Carl Icahn Puts Pressure on Caesars Entertainment

- By James Li

Carl Icahn (Trades, Portfolio), CEO of Icahn Enterprises LP (IEP), disclosed in a Schedule 13-D filing on Tuesday that he established a stake in Caesars Entertainment Corp. (CZR).

Warning! GuruFocus has detected 3 Warning Signs with CZR. Click here to check it out.

The intrinsic value of CZR

Managing a portfolio of 18 stocks, Icahn buys stock in out-of-favor companies and pushes for changes to unlock shareholder value. The Icahn Partners fund manager disclosed he invested in 13,210,746 shares of the Las Vegas-based casino operator on Feb. 7, when shares traded at $9.25.

Activist investor calls for sale of company

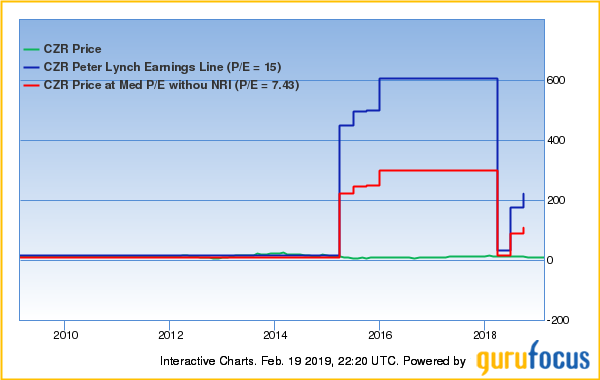

Icahn mentioned in his filing he established his investment believing that Caesars Entertainment is undervalued and can increase shareholder value by selling the company.

Icahn noted in his filing that his activist stance works well for Caesars, a company that "requires new thought, new leadership and new strategies." The fund manager seeks to hold discussions with Caesars' board of directors and expects the company to refrain from appointing a new CEO or extend outgoing CEO Mark Frissora's tenure until Icahn has an opportunity to "meaningfully engage" with them.

Company has poor financials

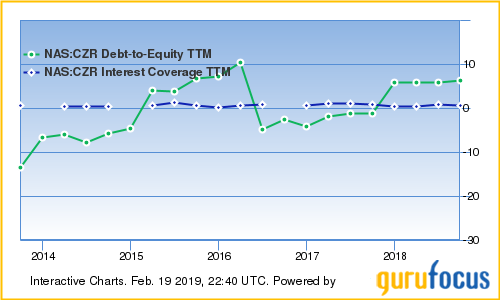

GuruFocus ranks Caesar's financial strength 4 out of 10 on several weak signs, which include low interest coverage, debt ratios that underperform over 90% of global competitors and an Altman Z-score that suggests potential bankruptcy within the next two years. Additionally, the company's Beneish M-score of -0.62 exceeds the safe threshold of -2.22, suggesting possible earnings manipulation.

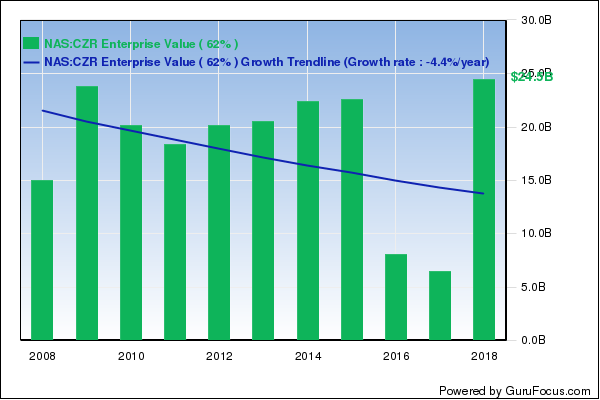

Caesars' profitability ranks a poor 4 out of 10: although the company's net margin and return on assets are outperforming over three-quarters of global competitors, its three-year revenue decline rate of 32.30% underperforms 95% of global resorts and casinos.

Despite poor financials, Caesars is still attracting major gurus like George Soros (Trades, Portfolio), David Tepper (Trades, Portfolio) and John Paulson (Trades, Portfolio).

Disclosure: No positions.

Read more here:

Bill Ackman's Pershing Square Discloses 2 New Positions for 4th Quarter

John Paulson's Top 5 Buys in 4th Quarter

David Tepper Buys 3, Boosts 3 in 4th Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with CZR. Click here to check it out.

The intrinsic value of CZR