 1 Month Momentum Index is 10.09.

Other Gurus' Investment in Southwest Gas Holdings Inc

Other notable investors in Southwest Gas Holdings Inc include Mario Gabelli (Trades, Portfolio), HOTCHKIS & WILEY, and Keeley-Teton Advisors, LLC (Trades, Portfolio). However, Icahn Capital Management LP holds the most shares in the company.

Conclusion

In conclusion, Carl Icahn (Trades, Portfolio)'s recent acquisition of additional shares in Southwest Gas Holdings Inc is a significant move that further solidifies his position in the company. Despite the company's current financial performance and market valuation, Icahn's increased stake could signal his confidence in the company's future prospects. This transaction provides valuable insights for value investors and underscores the importance of thorough analysis when making investment decisions.

This article first appeared on GuruFocus.